Jan 20, 2026

You've heard the name in pharmaceutical circles.

Maybe you've seen it on industry reports or research papers. Asymchem keeps appearing whenever serious discussions about peptide manufacturing come up, and there's a reason for that.

This China-based contract development and manufacturing organization has quietly become one of the most significant players in the global peptide supply chain. They manufacture the therapeutic peptides that power some of the most important drugs in modern medicine. GLP-1 agonists for diabetes and obesity. Antiviral compounds. Cancer treatments. The peptides that make headlines often trace back to facilities like theirs.

But here's what most people don't understand about Asymchem. They're not a research peptide vendor. They don't sell directly to individual researchers or consumers. They're something far more consequential, a pharmaceutical-grade contract manufacturer serving the world's largest drug companies.

Understanding the difference matters. When you're evaluating peptide sources or trying to comprehend peptide regulation and the global supply chain, companies like Asymchem sit at the foundation. They represent the industrial scale at which legitimate pharmaceutical peptides get made. And their capabilities, their quality standards, their regulatory track record, all of this shapes what reaches the market.

This guide breaks down everything you need to know about Asymchem's peptide operations. We'll examine their history, their manufacturing capabilities, their quality systems, and their position in the broader Chinese peptide manufacturing landscape. We'll also explore how their work connects to the therapeutic peptides that researchers and clinicians work with every day.

SeekPeptides provides detailed education on peptide sources, manufacturing standards, and quality verification, helping researchers navigate the complex landscape of peptide procurement with confidence.

What is Asymchem?

Asymchem Laboratories (Tianjin) Co., Ltd. operates as a contract development and manufacturing organization, commonly abbreviated as CDMO. The company was founded in 1995 with US headquarters and established its main Chinese operations in Tianjin in 1998.

Let's be clear about what a CDMO does.

These companies don't create their own drugs. They don't market pharmaceuticals to consumers. Instead, they partner with pharmaceutical and biotechnology companies to develop manufacturing processes and produce the active pharmaceutical ingredients that go into finished medications. Think of them as the factories behind the factories.

Asymchem is publicly traded on two stock exchanges, the Shenzhen Stock Exchange under ticker 002821.SZ and the Hong Kong Stock Exchange under ticker 6821.HK. The company's market capitalization hovers around $4.6 billion, with trailing twelve-month revenue of approximately $873 million.

The numbers tell only part of the story. What makes Asymchem significant in the peptide industry is their scale and their client list. They've partnered with more than 400 clients globally. Currently, they're involved in over 600 clinical projects and 30 commercial projects. Major pharmaceutical companies including Pfizer, Roche, Merck, and Bristol-Myers Squibb have established collaborations with them.

Their workforce exceeds 9,700 employees. More than 4,600 of those are dedicated R&D scientists. This ratio, nearly half the company focused on research and development, reflects the technical complexity of pharmaceutical manufacturing.

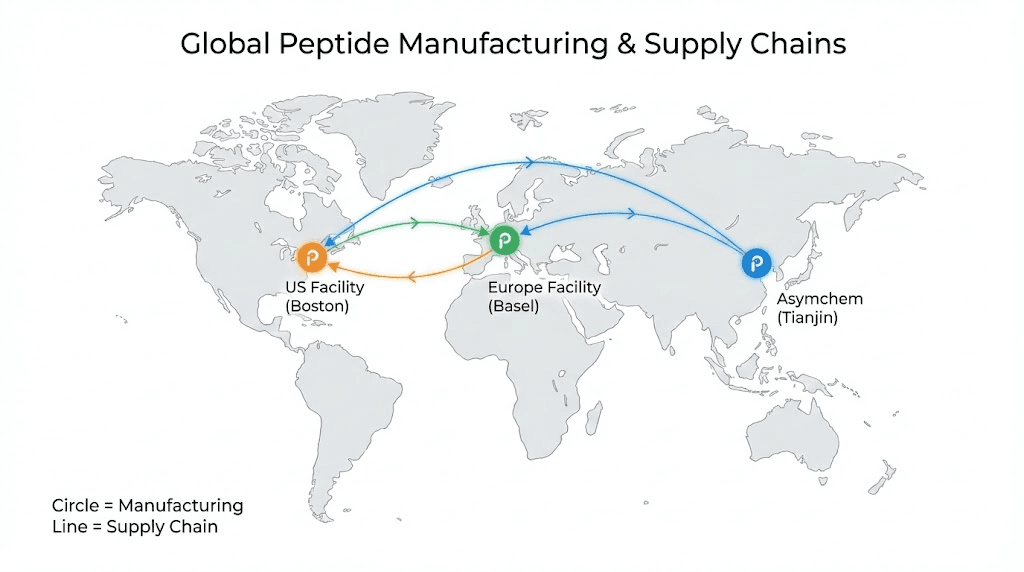

The company's headquarters sits in Tianjin, China, at No. 71, Seventh Avenue, in the Tianjin Economic and Technological Development Zone. But their operations span continents. They maintain eight manufacturing facilities in China, a US operations center in Research Triangle Park, North Carolina, and a European facility in Sandwich, Kent, UK, acquired from Pfizer.

