Jan 19, 2026

Ninety-nine percent of peptides sold online come from China. This includes peptides marketed by American companies, European retailers, and boutique research vendors. The vial in your refrigerator almost certainly originated in Guangdong province, where over seventy percent of China's peptide manufacturing facilities operate.

That reality creates a problem.

Not because Chinese manufacturing is inherently inferior. Some of the world's most sophisticated peptide synthesis facilities, including those passing FDA inspections, operate in China. The problem is visibility. Between a synthesis reactor in Hangzhou and your research bench, peptides pass through intermediaries, repackagers, and distributors who may or may not maintain quality standards. The chain gets murky. Documentation gets questionable. And researchers end up injecting compounds they cannot fully verify.

This guide examines everything researchers need to know about Chinese peptides, from manufacturing realities and quality verification to vendor vetting and risk mitigation.

The goal is not to discourage sourcing from China, that would be impractical given market realities, but to equip you with tools for making informed decisions. SeekPeptides provides comprehensive resources for navigating these complexities, helping researchers separate legitimate suppliers from operations cutting corners in ways that compromise research validity and personal safety.

Understanding where your peptides come from, how they're tested, and what questions to ask transforms you from a passive consumer into an informed researcher capable of quality assessment. That knowledge protects both your research outcomes and your health.

The reality of global peptide manufacturing

China dominates peptide manufacturing for reasons beyond cheap labor. The country invested heavily in biotechnology infrastructure over the past two decades, developing clusters of specialized facilities with advanced synthesis capabilities, trained chemists, and vertically integrated supply chains. The Guangdong region alone hosts facilities capable of producing metric tons of peptides annually, serving pharmaceutical companies, research institutions, and the burgeoning gray market for research compounds.

This concentration creates efficiency.

Raw material procurement, synthesis, purification, and quality testing happen within geographic proximity. Logistics are streamlined. Costs drop thirty to sixty percent compared to Western manufacturing for equivalent quality levels. A weight loss peptide synthesized in China may cost one-third what the same compound costs from a US-based manufacturer, assuming equal purity and documentation.

The assumption matters.

Manufacturing tiers in Chinese peptide production

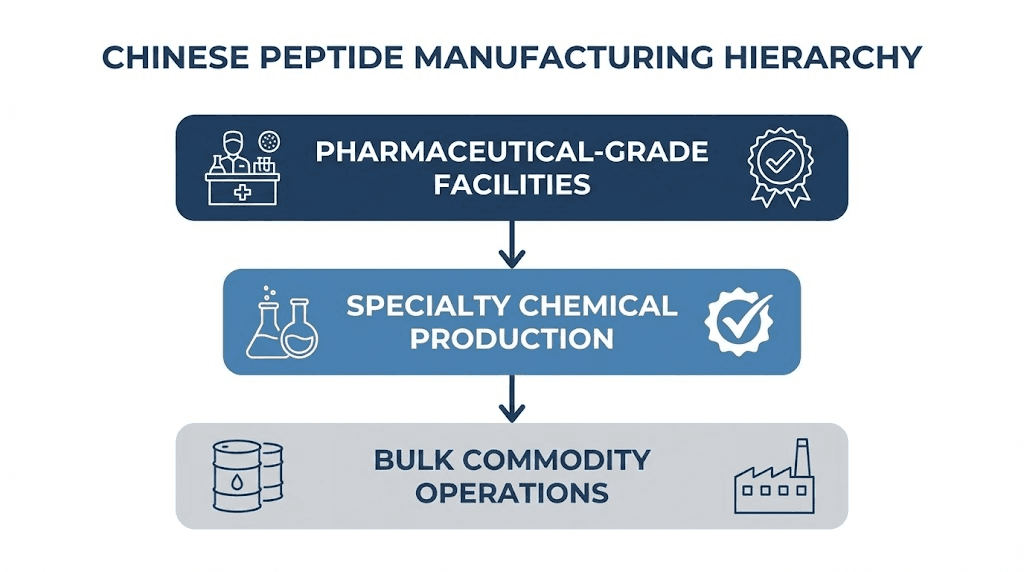

Not all Chinese manufacturers operate at the same standard. Understanding the tier system helps researchers assess what they're actually buying.

Pharmaceutical-grade facilities maintain cGMP compliance with regulatory oversight from agencies including NMPA (China's National Medical Products Administration), FDA, and EMA. Companies like CPC Scientific and Sinopep Biopharma have passed multiple FDA inspections, operate ISO-certified quality systems, and produce peptides for clinical trials and pharmaceutical applications. Their products come with comprehensive documentation, batch-specific certificates of analysis, and audit trails meeting international regulatory requirements.

These facilities charge accordingly. Research peptides from pharmaceutical-grade Chinese manufacturers cost significantly more than gray market alternatives, though still less than equivalent Western production. The premium buys verified quality, regulatory compliance, and documentation that withstands scrutiny.

Research-grade facilities operate below pharmaceutical standards but maintain quality systems, analytical capabilities, and reasonable consistency. They serve academic institutions, biotechnology companies conducting preclinical research, and sophisticated individual researchers who understand quality verification. Documentation quality varies. Some provide legitimate certificates of analysis with verifiable test results. Others generate documents that look official but contain fabricated data.

This tier presents the verification challenge. Products may be excellent or problematic, and distinguishing between them requires effort researchers often skip.

Bulk commodity facilities prioritize volume over documentation. They supply intermediaries who repackage peptides under various brand names, often without additional testing. Quality control may be minimal or nonexistent. These facilities serve price-sensitive markets where buyers don't ask detailed questions and sellers don't volunteer information.

Most gray market peptides originate from this tier, passing through multiple handlers before reaching end users with documentation of questionable provenance.

Why domestic vendors source from China

American and European peptide vendors rarely manufacture their own products.

The economics don't support it. Building and operating a peptide synthesis facility requires millions in capital investment, specialized equipment, trained personnel, and ongoing regulatory compliance costs. Purchasing bulk peptides from China and repackaging them under a domestic brand makes financial sense.

This arrangement isn't inherently problematic.

Reputable domestic vendors source from quality Chinese manufacturers, conduct independent testing on incoming batches, maintain proper storage and handling, and provide legitimate documentation. They add value through quality verification, customer service, faster shipping, and accountability under domestic legal frameworks. The markup reflects these services.

