Jan 19, 2026

What if the biggest obstacle to your peptide business isn't finding customers or sourcing quality products?

What if it's the platform you chose to sell them on?

Thousands of entrepreneurs discover this painful truth every year. They spend weeks building a Shopify store, uploading products, writing descriptions, and setting up payment processing. Everything looks perfect. Then one morning, they wake up to an email that makes their stomach drop. Account terminated. Funds frozen. No warning. No appeal. Their peptide business, gone overnight.

The question isn't whether Shopify allows peptide sales. It doesn't. The real questions are why, what alternatives exist, and how you can build a compliant peptide business that won't disappear without warning. This guide covers everything you need to know, from peptide legality and platform policies to current regulations and payment processing solutions that actually work for this industry.

Whether you're selling BPC-157 for research purposes, GHK-Cu copper peptides for skincare applications, or weight loss peptides through legitimate channels, understanding the ecommerce landscape is essential. The peptide industry operates in a complex regulatory environment where one wrong platform choice can cost you everything.

The short answer: Shopify prohibits peptide sales

No ambiguity here. Shopify explicitly prohibits the sale of peptides on its platform. This applies regardless of how you label them, how you market them, or what disclaimers you use.

The prohibition appears in Shopify's Acceptable Use Policy under multiple categories: research chemicals, pseudo-pharmaceuticals, nutraceuticals, and products claiming health or therapeutic benefits. Peptides check several of these boxes simultaneously, making them firmly off-limits.

This isn't a gray area. It's not open to interpretation. Shopify has made their position clear through policy documents, enforcement actions, and countless terminated accounts. Even if your peptides are injectable research compounds labeled "not for human consumption," the platform treats them the same way.

But why? Understanding Shopify's reasoning helps explain why most mainstream ecommerce platforms take similar positions, and why building a peptide business requires specialized solutions from the ground up.

Why Shopify prohibits peptide sales

Shopify's peptide prohibition stems from three interconnected concerns: regulatory risk, payment processor requirements, and liability exposure. Each factor alone might be manageable. Together, they create a risk profile that mainstream platforms simply won't accept.

FDA regulatory complexity

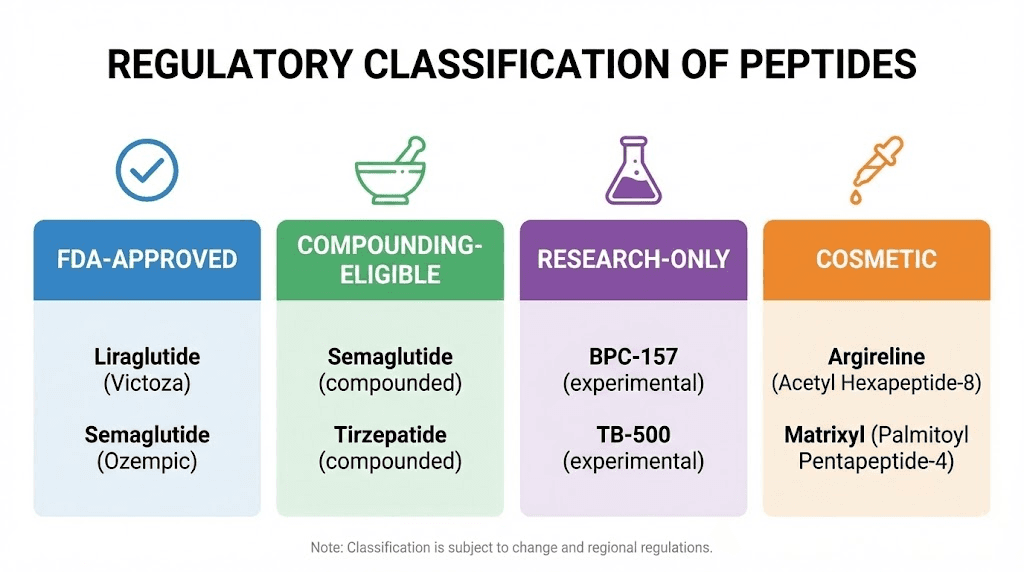

The FDA doesn't treat all peptides equally. Some have full approval for specific medical uses. Others exist in regulatory limbo. Understanding these distinctions matters for anyone considering entering the peptide market.