Asymchem's peptide manufacturing capabilities

Peptides present unique manufacturing challenges. These molecules, chains of amino acids ranging from just a few units to dozens, require specialized synthesis techniques that differ significantly from traditional small molecule chemistry. Asymchem addresses this through their Chemical Macromolecule Division, commonly called CMMD.

The CMMD supports multiple peptide types:

Traditional linear peptides

Cyclic peptides with ring structures

Pseudopeptides with modified backbones

Peptide-linker combinations for targeted delivery

Peptide-drug conjugates

Polymer-drug conjugates

Highly active peptide molecules requiring special handling

Their synthesis capabilities span both solid-phase and liquid-phase preparation, plus hybrid approaches that combine the advantages of each technique. They can produce linear and cyclic peptides with up to 40 amino acid units, covering the majority of therapeutic peptide applications.

The therapeutic areas covered by their peptide projects include some of the most active segments in pharmaceutical development:

GLP-1 agonists for diabetes and obesity treatment

Antiviral peptides for infectious disease

Antibacterial compounds

Antitumor agents for cancer therapy

Treatments for age-related macular degeneration

Their peptide modification capabilities extend the functionality of base peptides through techniques like PEGylation, lipidation, and N-methylation. These modifications can improve stability, extend half-life, or enhance tissue targeting, critical factors in therapeutic peptide design.

Understanding peptide reconstitution and handling becomes increasingly important as peptide therapeutics grow more complex. The manufacturing precision required at Asymchem's scale directly impacts the quality of the final therapeutic products.

The automation breakthrough

In late 2024, Asymchem achieved something the peptide manufacturing industry had been working toward for years. They developed fully automated, large-scale peptide production lines.

This wasn't incremental improvement. This was transformation.

Peptide synthesis, particularly solid-phase peptide synthesis, has traditionally required significant manual intervention. Each step in the synthesis cycle, the coupling of amino acids, the deprotection reactions, the washing steps, has demanded skilled operator oversight. This limits scalability and introduces variability.

Asymchem's Chemical Engineering Department and Center for Intelligent Manufacturing Technology tackled this challenge head-on. They designed a new solid-phase synthesizer that overcomes the limitations that had prevented scaling. The key innovations addressed resin mixing efficiency and reactor structure, both critical factors in achieving consistent results at scale.

The results speak through capacity numbers. Their solid-phase peptide synthesis capacity grew from a few hundred liters to over 10,000 liters. By the end of 2024, total capacity reached approximately 21,000 liters. They're now developing 2,000-liter solid-phase synthesizers, equipment that didn't exist in this form before their engineering work.

What does this mean practically? Several production lines have completed process validations. Some have transitioned into commercial technology transfer. Asymchem supported a major client in passing the first GLP-1 peptide project's dynamic verification, laying groundwork for their first commercial peptide delivery in 2025.

The automation extends beyond synthesis. Their host computer system integrates with process control systems, enabling unmanned production across entire solid-phase synthesis operations. This level of automation reduces human error, improves batch consistency, and enables the scale needed for drugs facing massive global demand.

For researchers tracking the peptide dosing and quality of therapeutic peptides, these manufacturing advances translate to more consistent products reaching clinical and commercial use.

Quality standards and regulatory compliance

Manufacturing scale means nothing without quality. In pharmaceutical production, quality isn't just desirable. It's mandatory. Regulatory agencies worldwide enforce strict standards, and facilities that fail inspections face consequences ranging from warning letters to import bans.

Asymchem's regulatory track record provides insight into their quality systems. The company has passed more than 65 inspections conducted by global regulatory bodies, including the US Food and Drug Administration and the European Medicines Agency. In February 2024, they passed an EU Qualified Person audit and received a GMP compliance statement.

GMP, Good Manufacturing Practice, represents the baseline for pharmaceutical quality. These regulations govern everything from facility design and equipment qualification to process validation and documentation. Meeting GMP requirements isn't optional for companies serving pharmaceutical clients.