The problem arises when domestic vendors skip verification steps. Some purchase from the cheapest available source, repackage without testing, and generate their own certificates of analysis based on manufacturer claims rather than independent verification. Others knowingly sell substandard products, betting that most customers lack the means to identify quality issues.

Understanding this supply chain helps researchers ask appropriate questions. Where do you source your peptides? Do you conduct independent testing? Can I verify your COA with the testing laboratory? Vendors who answer these questions transparently demonstrate quality commitment. Those who deflect or provide vague responses warrant skepticism.

Quality verification fundamentals

Peptide quality involves multiple dimensions that single metrics cannot capture. A compound might be chemically pure yet contain dangerous contaminants.

It might pass purity testing while being the wrong peptide entirely.

HPLC purity analysis

High-performance liquid chromatography measures how cleanly a peptide was synthesized and how stable it remains. The technique separates compounds based on chemical properties, producing a chromatogram showing peaks for different substances in a sample. The target peptide appears as a main peak, with impurities showing as smaller peaks.

Purity percentages derive from peak area comparisons. A 98% pure peptide means the main peak represents 98% of total detected material, with 2% attributable to synthesis byproducts, degradation products, or other impurities.

The 98% threshold represents an industry standard for research-grade peptides. Pharmaceutical applications often require higher purity. Gray market products frequently claim this figure regardless of actual composition.

HPLC has limitations. The technique is calibrated to detect specific compounds. If someone sends a sample expecting BPC-157 and the vial contains a completely different peptide, HPLC might still show high purity, just of the wrong substance. The test measures chemical cleanliness, not identity.

Additionally, HPLC cannot detect all potential contaminants. Heavy metals, bacterial endotoxins, and residual solvents may not appear on standard chromatograms. A peptide showing 99% purity by HPLC might still contain dangerous levels of substances the test wasn't designed to detect.

Mass spectrometry identity confirmation

Mass spectrometry addresses the identity question that HPLC cannot answer. The technique measures molecular mass with high precision, producing a spectrum showing mass-to-charge ratios of detected ions. Each peptide has a characteristic molecular weight determined by its amino acid sequence. TB-500 has a different molecular weight than BPC-157, which differs from GHK-Cu.

Comparing the measured mass to the expected mass confirms whether the sample contains the claimed peptide. If the vial says BPC-157 but mass spectrometry shows a different molecular weight, something is wrong.

This matters more than many researchers realize. HPLC alone cannot detect certain errors, including peptides missing amino acids or containing substitutions. A synthesis error that drops one amino acid from a fifteen-residue peptide might appear 99% pure on HPLC while being functionally different from the intended compound. Mass spectrometry catches these errors.

Combined HPLC and mass spectrometry testing, often designated HPLC-MS or LC-MS, provides both purity and identity verification. Legitimate certificates of analysis include both test results.

Documents showing only HPLC data without mass spectrometry confirmation raise questions about what was actually tested.

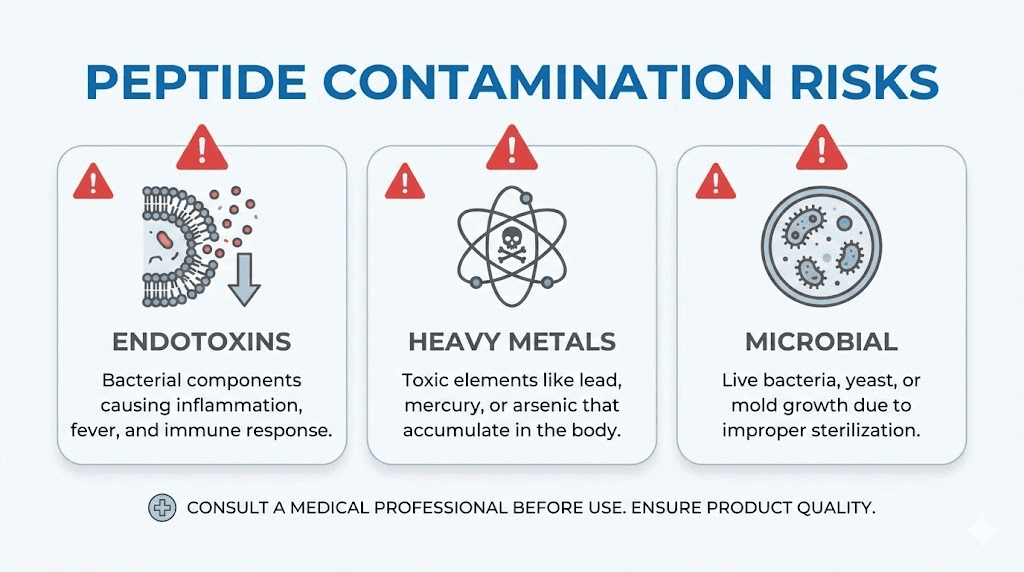

Endotoxin testing

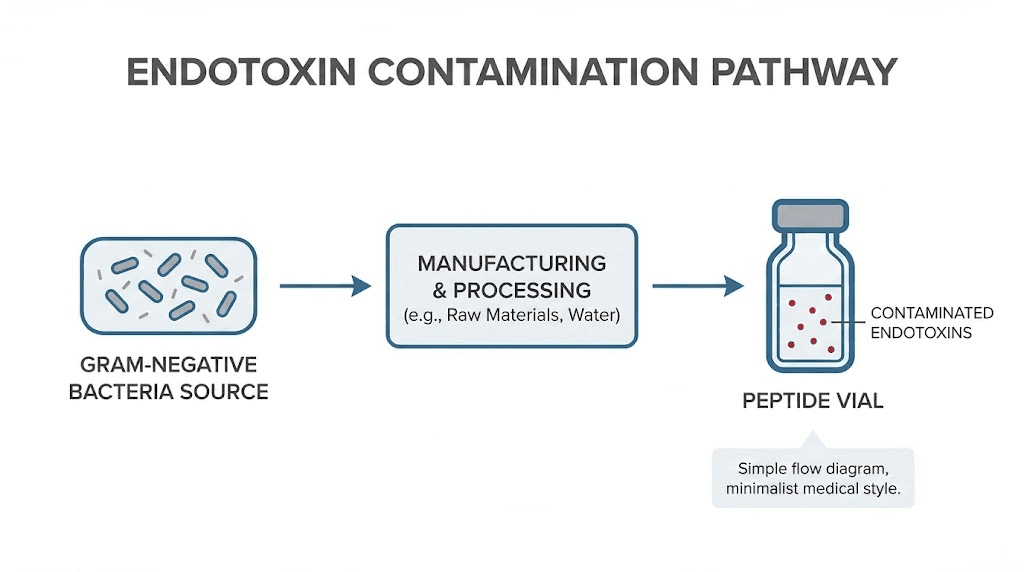

Endotoxins originate from gram-negative bacteria cell walls. These lipopolysaccharide molecules trigger inflammatory responses when injected, causing reactions ranging from fever and chills to systemic shock. They're ubiquitous in manufacturing environments, easily contaminating equipment, reagents, and final products.