FDA-approved peptides include familiar compounds like insulin for diabetes management, liraglutide for obesity and type 2 diabetes treatment, and hormone therapies like buserelin and leuprolide. These can be legally prescribed, dispensed, and administered under healthcare provider supervision. They flow through established pharmaceutical channels with proper licensing at every step.

Then there's the research category. Many peptides are designated "for research use only" or "not for human consumption." This classification means they can legally be sold for laboratory and experimental purposes but haven't received FDA approval for medical treatment or personal use. The research peptide market operates in this space.

The problem? The FDA has stated that "research use only" disclaimers are often "a ruse to avoid FDA scrutiny for selling misbranded and adulterated products." When companies sell peptides alongside diluent, syringes, and dosing instructions, the research-only label becomes difficult to defend. The agency pursues enforcement actions against companies making therapeutic claims or clearly targeting human use, regardless of their disclaimers.

Shopify doesn't want to evaluate each peptide seller's compliance status. They don't want to determine whether your TB-500 listing crosses the line from research supply to implied human use. A blanket prohibition eliminates this complexity entirely.

Payment processor pressure

Even if Shopify wanted to allow peptide sales, their payment infrastructure wouldn't cooperate.

Shopify Payments runs on Stripe's infrastructure. Stripe explicitly lists "peptides, research chemicals, and other toxic, flammable and radioactive materials" on their restricted businesses list. This isn't negotiable. It's not case-by-case. Peptides are categorically prohibited.

The card networks themselves, Visa and Mastercard, classify unapproved pharmaceuticals, supplements, and research chemicals under restricted categories. Mastercard's Business Risk Assessment and Mitigation program specifically flags research peptides and nutraceuticals as high-risk. Banks that process these transactions face enhanced scrutiny, potential fines, and relationship damage with the card networks.

This creates a cascade effect. Stripe prohibits peptides because Visa and Mastercard restrict them. Shopify Payments uses Stripe. Therefore, Shopify cannot process peptide transactions through their native payment system. Allowing peptide sales while blocking the primary payment method would create an untenable user experience and compliance nightmare.

Legal liability concerns

Peptide sellers face significant legal exposure. The FDA issues warning letters to companies selling unapproved peptides with therapeutic claims. The FTC pursues deceptive advertising cases. State attorneys general investigate consumer protection violations. Individual consumers file lawsuits over adverse events.

Platforms that facilitate these sales can become entangled in legal actions. While Section 230 provides some protection for user-generated content, actively providing ecommerce infrastructure for prohibited product categories creates different risk profiles. Shopify's legal team has clearly decided the peptide market isn't worth the exposure.

Types of peptides and their regulatory status

Not all peptides carry the same regulatory burden. Understanding the categories helps explain why some businesses operate successfully while others face shutdown and legal action.

FDA-approved therapeutic peptides

These peptides have completed clinical trials, received FDA approval, and can be legally prescribed for specific conditions.

They include:

Insulin and its analogues for diabetes management. GLP-1 agonists like semaglutide and tirzepatide for weight loss and diabetes. Hormone therapies for various conditions. These flow through licensed pharmacies and healthcare providers, not research chemical suppliers or direct-to-consumer ecommerce stores.

Selling these without proper pharmaceutical licensing violates federal law. Period. The distribution channels are regulated, and operating outside them exposes sellers to criminal liability.

Compounding-eligible peptides

Some peptides can be legally compounded by licensed 503A or 503B pharmacies. These include compounds that are FDA-approved, have GRAS (Generally Recognized as Safe) status, appear in the USP monograph, or are listed on the FDA's 503A Bulks List.

Sermorelin falls into this category. NAD+ can be compounded under certain conditions. These peptides can be prescribed by physicians and prepared by compounding pharmacies for individual patient use.

However, the compounding pathway has narrowed significantly. The FDA has classified compounds like BPC-157 and TB-500 as Category 2 substances, meaning they're prohibited from compounding due to safety concerns. This classification effectively removes them from legitimate pharmaceutical channels.