But Asymchem goes beyond baseline requirements.

Their analytical team provides comprehensive quality services:

Structure characterization confirming peptide identity

Analytical method development and validation

In-process control support during manufacturing

Final product release testing

Stability studies following ICH guidelines

ICH, the International Council for Harmonisation, establishes guidelines that pharmaceutical regulators worldwide recognize. Following ICH requirements means their stability data, their analytical methods, and their quality specifications align with what regulatory agencies expect to see.

They also employ Quality by Design principles, a systematic approach to pharmaceutical development that builds quality into products rather than simply testing for it afterward. QbD processes and analytical design help ensure that manufacturing consistently produces material meeting specifications.

Their peptide experts provide document preparation services supporting IND and NDA filings. IND stands for Investigational New Drug, the application companies must submit before clinical trials. NDA means New Drug Application, required before commercial approval. Supporting these filings means understanding exactly what regulators need to see.

This regulatory infrastructure matters for the broader research versus pharmaceutical peptide landscape. The standards applied at facilities like Asymchem define what pharmaceutical-grade truly means.

Where Asymchem fits in the global CDMO landscape

The peptide CDMO market operates as a specialized niche within pharmaceutical manufacturing. Peptide APIs account for only about 1.7% of the total API drug market, but this small percentage represents enormous dollar volumes and critical therapeutic importance.

Two companies dominate the global peptide CDMO space. Bachem holds approximately 25% market share. PolyPeptide Group claims about 20%. These Swiss-headquartered companies have built their positions over decades, with Bachem bringing more than 50 years of peptide manufacturing experience.

Geographic concentration characterizes the industry. Specialty peptide manufacturing capacity clusters in Switzerland, Germany, the United States, Sweden, Belgium, and select Asia-Pacific markets. Switzerland alone contributes over 12% of global GMP peptide capacity, largely through Bachem and PolyPeptide.

Where does Asymchem fit?

They represent the most significant Asia-based alternative to the Western incumbents. While their precise market share isn't publicly broken out the way Bachem's and PolyPeptide's are, their scale, client relationships, and recent capacity investments position them as a major force.

The competitive landscape also includes WuXi AppTec, Samsung Biologics, CordenPharma, AmbioPharm, ScinoPharm, Piramal Pharma, CPC Scientific, and Thermo Fisher. Emerging players across China, India, and the United States continue entering the market.

Market projections underscore why competition is intensifying. The global Peptide CDMO market was valued at $3.17 billion in 2023. By 2024, estimates put it at $3.81 billion. Long-term forecasts suggest the market could surge to $16.74 billion by 2032, reflecting a compound annual growth rate of 20.3%.

That growth rate dwarfs most pharmaceutical sectors. It's being driven largely by one class of drugs: GLP-1 agonists.

The GLP-1 effect on peptide manufacturing

The explosion in GLP-1 drugs has reshaped the entire peptide manufacturing industry. Semaglutide and tirzepatide, the active ingredients in Ozempic, Wegovy, Mounjaro, and Zepbound, have created unprecedented demand for peptide manufacturing capacity.

Consider the numbers. The global market for GLP-1s addressing type 2 diabetes and obesity has been estimated at $53 billion. Projections suggest this could reach $157 billion by 2030. One industry analyst described the situation as "a gold rush for CDMOs specializing in peptide synthesis and injectable formulations."

This demand created genuine shortages. For much of 2023 and 2024, semaglutide products faced supply constraints. Patients struggled to fill prescriptions. Compounding pharmacies stepped in with compounded alternatives, creating regulatory debates that continue today.

The shortages have largely resolved. In February 2025, the FDA announced that semaglutide injectable product shortages were resolved. The dulaglutide shortage ended in June 2025. But the industry learned important lessons about capacity constraints.

Major pharmaceutical companies responded with massive investments. Novo Nordisk acquired Catalent for $16.5 billion and announced a $4.1 billion investment for a new plant in North Carolina. Eli Lilly invested $5.3 billion in its Indiana site and $1.8 billion in Ireland facilities. CordenPharma announced over €900 million in peptide manufacturing capability investments in May 2025.

Asymchem's automation breakthrough and capacity expansion directly addresses this market reality. Their GLP-1 project work, their capacity growth from hundreds of liters to tens of thousands, and their commercial technology transfer activities all connect to meeting this demand.

For researchers studying cagrilintide, retatrutide, or other emerging GLP-1 variants, understanding the manufacturing landscape provides context for availability and quality considerations.