Standard purity testing doesn't detect endotoxins. A peptide can show 99.5% purity by HPLC while containing dangerous endotoxin levels. This represents one of the most significant safety concerns with research peptides, particularly those from facilities with inadequate contamination controls.

FDA regulations set maximum permissible endotoxin levels for injectable drugs at 5 EU/kg for standard injections and 0.2 EU/kg for intrathecal administration. Pharmaceutical manufacturers target much lower levels during production. Research peptide vendors often skip this testing entirely, leaving buyers unaware of contamination status.

Endotoxin testing follows USP <85> methodology using limulus amebocyte lysate assays. The test detects bacterial contamination that other methods miss. SeekPeptides emphasizes the importance of this testing in evaluating peptide suppliers, as endotoxin contamination can invalidate research results and create serious health risks.

Researchers using injectable peptides should prioritize suppliers who provide endotoxin test results. The absence of this data on certificates of analysis suggests either inadequate testing or unwillingness to disclose concerning results.

Heavy metals screening

Peptide synthesis involves various chemical reagents, solvents, and processing equipment that can introduce heavy metal contamination. Arsenic, cadmium, chromium, lead, and mercury all pose health risks at low concentrations. Chronic exposure accumulates in tissues, creating long-term health consequences that may not manifest immediately.

ICP-MS (inductively coupled plasma mass spectrometry) screens for heavy metals with high sensitivity. Pharmaceutical-grade facilities routinely test for metals contamination as part of quality protocols. Research-grade and commodity suppliers often skip this step to reduce costs.

Heavy metals don't affect peptide purity as measured by standard chromatographic methods. A sample could appear chemically pure while containing problematic metal levels. Without specific screening, these contaminants remain invisible.

Researchers conducting long-term protocols with frequent dosing face cumulative exposure risks. Even low levels of contamination become significant over months of daily injections. Prioritizing suppliers who screen for heavy metals protects against risks that standard purity testing cannot assess.

Sterility and microbial testing

Lyophilized peptides aren't necessarily sterile. While the freeze-drying process reduces microbial survival, it doesn't guarantee sterility. Bacteria, fungi, and other microorganisms can contaminate products during synthesis, processing, packaging, or storage.

Pharmaceutical manufacturing addresses this through sterile production environments following USP <795> and <797> protocols. Clean rooms, air filtration, personnel gowning procedures, and environmental monitoring minimize contamination risk. Final products undergo microbial testing before release.

Gray market facilities may lack these controls. Products manufactured in non-sterile environments, handled without appropriate precautions, or stored improperly can harbor microbial contamination invisible to the naked eye.

For researchers who reconstitute peptides with bacteriostatic water, some microbial contamination may be controlled by the preservative.

However, high initial contamination levels or certain organism types can overwhelm this protection.

Sterility testing provides assurance that standard purity methods cannot offer.

Certificate of analysis interpretation

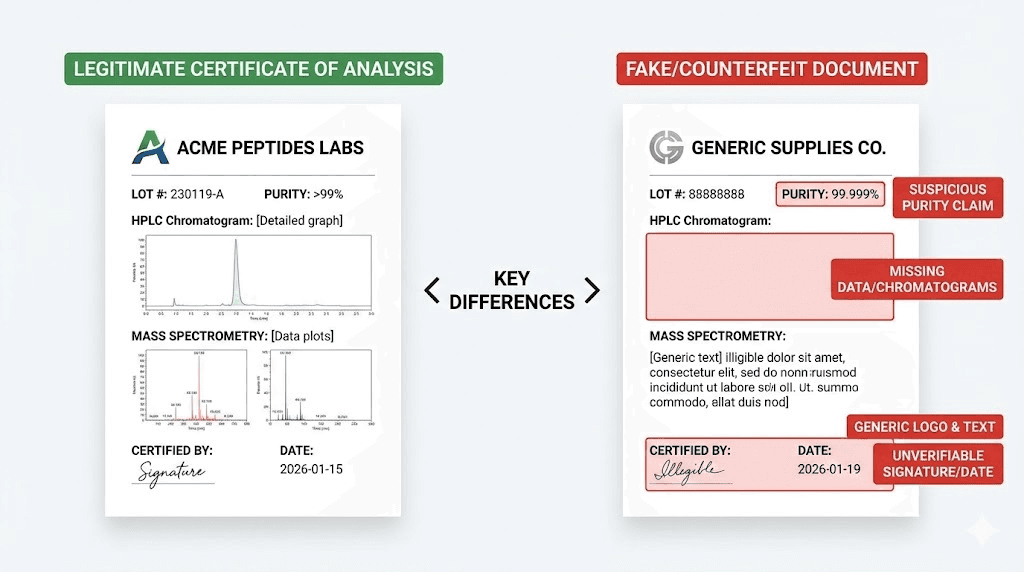

Certificates of analysis document quality testing results. They should provide evidence supporting purity claims, identity confirmation, and safety assessment. In practice, COAs range from comprehensive scientific documents to fabricated papers designed to deceive.

Learning to distinguish legitimate from fake COAs represents an essential skill for researchers sourcing peptides.

The prevalence of fraudulent documentation, estimated at over ninety percent for gray market peptides, makes this evaluation critical.

Components of legitimate COAs

A trustworthy certificate of analysis includes multiple elements that together provide quality verification.

Testing laboratory identification specifies who performed the analysis. Legitimate COAs name the laboratory, provide contact information, and often include accreditation details (ISO 17025, GLP compliance, etc.). The laboratory should be an entity you can independently verify exists and has appropriate capabilities.

Batch or lot numbers link the COA to a specific production run. Every batch of peptides should have a unique identifier traceable through documentation. Generic COAs without batch numbers may have been created once and reused across multiple products regardless of actual composition.

Test dates indicate when analysis occurred. Dates should be recent relative to product manufacturing. COAs showing test dates years old for recently produced peptides raise questions about whether testing actually occurred on the current batch.