Research-only peptides

This category includes most peptides sold through online research suppliers. They're labeled "for research purposes only" and "not for human consumption."

The legal theory is that researchers purchasing them for legitimate scientific study aren't violating any laws.

The reality is more complicated. These peptides often end up being self-administered by individuals seeking muscle growth, weight loss, injury recovery, or anti-aging benefits. Suppliers who clearly target this market through their marketing, packaging, or customer communications face FDA enforcement.

The research peptide market exists in a gray zone. It's not explicitly illegal to possess these compounds in most jurisdictions. But selling them while implying human use, making therapeutic claims, or targeting consumers rather than genuine researchers creates significant legal exposure.

Cosmetic peptides

Peptides used in skincare products occupy a different regulatory category. Under FDA regulations, cosmetics don't require pre-market approval. Companies can use peptide ingredients in serums, creams, and treatments as long as they don't make drug claims.

The distinction matters. A product claiming to "reduce the appearance of fine lines" is a cosmetic. A product claiming to "treat wrinkles" or "repair damaged skin" is making drug claims and falls under pharmaceutical regulations. Copper peptide skincare products, Snap-8 serums, and similar formulations can be sold legally when marketed appropriately.

The Modernization of Cosmetics Regulation Act of 2022 added new requirements. Manufacturers must register facilities with the FDA, list products and ingredients, report serious adverse events within 15 business days, and maintain safety substantiation records. These requirements apply to all cosmetics, including peptide-containing products.

Some cosmetic peptide businesses operate on mainstream platforms including Shopify. The key difference is positioning: they're selling skincare products, not peptides as such. The peptide is an ingredient, not the product category.

What happens if you try to sell peptides on Shopify anyway

Some sellers try it. They use vague product descriptions. They avoid the word "peptide" in listings. They hope to fly under the radar long enough to build a customer base and transition to another platform.

This approach fails. Here's why.

Detection and enforcement

Shopify employs automated systems that scan product listings, descriptions, images, and even customer reviews for prohibited content. The algorithms are sophisticated. They catch obvious violations and subtle ones.

Beyond automation, Shopify receives reports from competitors, customers, and regulatory agencies. Payment processors flag suspicious transaction patterns. Shipping partners identify problematic product categories. The network of detection extends far beyond Shopify's internal systems.

When violations are detected, enforcement is swift and severe. There's no warning email suggesting you modify your listings. There's no grace period to wind down operations. Accounts are terminated immediately.

Financial consequences

Account termination freezes all pending payments. If you have $10,000 in processing funds waiting for disbursement, that money becomes inaccessible. Shopify holds these funds to cover potential chargebacks, refunds, and legal claims.

The hold period can extend for months. In some cases, funds are never released. Sellers who violate the Acceptable Use Policy have limited recourse. The terms they agreed to when opening their account specifically authorize these actions.

Beyond the direct financial hit, terminated accounts damage your ability to work with other platforms and processors. Shopify shares data with payment networks. A termination for prohibited products creates a record that follows you, making it harder to open accounts elsewhere.

Legal exposure

Attempting to circumvent Shopify's policies doesn't protect you from regulatory enforcement. If anything, it increases your exposure. Using misleading product descriptions to evade platform detection also misleads consumers and regulators, potentially adding deceptive practices charges to any FDA or FTC action.

The FDA has issued warning letters to numerous peptide sellers.

These letters demand immediate cessation of sales and can lead to product seizures, injunctions, and criminal prosecution.

Operating on a platform that explicitly prohibits your products won't be viewed favorably in any enforcement proceeding.

Alternative ecommerce platforms for peptide sellers

If Shopify isn't an option, where do legitimate peptide businesses operate? Several alternatives offer more flexibility, though none provide a simple solution. Each requires careful compliance work and specialized payment processing.

WooCommerce

WooCommerce is an open-source ecommerce plugin for WordPress. It's the most recommended alternative for peptide sellers, and for good reason.

As a self-hosted solution, WooCommerce doesn't have a centralized Acceptable Use Policy. You own your website. You control your hosting. No corporate compliance team can terminate your store overnight. This autonomy is the primary advantage.