Understanding peptide manufacturing methods

To appreciate what companies like Asymchem do, you need to understand how peptides are actually made. The dominant approach is solid-phase peptide synthesis, commonly abbreviated SPPS. Liquid-phase peptide synthesis, or LPPS, serves specific applications. Many modern manufacturers use hybrid approaches combining both.

SPPS involves anchoring the growing peptide chain to an insoluble support, typically a polymer resin. Amino acids get added one at a time, each addition requiring a coupling step and a deprotection step to remove the temporary protecting group from the newly added amino acid. The process repeats until the full sequence is assembled, then the peptide is cleaved from the resin.

This method works excellently for small to medium peptides. It allows for automation and produces reasonably pure products. Most peptides under about 50 amino acids use SPPS as the primary synthesis method.

LPPS keeps the growing peptide in solution rather than attached to a solid support. This approach can work better for larger peptides where solid-phase synthesis becomes inefficient. Some manufacturers, including Bachem working with Jitsubo's Molecular Hiving technology, use specialized lipophilic tags for larger-scale production.

Hybrid approaches combine advantages of both methods. A peptide might be assembled in fragments using SPPS, then those fragments joined using solution-phase chemistry. This can improve yields and reduce impurity levels for complex sequences.

Asymchem employs all these approaches through their CMMD division. Their solid/liquid phase preparation and hybrid technology offerings give them flexibility to address different peptide structures and scales.

Purity matters enormously in peptide manufacturing. High-end CDMOs typically deliver purity above 98-99%, supported by advanced chromatographic purification platforms. Each impurity in a therapeutic peptide, whether a deletion sequence, an epimerized amino acid, or an oxidation product, must be characterized, controlled, and minimized.

Understanding peptide reconstitution requirements starts with understanding how the peptide was manufactured. The lyophilization conditions, the buffer systems used, and the purification approach all affect how the final product behaves.

The role of quality testing and certificates of analysis

Pharmaceutical peptide manufacturing produces extensive documentation. Certificates of Analysis, or COAs, capture the testing results that verify each batch meets specifications. Understanding how to read and evaluate these documents matters for anyone working with peptides.

A properly issued COA includes several critical elements. The peptide identity should be confirmed, typically through mass spectrometry showing that the observed molecular weight matches the theoretical value. Purity assessment, usually determined by HPLC or UPLC, should show the percentage of target peptide versus impurities.

For pharmaceutical-grade material, COAs become more extensive:

Appearance description of the final product

Peptide content by weight

Water content via Karl Fischer titration

Counter-ion content

Residual solvent analysis

Bioburden testing for microbial limits

Endotoxin levels via LAL assay

The analytical methods used to generate these results follow validated procedures. Method validation demonstrates that the analytical approach is suitable for its intended purpose, with documented accuracy, precision, specificity, and robustness.

Third-party testing adds an independent verification layer. Having external laboratories test samples reduces bias risk, validates in-house results, and ensures consistency with stated specifications. Companies claiming high purity without independent verification leave important questions unanswered.

A critical point often missed: a COA only reflects the material that was actually tested. Some suppliers test a single batch annually, then present subsequent batches as if covered by that same report. This approach cannot guarantee batch-to-batch consistency. Without proper upstream controls and documentation, a COA alone provides limited assurance.

When evaluating any peptide vendor or source, understanding their relationship to manufacturing quality standards provides essential context. SeekPeptides helps researchers understand these quality verification concepts through comprehensive educational resources.

China's position in pharmaceutical manufacturing

Understanding Asymchem requires understanding China's broader role in pharmaceutical supply chains. This context shapes both the opportunities and the considerations surrounding Chinese peptide manufacturers.

China has become the world's largest producer and exporter of active pharmaceutical ingredients. By 2023, China controlled approximately 80% of the global generic API supply chain. This concentration reflects decades of investment in chemical manufacturing infrastructure, skilled workforce development, and cost optimization.

The pharmaceutical industry's reliance on Chinese manufacturing extends beyond direct imports. India, itself a major pharmaceutical manufacturer, depends on China for approximately 70% of its bulk drug and intermediate imports. Many pharmaceutical products manufactured in India still contain Chinese raw materials.

This concentration creates both efficiency and risk. Supply chain disruptions, whether from pandemics, geopolitical tensions, or regulatory actions, can ripple through global pharmaceutical availability. The COVID-19 pandemic highlighted these vulnerabilities when Chinese manufacturing shutdowns raised concerns about drug supply continuity.

Quality concerns have also emerged with some Chinese manufacturers. The FDA has issued warning letters to API makers for significant deviations from Good Manufacturing Practice requirements. Some companies have been placed on Import Alert 66-40, barring their products from entering the US market.