HPLC chromatograms show the actual data from purity testing, not just a claimed percentage. The chromatogram should display a dominant peak for the target peptide with minimal impurity peaks. Method details (column type, mobile phase, detection wavelength) should be specified.

Mass spectrometry data confirms identity through molecular weight measurement. The spectrum should show the expected mass for the claimed peptide. Without MS data, purity claims cannot be verified as applying to the correct compound.

Additional testing results for endotoxin levels, residual solvents, heavy metals, and sterility appear on comprehensive COAs. The presence of these tests indicates quality commitment beyond minimal requirements.

Verification mechanisms allow independent confirmation. QR codes linking to laboratory databases, unique report IDs verifiable through lab websites, or contact information for direct verification demonstrate authenticity.

Red flags in fraudulent COAs

Fake certificates of analysis share common characteristics that careful examination can identify.

Missing chromatograms and spectra suggest the document was created without actual testing. Legitimate analysis produces data visualizations. Their absence indicates either testing didn't occur or results were unfavorable.

Generic laboratory names that cannot be independently verified raise immediate concerns. Some fraudulent COAs cite labs that don't exist or use names similar to legitimate laboratories. Searching for the named lab should produce verifiable contact information and evidence of analytical capabilities.

Suspicious formatting including misaligned text, inconsistent fonts, obvious digital alterations, or poor-quality reproduction suggests document manipulation. Legitimate COAs maintain professional formatting consistent with the issuing laboratory's standards.

Reused documents appear across multiple products or vendors with only minor modifications. If the same COA appears for different batch numbers or from different sellers, the document is almost certainly fraudulent.

Unverifiable claims cannot be confirmed through independent channels. If a COA cites a specific lab but that lab has no record of the testing, or if verification systems return no results for the provided report ID, the document should be considered fraudulent until proven otherwise.

Taking time to verify COAs before purchasing protects researchers from compounds that may not match claims. The process requires effort, but that effort is considerably less than dealing with contaminated products or failed experiments.

Janoshik and third-party verification

Janoshik Analytical operates from the Czech Republic as the most widely recognized independent testing laboratory for research peptides.

They analyze samples submitted by vendors and individual researchers, providing HPLC, mass spectrometry, and additional testing services.

The laboratory's verification system allows checking whether specific test reports are legitimate. Entering a report ID or scanning a QR code confirms whether Janoshik actually performed the claimed analysis. This verification capability makes Janoshik reports more trustworthy than unverifiable alternatives.

However, the system has limitations. Some vendors have been caught using legitimate Janoshik reports from one batch to sell different products. The COA might be real, but it may not correspond to what you're purchasing. Batch number matching remains essential.

Other laboratories provide similar services, though with varying recognition and verification capabilities. Chromate, Vanguard Laboratory, and several others offer independent testing. The key criterion is whether results can be independently verified rather than taking documentation at face value.

For high-value purchases or ongoing supplier relationships, researchers might consider sending samples for independent testing. The cost of laboratory analysis is modest compared to wasted research from substandard compounds or health risks from contaminated products.

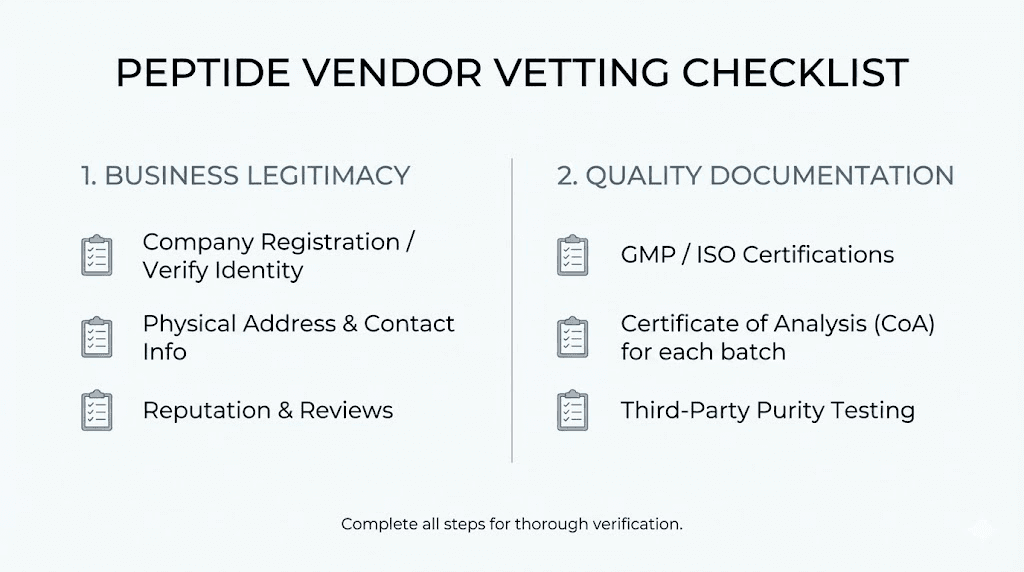

Vendor vetting protocols

Selecting peptide suppliers requires systematic evaluation beyond marketing claims. The gray market operates with minimal accountability, allowing problematic vendors to persist until enough complaints accumulate or legal action occurs. Proactive vetting protects researchers from becoming cautionary tales.

Business verification fundamentals

Legitimate businesses maintain verifiable identities. Physical addresses, business registration, phone numbers, and professional email domains indicate authentic operations. The absence of these elements suggests operations designed to avoid accountability.

Address verification starts with checking whether a claimed location exists and appears appropriate. Satellite imagery reveals whether an address corresponds to an office building, warehouse, residential property, or empty lot. Registered agent services that accept mail on behalf of businesses without physical presence warrant scrutiny. While some legitimate businesses use these services, they also provide cover for operations avoiding transparency.

Contact method evaluation assesses communication channels. Business email addresses on company domains suggest more established operations than generic Gmail or Outlook addresses. Exclusive use of WhatsApp, Telegram, or other encrypted messaging for business communication characterizes gray market suppliers avoiding formal business records.

Licensing verification applies when vendors claim specific credentials. Compounding pharmacies must hold licenses verifiable through state pharmacy boards. Claims of FDA registration can be checked through agency databases. ISO or GMP certifications should include certificate numbers verifiable with issuing organizations.

These verification steps require minimal time and eliminate vendors making false claims about their business status. Starting here prevents wasted effort evaluating quality claims from entities that aren't what they represent.