WooCommerce integrates with various payment gateways, including high-risk processors that work with peptide businesses. NMI, Authorize.Net, and specialized high-risk gateways can be connected through plugins or custom integrations. You're not locked into a single payment provider.

The tradeoffs are significant. WooCommerce requires technical expertise to set up and maintain. You need hosting, security certificates, plugin management, and ongoing updates. If something breaks, you fix it. There's no support team to call.

Security becomes your responsibility. PCI compliance, fraud prevention, customer data protection, these all fall on you. A poorly secured WooCommerce store exposes you to data breaches and the regulatory consequences that follow.

Despite these challenges, WooCommerce hosts many successful peptide vendors. The flexibility to work with specialized processors and the elimination of platform termination risk make it the default choice for serious operators.

BigCommerce

BigCommerce occupies a middle ground between Shopify's restrictions and WooCommerce's technical demands. It's a hosted platform like Shopify, but with more flexibility for high-risk products.

BigCommerce evaluates peptide sellers on a case-by-case basis. They don't have a blanket prohibition like Shopify. However, approval isn't guaranteed, and merchants must work with approved payment processors that handle regulated products.

The platform offers more built-in functionality than WooCommerce, reducing technical burden. You get hosting, security, and support as part of the package. This makes it attractive for sellers who want platform benefits without Shopify's restrictions.

However, BigCommerce still has terms of service.

They can still terminate accounts that violate their policies or create legal exposure.

The case-by-case approach means your account depends on ongoing compliance assessment, not just initial approval.

Shift4Shop

Formerly known as 3dcart, Shift4Shop explicitly positions itself as friendly to high-risk industries. Their prohibited products policy is more nuanced than Shopify's, allowing certain gray-area products when sellers demonstrate legal compliance.

The platform includes built-in features for regulated industries: age verification systems, customizable checkout restrictions, and compliance documentation tools. These features matter for peptide sellers navigating state-level regulations like New York's restrictions on sales to minors.

Shift4Shop integrates with Shift4 Payments, their parent company's processing solution. This can simplify the payment processing challenge, though peptide businesses typically still need specialized high-risk accounts.

Custom solutions

Some established peptide businesses build custom ecommerce platforms. This approach offers maximum control and eliminates platform dependency entirely. You own the code, the data, and the infrastructure.

Custom development is expensive. It requires ongoing technical resources for maintenance and updates. Security responsibility is entirely yours. For most peptide businesses, the cost doesn't justify the benefits over WooCommerce or BigCommerce.

However, businesses with significant transaction volumes and specialized requirements sometimes find custom solutions worthwhile. The absence of any platform dependency eliminates a category of risk entirely.

Payment processing for peptide businesses

Choosing an alternative platform solves only half the problem. Payment processing presents the bigger challenge. Mainstream processors like Stripe, PayPal, and Square prohibit peptide transactions. Finding a processor that works requires entering the high-risk merchant account world.

Why peptides are classified as high-risk

Payment processors classify industries by risk level. High-risk categories face higher fees, stricter requirements, and limited processor options. Peptides qualify as high-risk for several reasons.

Regulatory uncertainty tops the list. The FDA's enforcement posture toward research peptides creates legal exposure for anyone in the supply chain, including payment processors. Banks don't want to facilitate potentially illegal transactions.

Chargeback rates in the peptide industry exceed typical ecommerce categories. Customers dispute charges for various reasons: products didn't meet expectations, shipments were seized, credit card fraud is common in supplement categories. Each chargeback costs processors money and damages their relationship with card networks.

Reputational risk matters too. Banks and processors don't want their names associated with industries facing regulatory scrutiny. The potential for negative publicity outweighs the processing revenue from peptide merchants.

High-risk merchant account basics

High-risk merchant accounts are specialized processing solutions for industries that mainstream providers won't serve. They exist because these industries have legitimate processing needs, even if those needs come with elevated risk profiles.

Obtaining a high-risk account requires more documentation than standard merchant accounts. Expect to provide business formation documents, processing history if available, bank statements demonstrating financial stability, personal identification for owners, and detailed descriptions of your products and marketing practices.