Asymchem's position differs from manufacturers facing regulatory actions. Their track record of 65+ FDA and EMA inspections, their GMP compliance statements, and their relationships with major pharmaceutical companies indicate different quality standards. Not all Chinese manufacturers are equivalent.

The BIOSECURE Act introduced new considerations for Chinese biotechnology companies. This legislation prohibits certain US firms from partnering with specific Chinese biotechnology companies, with implementation deadlines extending to 2032. While Asymchem isn't currently named in the legislation, the regulatory environment continues evolving.

Supply chain diversification has become a strategic priority for many pharmaceutical companies. "China+1" strategies seek to maintain Chinese manufacturing relationships while developing alternative sources. India has emerged as a preferred destination for CDMO services under these strategies.

For researchers sourcing Chinese peptides, these dynamics provide important context. Manufacturing origin matters less than quality systems, regulatory compliance, and verification practices.

Comparing Asymchem to other peptide CDMOs

How does Asymchem compare to the established Western peptide manufacturers? Several factors differentiate major players in this space.

Bachem brings more than 50 years of peptide manufacturing experience. They've built integrated capabilities spanning peptides and oligonucleotides, with commercial-scale oligonucleotide production established since 2021. Their Swiss headquarters provides access to a region with high peptide manufacturing concentration. Market share leadership at approximately 25% reflects decades of relationship building and capability development.

PolyPeptide Group holds the second-largest market position at approximately 20%. Their facilities span multiple countries, providing geographic diversification. Both Bachem and PolyPeptide have been publicly traded longer than Asymchem, with more extensive Western investor familiarity.

Asymchem brings different advantages. Their cost structure, reflecting Chinese manufacturing economics, can be more competitive for certain projects. Their recent automation investments represent some of the industry's most advanced manufacturing technology. The 21,000-liter solid-phase synthesis capacity achieved by end of 2024 demonstrates serious scale commitment.

Their workforce scale, 9,700+ employees with 4,600+ R&D scientists, provides significant technical depth. Having nearly half the company focused on R&D enables process innovation and efficient technology transfer.

The trade-offs involve geographic and regulatory considerations. Western pharmaceutical companies increasingly scrutinize Chinese supply chain exposure. The BIOSECURE Act, even where it doesn't directly apply, signals evolving regulatory attitudes. Some clients may prefer Western manufacturing for strategic reasons regardless of technical equivalence.

For researchers comparing peptide solutions or evaluating supply chain considerations, understanding these CDMO dynamics provides useful background.

Therapeutic applications of Asymchem-manufactured peptides

While Asymchem serves pharmaceutical clients rather than individual researchers, understanding the therapeutic applications they support connects their work to research interests.

GLP-1 agonists represent their most significant current focus. These peptides, used for weight management and diabetes treatment, have transformed metabolic disease care. The mechanisms involve gut hormone signaling, insulin secretion regulation, and appetite suppression. Understanding how peptides work at the receptor level illuminates why manufacturing precision matters for therapeutic outcomes.

Antiviral peptides target infectious disease. Peptide-based approaches can interfere with viral entry, replication, or assembly. Manufacturing these compounds requires attention to sequence accuracy since even single amino acid errors can eliminate activity.

Antibacterial peptides address the growing antibiotic resistance crisis. Many antimicrobial peptides work through membrane disruption mechanisms distinct from conventional antibiotics. Research into immune-supporting peptides connects to some of these therapeutic directions.

Antitumor peptides span multiple mechanisms. Some directly target cancer cells. Others modulate immune responses. Peptide-drug conjugates can deliver cytotoxic payloads specifically to tumor tissue. The complexity of these molecules pushes manufacturing capabilities.

Age-related macular degeneration treatments demonstrate peptide applications in ophthalmology. These conditions involve anti-aging mechanisms at the tissue level, where peptide therapies can address specific degenerative pathways.

Beyond these named therapeutic areas, Asymchem's client projects span cardiovascular, nervous system, and other disease categories. Each therapeutic area brings specific peptide requirements, sequence considerations, and manufacturing challenges.

Peptide handling and storage considerations

Whether peptides come from Asymchem facilities or any other manufacturer, proper handling after production determines whether the product maintains its integrity. Understanding peptide storage requirements helps researchers preserve product quality.

Lyophilized peptides, the powder form most commonly supplied, generally offer better stability than reconstituted solutions. The absence of water reduces hydrolysis and other degradation reactions. Proper storage temperature, typically frozen at -20°C or colder, further extends stability.