Quality documentation assessment

Beyond COA verification, several quality-related questions help assess vendor commitment to product integrity.

Sourcing transparency addresses supply chain origins. Reputable vendors identify their manufacturers or at least confirm manufacturing regions and quality standards. Reluctance to discuss sourcing suggests either lack of knowledge about their own products or awareness that disclosure would undermine confidence.

Testing protocols should be documented and consistent. Does the vendor conduct independent testing on incoming batches, or do they rely entirely on manufacturer claims? What tests are performed? How are failures handled? Vendors who can describe their quality systems demonstrate more commitment than those who cannot articulate their processes.

Storage and handling affects peptide stability. Vendors should maintain appropriate cold storage, typically at -20°C or colder for lyophilized peptides. Shipping protocols should include insulated packaging with appropriate cold packs or dry ice depending on ambient temperatures and transit times. Vendors who cannot describe their cold chain protocols probably don't have effective ones.

Documentation completeness extends beyond COAs. Batch tracking, expiration dating, storage instructions, and reconstitution guidance all indicate quality-focused operations. Vendors providing minimal information likely have minimal systems underlying their operations.

Pricing analysis

Peptide prices vary legitimately based on manufacturing quality, testing comprehensiveness, and distribution costs. However, dramatic departures from market norms signal problems.

Suspiciously low prices usually indicate quality compromises. Synthesis, purification, and testing have irreducible costs. Vendors offering prices far below market averages likely skip quality steps, source from problematic manufacturers, or sell diluted or counterfeit products. The savings come from somewhere, and that somewhere typically affects what you're injecting.

Premium pricing doesn't guarantee quality but often correlates with better practices. Vendors investing in quality systems, independent testing, proper storage, and customer support must charge accordingly. While high prices don't ensure legitimacy, consistently low prices virtually guarantee compromise.

Comparative shopping helps establish market ranges. Check prices across multiple vendors for the same peptides. Dramatic outliers in either direction warrant explanation. Vendors priced reasonably within market norms while demonstrating quality commitment merit consideration over both bargain and luxury alternatives.

Community reputation research

Online communities discussing research peptides provide valuable vendor intelligence. Forums, Reddit communities, and review platforms aggregate experiences from many buyers, revealing patterns that individual transactions cannot.

Consistent complaints about specific issues, whether shipping problems, quality inconsistencies, customer service failures, or product effectiveness, suggest systemic problems rather than isolated incidents. Multiple reports of similar issues warrant concern.

Suspiciously positive reviews that sound promotional rather than authentic may be planted.

Genuine reviews typically include specific details about products, experiences, and outcomes.

Marketing copy disguised as reviews lacks this specificity.

Community verification projects like Finnrick Analytics aggregate independent testing data across vendors, providing quality rankings based on actual laboratory results rather than vendor claims. These resources help identify consistently reliable suppliers.

Recency matters in reputation assessment. Vendor quality can change over time, particularly after ownership changes, supplier switches, or business pressures.

Recent reviews carry more weight than older ones.

A vendor who was excellent two years ago may not maintain those standards today.

Combining community research with direct verification creates a comprehensive vendor assessment. Neither approach alone provides complete information, but together they minimize risk of problematic purchases.

Major Chinese peptide sources

Understanding the landscape of Chinese peptide manufacturing helps researchers contextualize vendor claims and assess supply chain credibility. Several categories of Chinese sources supply the global market.

Pharmaceutical-grade manufacturers

Companies like CPC Scientific, Sinopep Biopharma, and AmbioPharm represent the top tier of Chinese peptide manufacturing. These facilities maintain cGMP compliance, undergo regular regulatory inspections, and produce peptides for pharmaceutical applications including clinical trials.

CPC Scientific has passed FDA inspections five times, holds ISO 9001 and ISO 13485 certifications, and maintains production capacity exceeding one thousand kilograms of peptide API annually. Their facility in Hangzhou serves global pharmaceutical companies with comprehensive documentation meeting international regulatory requirements.

Sinopep Biopharma has similarly passed multiple FDA inspections since 2014, along with audits from Korean MFDS and twenty NMPA inspections in China. Their GMP facilities produce peptides for pharmaceutical development and commercial manufacturing.

These manufacturers don't typically sell directly to individual researchers. Their products reach end users through pharmaceutical companies, licensed distributors, or research-grade vendors who source from their facilities. Knowing these names helps evaluate vendor claims about supply chain quality.

Research-grade chemical suppliers

GL Biochem, QYAOBIO (ChinaPeptides), and similar companies specialize in custom peptide synthesis for research applications. They serve academic institutions, biotechnology companies, and sophisticated individual researchers with products meeting research-grade but not pharmaceutical specifications.

These suppliers typically provide certificates of analysis with analytical data, though documentation quality and testing comprehensiveness vary. Some maintain quality systems approaching pharmaceutical standards. Others operate more casually with less rigorous controls.

Researchers purchasing directly from these suppliers face minimum order requirements, international shipping logistics, and communication challenges. The arrangement makes sense for institutions with procurement infrastructure and quality assessment capabilities. Individual researchers often find domestic intermediaries more practical despite markup costs.

Gray market aggregators

The gray market for research peptides operates through a network of aggregators, repackagers, and distributors sourcing from various Chinese manufacturers. Quality varies dramatically within this tier, from legitimate operations maintaining quality controls to fraudulent sellers of diluted or counterfeit products.

QSC (Qingdao Sigma Chemical) represents one of the more visible gray market sources, frequently discussed in research peptide communities. Reviews are mixed, with some users reporting quality products and others documenting problems. The vendor gained attention through a Wall Street Journal article describing them as "a major gray market source."

Gray market operations typically offer direct-to-consumer sales at prices significantly below retail vendors. The savings come with risks including inconsistent quality, questionable documentation, customs complications, and limited recourse for problems. Sophisticated researchers who understand verification methods may navigate this tier successfully. Others encounter problems ranging from ineffective products to health complications.

The gray market isn't uniformly problematic, but it requires more buyer sophistication than retail channels. Researchers who cannot or won't invest in quality verification should stick with established vendors who provide that service as part of their value proposition.

Common quality issues and their implications

Understanding specific quality problems helps researchers recognize symptoms and assess risks. Several issues recur frequently in research peptide markets.

Purity below claims

Perhaps the most common issue, actual purity frequently falls below claimed levels. A product advertised as 98% pure might test at 90%, 85%, or lower. Sometimes the peptide is present but with more impurities than claimed. Other times the product is diluted with fillers or different compounds entirely.