Underwriting takes longer. While a standard Stripe account activates in minutes, high-risk accounts typically require days to weeks of review. Underwriters assess your business model, compliance practices, and risk factors before approval.

Approval isn't guaranteed. Processors reject applications for various reasons: insufficient operating history, concerning product categories, poor credit, or simply too much risk for their portfolio. Being declined by one processor doesn't mean universal rejection, different processors have different risk tolerances.

Fee structures and reserves

High-risk processing costs more. Significantly more. Understanding the fee structure helps you plan accordingly.

Transaction fees typically range from 2.95% to 5% per transaction, compared to 2.9% or less for standard accounts. Monthly fees, statement fees, and gateway fees add additional costs. Some processors charge setup fees ranging from hundreds to thousands of dollars.

Rolling reserves are common. Processors hold a percentage of your monthly volume, typically 5-10%, as protection against chargebacks and potential losses. This money is released on a rolling basis, usually after 6 months, but the reserve means you're always operating with a portion of your revenue held back.

Chargeback fees are higher for high-risk accounts, often $25-100 per occurrence versus $15-25 for standard merchants. Given the elevated chargeback rates in the peptide industry, these fees add up quickly.

Volume caps may apply initially. New accounts often start with processing limits of $50,000-100,000 monthly. As you establish a track record of low chargebacks and stable processing, limits increase. Exceeding your cap can result in held funds or account termination.

LegitScript certification requirements

Many high-risk processors require LegitScript certification for peptide merchants. This certification has become the de facto standard for demonstrating regulatory compliance in the peptide and supplement industries.

LegitScript is a verification and monitoring organization that certifies healthcare-related businesses. Certification signals to payment processors, advertising platforms, and business partners that your operation meets specific compliance standards.

The certification process involves submitting documentation about your business, products, and practices. LegitScript reviews your website, marketing materials, and product offerings for compliance with applicable regulations. They verify business licensing, check for prohibited claims, and assess overall operational legitimacy.

Certification benefits extend beyond payment processing. Google, Facebook, and other advertising platforms require LegitScript certification for certain healthcare advertising. The certification can enable advertising channels that would otherwise be unavailable to peptide businesses.

Costs vary by certification type and business size. Annual fees typically range from hundreds to thousands of dollars. Many processors offer discounts or partnerships that reduce certification costs for their merchants.

High-risk processor options

Several processors specialize in peptide and supplement merchant accounts. Each has different requirements, risk tolerances, and fee structures.

Easy Pay Direct focuses on high-risk industries and explicitly supports peptide businesses. They require LegitScript certification and provide access to multiple bank relationships, reducing dependency on any single processor.

Their chargeback alert system helps prevent disputes before they occur.

Corepay serves the peptide industry with specialized underwriting that understands the regulatory nuances. They require at least six months in business and restrict international shipping for most accounts.

PayDiverse, Instabill, and similar processors offer peptide merchant accounts with varying requirements and fee structures. Shopping multiple processors helps identify the best fit for your specific situation.

Requirements common across processors include: LegitScript certification, U.S.-based business operations, no FDA warning letters or negative regulatory history, and willingness to register prescription peptides with card brands when applicable.

Compliance framework for peptide businesses

Operating a peptide business legally requires navigating federal regulations, state laws, platform policies, and payment processor requirements simultaneously. A compliance framework addresses each layer systematically.

FDA compliance for research peptides

Research peptide businesses must maintain clear separation between their products and human therapeutic use. This separation must be evident in every aspect of operations.

Labeling requirements are strict. Products must be clearly marked "For Research Purposes Only" and "Not for Human Consumption." These disclaimers must appear prominently on product labels, website listings, and all marketing materials.

Marketing language must focus on scientific research applications. Descriptions can discuss receptor binding, cellular modeling, and laboratory applications. They cannot discuss dosing for humans, expected benefits from personal use, or therapeutic applications. The distinction matters enormously.