Once reconstituted, peptides become more vulnerable. Bacteriostatic water provides the standard reconstitution medium, with the bacteriostatic agent helping prevent microbial contamination during multiple-use scenarios. Understanding how long reconstituted peptides last helps researchers plan usage patterns.

Light exposure can degrade certain peptides, particularly those containing photosensitive amino acids like tryptophan or tyrosine. Amber vials or aluminum foil wrapping provides protection.

Repeated freeze-thaw cycles stress peptide stability. Each cycle can cause aggregation, denaturation, or degradation. Aliquoting reconstituted peptide into single-use portions before freezing minimizes this stress.

Temperature excursions during shipping or storage can compromise peptides even before a researcher receives them. Understanding the cold chain requirements and verifying proper shipping conditions protects against receiving degraded material.

The peptide reconstitution calculator helps researchers determine appropriate dilution volumes for their specific research needs. Proper concentration preparation connects manufacturing quality to research outcomes.

Cost considerations in peptide manufacturing

Peptide manufacturing costs significantly more than small molecule synthesis. The sequential amino acid coupling process, the purification requirements, and the analytical testing all contribute to higher production costs.

Understanding these economics helps contextualize peptide pricing across the market.

Raw material costs include protected amino acids, coupling reagents, resins, solvents, and purification media. Specialty amino acids or those requiring extensive protecting group strategies add cost. Longer sequences require more coupling cycles, multiplying material consumption.

Labor costs reflect the technical expertise required. Skilled peptide chemists command premium compensation. Process development, method validation, and quality control all require specialized personnel.

Equipment costs for modern peptide synthesis are substantial. Automated synthesizers, HPLC systems for purification and analysis, mass spectrometers for characterization, and lyophilizers for final processing represent significant capital investments.

Facility costs include clean room maintenance, utility systems, and regulatory compliance infrastructure. GMP facilities require validated systems, documentation practices, and ongoing quality management that exceed research-grade requirements.

Scale effects work in peptide manufacturing, but differently than in small molecule chemistry. While larger batches reduce per-unit costs, the fundamental step-by-step synthesis approach means costs don't decrease as dramatically with scale as in traditional chemistry.

The peptide cost calculator helps researchers estimate expenses for their specific needs. Understanding manufacturing economics informs realistic budget expectations.

Specific peptides and their manufacturing requirements

Different peptide types present different manufacturing challenges. Understanding these specifics illuminates why CDMO capabilities matter.

BPC-157, a 15-amino acid peptide sequence, represents a relatively straightforward synthesis target. Its size falls well within SPPS capabilities, and its sequence doesn't present unusual coupling challenges. Manufacturing considerations focus on purity achievement and proper lyophilization. The BPC-157 dosage calculator helps researchers plan appropriate use.

TB-500 (Thymosin Beta-4) at 43 amino acids sits near the upper range for efficient SPPS synthesis. Longer sequences increase the risk of deletion sequences and other impurities. Manufacturing requires careful optimization to maintain acceptable purity levels. Comparing BPC-157 versus TB-500 involves understanding both their biological differences and their manufacturing characteristics.

Semaglutide and tirzepatide present additional complexity through their lipid modifications. These GLP-1 agonists include fatty acid chains that improve pharmacokinetic properties but complicate synthesis. The lipidation step, ensuring proper attachment and purity, requires specialized capabilities.

Ipamorelin, a five-amino acid growth hormone secretagogue, represents a simpler synthesis target. Its short length makes manufacturing more straightforward, though quality specifications remain stringent. The ipamorelin versus CJC-1295 comparison involves peptides with different length and complexity profiles.

GHK-Cu copper peptides add metal ion coordination to the manufacturing equation. The copper must be properly incorporated and the complex characterized to verify correct formation. Understanding GHK-Cu dosing requires confidence in proper manufacturing.

KPV, an anti-inflammatory tripeptide, presents a different challenge at just three amino acids. Very short peptides can be difficult to purify since they don't separate as distinctly from impurities. Despite simple sequence, manufacturing requires appropriate analytical methods.

Each peptide type connects to specific therapeutic applications.

Understanding injury healing peptides, muscle growth peptides, or gut health peptides means understanding the manufacturing requirements that enable their production.

The future of peptide manufacturing

Several trends will shape peptide manufacturing over the coming years. Understanding these directions helps contextualize current developments.

Automation acceleration will continue. Asymchem's fully automated production lines represent early achievement of a broader industry direction. Reducing manual intervention improves consistency, enables scale, and addresses skilled workforce limitations.