Low purity affects dosing accuracy. If you calculate a 250mcg dose based on label claims but actual peptide content is 80% of stated amounts, you're administering 200mcg. Researchers adjusting doses based on expected results may escalate amounts beyond intended ranges, creating safety concerns.

This issue particularly affects potent compounds where precision matters. Semaglutide dosing, for instance, occurs in microgram ranges where percentage errors significantly impact effects. Less potent compounds may be more forgiving of purity variations.

Wrong peptide identity

More concerning than purity issues, some products contain different peptides than claimed or no peptide at all. Mass spectrometry reveals cases where vials labeled as one compound contain something else entirely. Sometimes the substitution involves a cheaper peptide with similar properties. Other times the content bears no relation to claims.

This problem cannot be detected through normal use. Researchers may attribute lack of expected effects to individual response variation, incorrect protocols, or other factors when the actual cause is receiving the wrong compound. Only laboratory testing reveals these mismatches.

Identity errors create both research validity and safety concerns. An experiment using the wrong peptide produces meaningless results regardless of other protocol quality.

Safety profiles differ between compounds, so researchers may unknowingly take substances with different risk characteristics than expected.

Contamination issues

Contamination takes multiple forms, each with different implications.

Bacterial endotoxin contamination triggers inflammatory responses, potentially severe. Symptoms include fever, chills, nausea, hypotension, and in extreme cases, septic shock. Researchers who experience unexplained reactions after injections should consider endotoxin contamination as a possibility.

Heavy metals accumulate with chronic exposure. Single-dose effects may be unnoticeable, but months of daily injections from contaminated sources build tissue burdens. Effects may not manifest for years, complicating attribution to peptide use.

Microbial contamination causes infections at injection sites or systemic illness. Bacteria, fungi, and other organisms surviving in poorly manufactured or stored products create infection risks. Proper reconstitution technique reduces but cannot eliminate risks from initially contaminated products.

Contamination issues underscore why testing beyond simple purity matters. A chemically pure peptide can still be dangerous if contamination testing wasn't performed or results weren't disclosed.

Degradation and stability problems

Peptides degrade over time, especially with improper storage. Exposure to heat, light, moisture, or oxygen accelerates breakdown. Products that were initially high-quality can deteriorate before reaching researchers.

Cold chain failures represent a common cause. Peptides shipped without appropriate temperature control during hot weather may arrive degraded. Products stored improperly at any point in the supply chain, whether at the manufacturer, distributor, or vendor, accumulate damage.

Degraded peptides may show reduced purity on testing, but sometimes degradation products co-elute with the parent compound on HPLC, masking the problem. Researchers using degraded products experience reduced effectiveness without obvious explanation.

Proper storage instructions and recent manufacturing dates reduce degradation risks.

Products sitting in inventory for extended periods warrant skepticism, particularly if storage conditions are unknown.

Risk mitigation strategies

Given the challenges of peptide sourcing, researchers can employ several strategies to reduce quality-related risks.

Start with small test orders

Before committing significant funds to any vendor, place a small initial order. Test a single vial rather than buying in bulk. This approach limits financial exposure while allowing quality assessment before larger purchases.

Evaluate the test order carefully. How was packaging quality? Did shipping maintain appropriate temperatures? Does documentation match the product? Are COAs verifiable? Does the product behave as expected based on established research? Satisfactory answers support larger future orders. Problems suggest finding alternative sources.

This testing approach costs more per unit than bulk purchasing but protects against catastrophic purchases of large quantities of problematic products. The slight premium represents insurance against much larger losses.

Verify before trusting

Apply verification procedures consistently rather than assuming good faith. Check COAs against testing laboratory records. Verify business credentials through independent sources. Research vendor reputation in community forums. Confirm that claims about certifications, testing, and sourcing are actually true.

This vigilance may feel excessive, but the prevalence of misrepresentation in research peptide markets justifies it. Most vendors make quality claims. Fewer can substantiate them. The verification process separates legitimate operations from those relying on buyer credulity.

SeekPeptides helps researchers navigate these verification challenges by providing educational resources and quality assessment frameworks. The platform emphasizes evidence-based evaluation rather than accepting marketing at face value.

Consider independent testing

For critical applications or ongoing relationships, sending samples for independent laboratory testing provides definitive quality assessment. Services like Janoshik, Vanguard Laboratory, and others analyze submitted samples and return verified results.

Testing costs range from tens to hundreds of dollars depending on analyses requested.

For research protocols involving significant investment or health considerations, this expense is minor compared to the value of certainty. A $100 test that confirms (or reveals problems with) a $500 purchase protects both the financial investment and the research it supports.

Testing is particularly valuable when establishing new supplier relationships. Verify the first batch from a new source before assuming subsequent batches match quality. Periodic testing of ongoing suppliers helps detect quality changes that might otherwise go unnoticed.

Maintain proper handling

Quality control doesn't end at purchase. How researchers handle peptides after receipt affects their integrity.

Storage temperature matters for longevity. Lyophilized peptides generally require -20°C or colder for extended storage. Reconstituted solutions may need refrigeration and have shorter stability windows. Following storage recommendations preserves initial quality.

Reconstitution technique affects solution quality. Using appropriate diluents like bacteriostatic water, maintaining sterility during preparation, and avoiding contamination introduction protects against problems that careful sourcing prevented.

Usage timeframes should respect stability limitations. Reconstituted peptides don't last indefinitely. Using solutions within recommended timeframes prevents degradation-related effectiveness loss.

Excellent sourcing combined with poor handling wastes quality investment. The reverse, careful handling of poor-quality products, cannot compensate for initial deficiencies. Both sourcing and handling require attention.

Specific peptide sourcing considerations

Different peptide types present varying sourcing challenges based on synthesis complexity, market demand, and counterfeiting prevalence.

Growth hormone secretagogues

Peptides like CJC-1295, ipamorelin, and sermorelin represent popular categories with established manufacturing and relatively abundant supply. Quality varies across the market, but legitimate sources exist at various price points.

These peptides have defined structures that mass spectrometry can verify. Identity confirmation through MS data provides reasonable assurance of receiving the correct compound. Purity and contamination testing complete the quality assessment.

The ipamorelin versus CJC-1295 decision and similar compound selections should be based on research goals rather than sourcing convenience. Both are available from quality sources for researchers who verify appropriately.