Packaging considerations extend beyond labeling. Selling peptides alongside syringes, bacteriostatic water, alcohol swabs, and other administration supplies implies human use. The FDA has cited this practice in enforcement actions. Research suppliers typically sell compounds only, without ancillary products that suggest personal administration.

Customer communications require similar care. Providing dosing advice, discussing personal experiences, or answering questions about human use can undermine research-only positioning.

Staff training must emphasize these boundaries.

FTC advertising compliance

The Federal Trade Commission regulates advertising claims for health-related products. Peptide businesses face FTC scrutiny when marketing suggests specific health benefits.

Substantiation requirements apply to all product claims. If you state that a peptide produces specific effects, you must have competent and reliable scientific evidence supporting that claim. For research peptides, making such claims about human effects is inherently problematic since you're not supposed to be targeting human use.

Testimonials and reviews create compliance exposure. Customer reviews describing personal results can be attributed to your business under FTC guidelines. Moderating reviews to remove human-use descriptions may be necessary, even though this feels counterintuitive for building social proof.

The safest approach for research peptides is avoiding any claims about effects, benefits, or outcomes. Describe the compound scientifically.

Link to published research.

Let customers draw their own conclusions without making claims you can't substantiate.

State-level regulations

Federal regulations provide the baseline, but states add additional requirements that peptide sellers must navigate.

New York's 2024 law prohibits selling muscle-building and weight-loss supplements to minors under 18. This applies to peptide products marketed for these purposes. Age verification systems become mandatory for sales into New York.

New Jersey requires parental consent for minor purchases of similar products. California has strict labeling and disclosure requirements. Other states consider similar legislation.

The patchwork of state regulations creates operational complexity. Some businesses choose to block sales to states with restrictive regulations rather than navigate compliance requirements. Others implement state-specific checkout flows with appropriate verification steps.

International considerations

Selling peptides internationally introduces additional regulatory layers. Each country has its own rules regarding peptide importation, classification, and sale.

The United Kingdom bans peptides for human consumption but allows research sales. France permits peptides only for clinical trials and research. Australia has strict importation controls that result in frequent customs seizures. The EU has varying regulations by member state.

Customs documentation must accurately declare shipment contents. Misdeclaring peptides as something else creates criminal liability and ensures seizure when packages are inspected. Proper documentation reduces, but doesn't eliminate, the risk of customs holds.

Many peptide businesses restrict international shipping to avoid these complications. The regulatory complexity, shipping costs, and seizure risks often don't justify the additional revenue from international customers.

Building a compliant peptide business: practical steps

Theory matters, but implementation determines success. Here's how to build a peptide business that can operate sustainably without platform terminations, payment freezes, or regulatory enforcement.

Business structure and licensing

Proper business formation provides foundational protection. Most peptide businesses operate as LLCs, which offer liability protection while maintaining operational flexibility.

State business registration is mandatory. Depending on your jurisdiction and product categories, additional licensing may apply. Some states require specific licenses for selling research chemicals or laboratory supplies.

A dedicated business bank account separates personal and business finances. This separation matters for liability protection, tax compliance, and payment processor relationships. Processors want to see established business banking, not personal accounts handling commercial transactions.

Website and content strategy

Your website is the primary compliance touchpoint.

Every page must reinforce research-only positioning.

Homepage messaging should clearly state that products are for research purposes only. This positioning must be unmistakable to any visitor, including regulators reviewing your site.

Product pages need research-focused descriptions. Discuss molecular weight, amino acid sequences, purity specifications, and research applications. Avoid any language suggesting personal use, dosing for humans, or therapeutic benefits.

Educational content can build authority while maintaining compliance. Discussing peptide research findings, scientific mechanisms, and laboratory applications provides value without crossing compliance lines. SeekPeptides provides educational resources that help researchers understand peptide science without making improper claims.

Terms of service should explicitly restrict purchases to legitimate researchers. Requiring customers to acknowledge research-only use creates a record of proper positioning, though enforcement of such terms is obviously limited.

Quality assurance and documentation

Product quality directly impacts compliance risk and business sustainability. Cutting corners on quality creates problems that compound over time.