Capacity expansion will persist as long as GLP-1 demand grows. The investments announced by Novo, Lilly, CordenPharma, and others signal sustained build-out. Companies not expanding risk losing market position.

Process intensification aims to produce more peptide per unit of equipment, time, and materials. Continuous manufacturing approaches, improved coupling chemistries, and optimized purification methods all contribute to intensification goals.

Sustainability focus is increasing. Peptide synthesis generates significant solvent waste and consumes substantial energy. Green chemistry approaches, solvent recycling, and energy efficiency improvements address environmental concerns while often reducing costs.

Supply chain diversification will continue as pharmaceutical companies manage geopolitical risks. The concentration of manufacturing in any single geography creates vulnerabilities that prudent supply chain management seeks to address.

Regulatory evolution will impact Chinese manufacturers specifically. How the BIOSECURE Act is implemented, whether additional legislation emerges, and how trade policies develop will all affect companies like Asymchem.

Novel modalities including peptide-drug conjugates, bicyclic peptides, and stapled peptides push manufacturing capabilities. CDMOs investing in these advanced capabilities position themselves for next-generation therapeutics.

SeekPeptides tracks these industry developments, helping researchers understand how manufacturing trends affect peptide availability, quality, and pricing.

Evaluating peptide sources: what matters

For researchers navigating peptide procurement, several evaluation criteria deserve attention regardless of the specific source.

Documentation quality indicates organizational seriousness. Properly issued certificates of analysis, clear batch identification, and appropriate storage instructions reflect quality management systems.

Testing methodology transparency matters. Understanding what was tested, how it was tested, and by whom provides context for interpreting results. Third-party testing adds independence to the verification process.

Consistency indicators help assess reliability. Does the supplier test each batch? Can they provide historical data demonstrating batch-to-batch consistency? Single-time testing with results applied to subsequent batches offers limited assurance.

Supply chain visibility helps understand origins. Where was the peptide synthesized? Under what quality systems? Traceability back to manufacturing provides important context.

Regulatory compliance status indicates quality infrastructure. Has the manufacturer passed relevant inspections? Are there warning letters or import alerts affecting them? Regulatory records are often publicly accessible.

Customer feedback patterns provide real-world input. What do other researchers report about product quality, consistency, and service? While individual experiences vary, patterns matter.

The peptide testing labs guide helps researchers understand third-party verification options. When evaluating any source, understanding how to independently verify quality provides important protection.

Common misconceptions about peptide manufacturing

Several misconceptions circulate about how peptides are manufactured and what distinguishes quality products.

"All peptides from China are low quality" oversimplifies a complex reality. China produces both excellent and poor-quality peptides, just as other countries do. Quality depends on the specific manufacturer's systems, not geographic location. Asymchem's regulatory track record demonstrates that Chinese manufacturing can meet the highest standards.

"Higher price means better quality" isn't reliably true. Pricing reflects many factors including brand positioning, overhead structures, and market strategies. Expensive peptides aren't automatically better, and economical peptides aren't necessarily inferior. Documentation and testing provide better quality indicators than price alone.

"Research peptides are just as good as pharmaceutical peptides" ignores important distinctions. Research-grade and pharmaceutical-grade peptides face different manufacturing requirements. Pharmaceutical production involves stricter process controls, more extensive testing, and complete documentation that research-grade may lack.

"Purity percentage tells the whole story" misses important nuances. A 98% purity statement doesn't specify what the other 2% contains. Deletion sequences, oxidized forms, epimerized amino acids, and residual solvents all present different concerns. Complete characterization matters more than a single number.

"CDMOs sell directly to consumers" misunderstands the business model. Companies like Asymchem, Bachem, and PolyPeptide serve pharmaceutical and biotechnology companies as clients. They don't maintain retail operations selling to individual researchers. Their products reach the market through pharmaceutical company commercialization.

"GMP means perfect quality" overstates what GMP certification indicates. GMP establishes minimum quality systems, not perfection. GMP-compliant facilities can still produce products that don't meet specifications. The systems are designed to catch such failures, not prevent them entirely.

The relationship between manufacturing and research outcomes

For researchers using peptides, manufacturing quality directly impacts experimental results. Understanding this connection helps interpret outcomes and troubleshoot problems.

Impure peptides introduce confounding variables. If 5% of your "BPC-157" is actually a deletion sequence missing one amino acid, your experiment is actually testing a mixture. Results may not reflect the target peptide's true activity.

Inconsistent manufacturing creates batch-to-batch variation. If your supplier's quality control varies, the peptide you use this month may differ from what you used last month. Reproducibility suffers.