GLP-1 agonists

Semaglutide and tirzepatide have attracted massive demand due to weight loss applications. This demand creates both opportunity and risk. Many vendors have added these products, but quality consistency varies widely.

Complex molecules like tirzepatide present greater synthesis challenges than simpler peptides.

The potential for synthesis errors, lower purity, or outright counterfeiting increases with compound complexity. Researchers sourcing GLP-1 agonists should apply especially rigorous verification.

The cost analysis for these compounds should factor in quality verification expenses. Apparently cheap sources that require extensive testing to verify may not be economical compared to premium sources with established reliability.

Healing peptides

BPC-157 and TB-500 dominate the healing peptide category, with extensive gray market availability. Their popularity makes them common offerings from vendors across quality tiers.

The BPC-157 versus TB-500 comparison matters less than ensuring whatever you choose is actually that compound at claimed purity. Both peptides are available from legitimate sources.

Both are also commonly counterfeited or substituted with cheaper alternatives.

Stacking approaches combining these peptides require quality verification of each component. A stack with one quality component and one substandard one undermines the combined protocol.

Cosmetic and research peptides

Compounds like GHK-Cu, SNAP-8, and similar peptides serve both research and cosmetic applications. Quality requirements differ somewhat between applications, but verification principles remain consistent.

Topical applications may tolerate lower purity than injectable use, though contamination concerns persist regardless of administration route.

Researchers should match quality standards to intended applications while maintaining safety baselines.

Legal and regulatory considerations

Peptide sourcing involves legal frameworks that vary by jurisdiction and change over regulatory attention shifts.

Research chemical status

Most research peptides occupy a gray legal zone. They're not approved pharmaceuticals, so pharmaceutical regulations don't directly apply. They're sold as research chemicals "not for human use," creating legal distance between sellers and buyers using them personally.

This arrangement provides legal cover rather than approval. Researchers use these compounds at their own risk, with sellers disclaiming responsibility through labeling.

The "research chemical" designation doesn't mean products are legal for any purpose, just that certain regulations don't apply to their sale.

Regulatory attention to research peptides has increased with their growing popularity. FDA has taken action against some vendors, and the regulatory landscape may shift further.

Researchers should stay informed about legal developments affecting compound availability.

Import considerations

International sourcing introduces customs complexities.

Peptides imported from China may face inspection, seizure, or delay at customs. Different countries have different regulations regarding what can be imported and under what circumstances.

Some vendors maintain domestic warehouses specifically to avoid customs complications. Products shipped from US addresses don't face import scrutiny that direct China shipments might. This arrangement adds cost but improves delivery reliability and reduces legal exposure.

Researchers in countries with strict import controls should understand local regulations before international ordering. Customs seizure means lost money and potentially unwanted attention from authorities.

Prescription peptide considerations

Some peptides have approved pharmaceutical versions requiring prescriptions. Semaglutide (Ozempic, Wegovy) and tirzepatide (Mounjaro, Zepbound) are prescription medications. Research versions of these compounds exist in the gray market, but they don't have pharmaceutical approval.

Using research peptides to circumvent prescription requirements carries both legal and medical risks. The legal framework differs from research chemicals without approved analogues.

Medical risks include lack of physician oversight for compounds that require monitoring.

SeekPeptides provides educational content to help researchers understand these distinctions and make informed decisions about their research approaches.

Building reliable supply chains

Researchers with ongoing peptide needs benefit from developing consistent supply relationships rather than continually seeking new sources.

Establishing vendor relationships

After identifying vendors who pass verification scrutiny, developing ongoing relationships provides advantages.

Consistent quality from known sources reduces verification burden over time.

Vendors may offer better terms to repeat customers. Direct communication channels help resolve issues efficiently.

Building relationships requires initial verification investment. But once a vendor demonstrates reliability through multiple transactions, subsequent orders carry lower risk and administrative overhead. The first order from any source requires extensive checking.

The tenth order from a proven source requires less.

Maintaining multiple sources

Dependence on single suppliers creates vulnerability. Vendors may experience quality issues, stock shortages, business disruptions, or regulatory problems that interrupt supply. Maintaining relationships with multiple verified sources provides backup options.

Different sources may also offer different strengths. One vendor might excel with certain peptide categories while another provides better options for different compounds. Diversification allows matching sources to specific needs.

Documentation and tracking

Systematic record-keeping supports quality management over time. Tracking which batches came from which vendors, storing COAs and verification documentation, and noting any quality observations creates an information foundation for future decisions.

When problems occur, documentation helps identify patterns. If issues correlate with specific vendors, batches, or time periods, the patterns inform corrective action. Without records, the same mistakes may repeat.

Practical protocols for quality assurance

Implementing quality assurance doesn't require laboratory facilities or specialized training. Researchers can follow straightforward protocols to minimize sourcing risks.

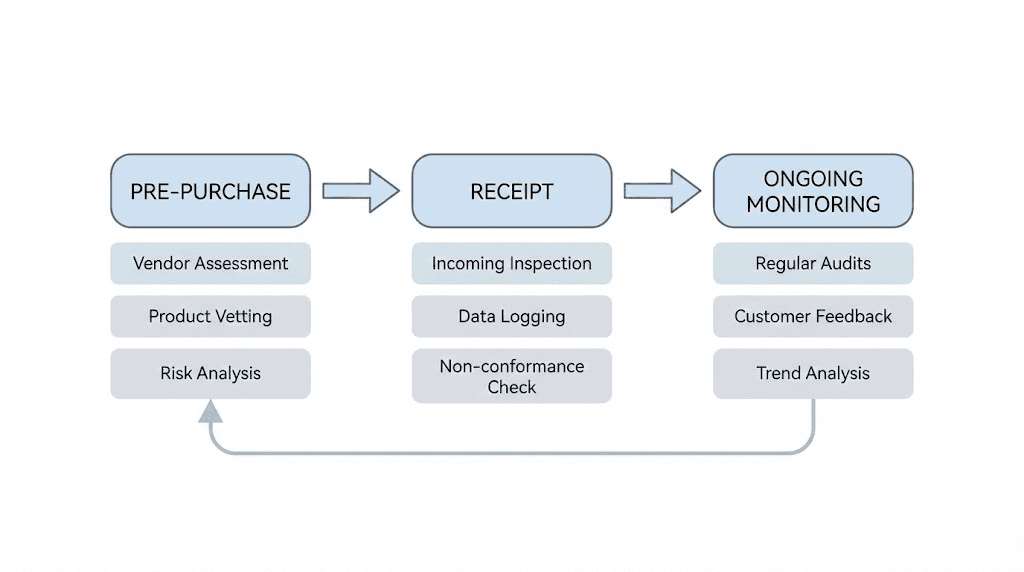

Pre-purchase checklist

Before ordering from any vendor:

Verify business legitimacy through address, registration, and contact confirmation. Check COA authenticity through testing laboratory verification. Research vendor reputation in community forums and review aggregators. Compare pricing to market norms, investigating significant deviations. Confirm storage and shipping protocols maintain appropriate conditions. Review return and complaint policies for recourse options.