Third-party testing verifies that products meet stated specifications. Certificates of Analysis (COAs) documenting purity, identity, and absence of contaminants should accompany every batch. Reputable suppliers provide these automatically.

Sourcing documentation matters for regulatory inquiries. Know where your products come from. Maintain records of supplier relationships, quality certifications, and import documentation. If regulators ask questions, thorough documentation demonstrates legitimate operations.

The peptide sourcing landscape includes manufacturers of varying quality. Working with established, certified manufacturers reduces the risk of receiving mislabeled, contaminated, or subpotent products that create customer complaints and regulatory exposure.

Customer verification procedures

Legitimate research suppliers often implement customer verification to support research-only positioning. These procedures aren't legally required but demonstrate good faith compliance efforts.

Some suppliers require customers to submit institutional affiliations or research credentials before purchase. Others require signed acknowledgments of research-only intended use.

The specific approach matters less than having some verification system in place.

Age verification systems address state-level requirements for supplements marketed for muscle-building or weight loss. Various third-party tools integrate with ecommerce platforms to verify customer age at checkout.

Payment processing setup

With your business structure, website, and compliance framework in place, you can approach payment processors from a position of strength.

Begin the LegitScript certification process early. Certification typically takes several weeks, and many processors won't begin underwriting without it. Starting this process before you're ready to launch avoids delays.

Prepare documentation packages for processor applications. Business formation documents, bank statements, processing history (if any), website screenshots, and product descriptions should be ready before submitting applications.

Apply to multiple processors simultaneously. Approval rates vary, and having options ensures you're not dependent on any single processor's decision. Even after approval, maintaining relationships with multiple processors provides backup if one relationship deteriorates.

Understanding the LegitScript certification process

LegitScript certification deserves detailed attention given its importance for peptide businesses. Understanding the process helps you prepare effectively and increases approval likelihood.

Certification categories

LegitScript offers different certification types for different business models. Peptide businesses typically pursue one of several pathways.

Healthcare Merchant Certification applies to businesses selling health-related products online. This is the most common certification for research peptide suppliers. It verifies that your business complies with applicable laws and industry best practices.

Telemedicine and Healthcare Provider Certification applies to clinics and medical practices offering peptide therapies. This certification has additional requirements related to healthcare provider licensing and prescribing practices.

The certification you need depends on your business model. Pure research suppliers typically need Healthcare Merchant Certification. Businesses that combine sales with telehealth consultations may need multiple certifications.

Application requirements

LegitScript evaluates multiple aspects of your business during the certification process.

Business licensing verification confirms that you hold required licenses for your jurisdiction and product categories. Documentation includes business registration certificates, professional licenses where applicable, and corporate formation documents.

Website review assesses your compliance with FDA, FTC, and state regulations. Reviewers examine product listings, marketing claims, checkout processes, and terms of service. Non-compliant elements must be corrected before certification.

Product evaluation determines whether your offerings fall within certifiable categories. LegitScript won't certify businesses selling products that are categorically illegal or that make clearly prohibited claims.

Operational practices review covers customer service, complaint handling, refund policies, and other business operations. Legitimate business practices support certification; problematic patterns prevent it.

Common reasons for denial

Understanding why applications fail helps you avoid common mistakes.

Therapeutic claims on research products are automatic disqualifiers. If your website suggests that your peptides treat, cure, or prevent any condition in humans, certification won't be granted until these claims are removed.

Missing or invalid business licenses prevent certification. Ensure all required registrations are current and documentation is available.

Products outside certifiable categories can't be included. If you're selling compounds that LegitScript considers uncertifiable, you may need to modify your product lineup or accept certification for only a portion of your offerings.

Poor website compliance with consumer protection requirements, unclear refund policies, missing contact information, or other basic business practice deficiencies must be corrected before approval.

Maintaining certification

Certification isn't one-time. LegitScript conducts ongoing monitoring and requires annual renewal.

Monitoring includes periodic website reviews, complaint tracking, and compliance verification. Significant changes to your business, such as new product lines or operational changes, may trigger additional review.

Annual renewal requires updated documentation and continued compliance with certification standards. Fees apply for renewal, typically similar to initial certification costs.