Degraded peptides from poor storage or handling lose activity. If temperature excursions during shipping compromised the product, your apparently correct protocol may fail for reasons unrelated to the peptide's inherent properties.

Contamination introduces artifacts. Endotoxin contamination in injectable peptides triggers inflammatory responses that may be mistaken for peptide effects. Microbial contamination affects cell culture experiments.

Understanding peptide safety considerations connects to manufacturing quality. Many safety concerns trace to impurities or degradation products rather than the target peptide itself.

The lesson: peptide source selection isn't separate from experimental design. It's part of experimental design. Choosing appropriate sources, verifying quality, and maintaining proper handling all contribute to meaningful results.

Frequently asked questions

Is Asymchem a peptide vendor that sells to individual researchers?

No. Asymchem operates as a contract development and manufacturing organization serving pharmaceutical and biotechnology companies. They don't maintain retail operations or sell directly to individual researchers. Their peptides reach the market through pharmaceutical company products rather than direct sales.

What makes Asymchem different from research peptide suppliers?

Asymchem operates under pharmaceutical manufacturing standards with GMP compliance, extensive regulatory inspections, and quality systems designed for drug production. Research peptide suppliers operate under different requirements. The manufacturing scale, documentation depth, and regulatory oversight differ substantially between pharmaceutical CDMOs and research suppliers.

Does Asymchem manufacture semaglutide?

Asymchem has peptide CDMO capabilities supporting GLP-1 projects and has completed GLP-1 peptide project validations. However, specific client relationships and product details are typically confidential. The branded semaglutide products from Novo Nordisk are manufactured through their own facilities and contracted manufacturing partners.

How does Asymchem compare to Bachem?

Bachem is the global market share leader with 50+ years of peptide experience and strong Western regulatory presence.

Asymchem offers competitive pricing reflecting Chinese manufacturing economics, recent automation innovations, and substantial scale. Both maintain high quality standards but serve somewhat different client preferences based on geographic, strategic, and cost considerations.

Are Chinese peptide manufacturers safe to use?

Quality varies by manufacturer regardless of country. Some Chinese manufacturers have excellent regulatory records including Asymchem's 65+ FDA/EMA inspections passed. Others have received FDA warning letters or import bans. Evaluating specific manufacturer quality systems, testing practices, and regulatory status matters more than country of origin.

What peptide types can Asymchem manufacture?

Their capabilities include linear peptides, cyclic peptides, pseudopeptides, peptide-linker combinations, peptide-drug conjugates, and polymer-drug conjugates up to 40 amino acid units. Modification capabilities include PEGylation, lipidation, and N-methylation. They support therapeutic areas including GLP-1, antiviral, antibacterial, antitumor, and age-related macular degeneration treatments.

What is solid-phase peptide synthesis?

SPPS involves anchoring a growing peptide chain to an insoluble polymer resin, then sequentially adding amino acids through coupling and deprotection steps until the full sequence is assembled. The completed peptide is then cleaved from the resin. This method dominates peptide manufacturing for sequences under approximately 50 amino acids and enables automation. Understanding peptide reconstitution connects to how these manufactured products are prepared for use.

Why do GLP-1 drugs affect the peptide manufacturing industry?

GLP-1 agonist demand for diabetes and obesity treatment has exploded, creating unprecedented peptide manufacturing capacity requirements. The global GLP-1 market could reach $157 billion by 2030. This demand drives massive capacity investments by pharmaceutical companies and CDMOs including Asymchem, reshaping the entire peptide manufacturing landscape.

What does a peptide certificate of analysis show?

A COA documents testing results for a specific peptide batch including identity confirmation via mass spectrometry, purity assessment via HPLC, and for pharmaceutical-grade material, additional parameters like water content, residual solvents, endotoxin levels, and microbial limits. The COA should be batch-specific and issued by qualified personnel. Understanding COAs helps researchers from SeekPeptides evaluate their peptide sources appropriately.

Will the BIOSECURE Act affect Asymchem?

The BIOSECURE Act targets specific Chinese biotechnology companies with implementation deadlines extending to 2032. Asymchem is not currently named in the legislation. However, the regulatory environment continues evolving, and companies with Chinese manufacturing relationships monitor legislative developments closely. Supply chain diversification strategies reflect these considerations.

External resources

For researchers serious about understanding the peptide supply chain, SeekPeptides provides comprehensive resources on manufacturing standards, quality verification, and source evaluation, helping navigate the complex landscape where pharmaceutical manufacturing meets research applications.

In case I don't see you, good afternoon, good evening, and good night.