Completing this checklist before purchasing prevents many common problems. Skipping steps to save time often costs more through problematic purchases.

Receipt inspection protocol

Upon receiving orders:

Check packaging integrity for damage or tampering signs. Verify temperature indicators if included show appropriate conditions were maintained. Confirm product matches order in type, quantity, and labeling. Review included documentation against pre-purchase information. Photograph everything for records before opening sealed containers. Store immediately at appropriate temperatures.

Identifying problems immediately preserves complaint options. Vendors are more responsive to issues raised promptly than complaints weeks after receipt.

Ongoing monitoring

During use:

Note any unusual appearance, smell, or behavior during reconstitution. Track effects relative to expectations from established research. Document any adverse reactions or unexpected outcomes. Compare experiences across batches from the same and different sources. Watch for changes in vendor quality indicators over time.

Systematic observation helps identify quality issues that might otherwise be attributed to other factors. Patterns across multiple uses provide more reliable signals than single observations.

The role of testing laboratories

Independent testing laboratories provide objective quality assessment beyond vendor claims. Understanding their role helps researchers use these resources effectively.

Available testing services

Laboratories like Janoshik, Vanguard Laboratory, PED Test Australia, and others offer analytical services for research peptides. Standard offerings include HPLC purity analysis, mass spectrometry identity confirmation, and sometimes additional tests for endotoxins, heavy metals, or residual solvents.

Services vary in turnaround time, cost, and comprehensiveness. Basic purity and identity testing costs around $50-100 per sample. Additional analyses increase costs.

Results typically arrive within one to three weeks depending on laboratory backlog and shipping times.

When to use independent testing

Independent testing makes sense in several situations:

New vendor evaluation provides objective data before committing to ongoing purchases. Testing the first order from a new source verifies their products match claims.

High-value purchases justify testing costs relative to the amount at stake. Spending $100 to verify a $500 purchase makes more sense than testing a $50 order.

Critical research applications where quality directly affects outcomes benefit from verification certainty. Academic research, serious experimentation, or health-critical protocols warrant investment in confirmation.

Suspected problems when products don't perform as expected may indicate quality issues worth investigating through testing.

Interpreting laboratory results

Test reports require interpretation to extract actionable conclusions.

HPLC purity percentages indicate chemical cleanliness. Results above 98% meet research-grade standards. Results between 95-98% may be acceptable depending on application. Below 95% raises significant concerns.

Mass spectrometry results should show detected mass matching expected molecular weight for the claimed peptide. Significant discrepancies indicate either wrong identity or major structural problems.

Additional tests provide context for specific concerns. High endotoxin levels indicate contamination risk. Detected heavy metals raise chronic exposure concerns. Residual solvents suggest incomplete purification.

Laboratories provide data but typically not interpretation advice. Researchers must understand what results mean for their specific applications and risk tolerances.

Frequently asked questions

Are Chinese peptides safe to use for research?

Safety depends on manufacturing quality and verification rather than geographic origin. Chinese facilities range from pharmaceutical-grade operations passing FDA inspections to commodity producers with minimal quality controls. Peptides from quality Chinese manufacturers, verified through appropriate testing and documentation, can be safe for research. Products from unknown or questionable sources carry risks regardless of claimed origin. The key is verification rather than geography.

How can I tell if my peptide COA is fake?

Legitimate COAs include testing laboratory identification with verifiable contact information, batch-specific numbers linking to the actual product, dated test results within reasonable timeframes, HPLC chromatograms and mass spectrometry data rather than just claimed numbers, and verification mechanisms like QR codes or report IDs that confirm with the laboratory directly. Missing elements, suspicious formatting, or verification failures all indicate potential fraud. When uncertain, contact the claimed testing laboratory directly with the report details.

Is it worth paying more for domestic peptide vendors?

Domestic vendors add value through quality verification, proper storage and handling, customer service, and legal accountability within your jurisdiction. Whether this value justifies price premiums depends on your verification capabilities and risk tolerance. Researchers who can evaluate quality independently may find direct sourcing economical. Those preferring vendors to provide quality assurance pay accordingly for that service. The answer differs based on individual circumstances, skills, and priorities.

What happens if customs seizes my peptide order?

Seized orders typically result in loss of both product and payment. Vendors may or may not offer reshipping or refunds depending on their policies. Some vendors maintain domestic warehouses specifically to avoid customs issues. Before international ordering, understand the specific customs risks in your jurisdiction and vendor policies regarding seized shipments. Using domestic sources eliminates this particular risk despite potentially higher costs.

How long do peptides remain stable in storage?

Lyophilized peptides stored properly at -20°C or colder maintain stability for one to two years or longer, depending on the specific compound. Reconstituted solutions have shorter stability, typically two to four weeks refrigerated when prepared with bacteriostatic water. Stability decreases with temperature increases, light exposure, moisture, and repeated freeze-thaw cycles. Products should be stored according to manufacturer recommendations, and reconstituted amounts should be based on anticipated usage within stability windows.

Should I test every batch of peptides I purchase?

Testing every batch provides maximum assurance but may not be practical or cost-effective. A reasonable approach tests initial orders from new vendors, then periodically verifies ongoing relationships. High-value purchases, critical applications, or any suspected quality issues warrant testing. Establishing trust with verified vendors reduces the ongoing testing burden while maintaining quality confidence.

What questions should I ask vendors before purchasing?

Important questions include: Where do you source your peptides? Do you conduct independent quality testing? Can I verify your COA with the testing laboratory? How do you store products before shipping? What are your shipping temperature protocols? What is your policy for quality complaints? Vendors who answer transparently demonstrate quality commitment. Evasive or vague responses suggest either ignorance about their own supply chain or unwillingness to disclose concerning information.

External resources

In case I don't see you, good afternoon, good evening, and good night. Join SeekPeptides.