Certification can be revoked if compliance lapses. Receiving FDA warning letters, accumulating customer complaints, or making website changes that violate certification standards can result in revocation. Losing certification typically means losing your payment processing relationship as well.

Marketing peptides without platform bans

Even with a compliant website and payment processing, reaching customers presents challenges. Major advertising platforms restrict peptide marketing, requiring creative approaches to customer acquisition.

Advertising platform restrictions

Google Ads, Facebook, Instagram, and TikTok all restrict or prohibit peptide advertising. These restrictions apply even to research peptides with proper disclaimers.

LegitScript certification can unlock certain advertising options. Google and Facebook have programs that allow certified healthcare merchants to advertise products that would otherwise be prohibited. However, approval isn't guaranteed, and restrictions on ad content still apply.

The safest approach for research peptides is assuming advertising platforms are unavailable. Build marketing strategies that don't depend on paid advertising to these platforms.

Content marketing and SEO

Organic search remains the primary customer acquisition channel for most peptide businesses. Educational content that ranks well for relevant searches drives traffic without advertising restrictions.

Research-focused content works within compliance constraints. Articles discussing peptide studies, mechanisms of action, and safety considerations provide value while maintaining research positioning. SeekPeptides demonstrates how educational content can serve researchers while respecting regulatory boundaries.

Long-tail keywords often convert better than broad terms. Someone searching for specific peptide research applications is more likely to purchase than someone searching generic terms.

Community and relationship building

Direct relationships with researchers provide sustainable customer acquisition. These relationships develop through quality products, reliable service, and genuine value provision.

Email marketing to existing customers costs nothing and faces no platform restrictions. Building an email list and providing ongoing value keeps customers returning without advertising dependency.

Research community engagement, whether through forums, professional networks, or academic channels, builds awareness among target customers. These channels require careful compliance attention but can drive significant business.

The cosmetic peptide exception

Cosmetic peptide businesses operate under different rules than research peptide suppliers. Understanding this exception helps entrepreneurs identify opportunities that may be viable on mainstream platforms.

Regulatory framework for cosmetics

The FDA regulates cosmetics differently than drugs or research chemicals. Cosmetic products don't require pre-market approval. Companies can use peptide ingredients as long as products are safe and properly labeled.

The key distinction is claims. A product that claims to "improve the appearance of skin" is a cosmetic. A product claiming to "treat skin conditions" is making drug claims and faces pharmaceutical regulations.

Copper peptide serums, anti-aging formulations, and eye treatments containing peptides can be sold as cosmetics when marketed appropriately. These products may be permissible on platforms like Shopify since they're positioned as skincare, not peptides as such.

Platform possibilities for cosmetics

Cosmetic brands selling peptide-containing products sometimes operate on mainstream ecommerce platforms. The products are cosmetics that happen to contain peptide ingredients, not peptide products marketed for their peptide content.

This positioning requires careful execution.

Product names and descriptions must emphasize the cosmetic nature. Marketing must avoid drug claims.

The overall presentation must be indistinguishable from other skincare products on the platform.

Payment processing for cosmetics is typically available through standard providers. Stripe and PayPal process cosmetic transactions without the restrictions applied to research chemicals or supplements.

Limitations of the cosmetic approach

The cosmetic exception has significant limitations for those wanting to serve the research peptide market.

Formulated products only qualify. Raw peptide compounds sold for research don't fit the cosmetic category. You can't simply relabel research peptides as cosmetics.

Manufacturing requirements apply. Cosmetic products must be manufactured under appropriate conditions with proper quality controls. The 2022 MoCRA legislation added facility registration, product listing, and adverse event reporting requirements.

The customer base differs. Cosmetic customers seek skincare products. Research customers seek compounds for scientific applications. Positioning as a cosmetic brand means abandoning the research market.

For entrepreneurs interested in peptide skincare, the cosmetic pathway offers mainstream platform access. For those serving the research community, alternative platforms and high-risk processing remain necessary.

Risk management for peptide businesses

Even with proper compliance, peptide businesses face ongoing risks that require active management. Building systems to identify and address risks before they become problems protects business continuity.

Payment processing diversification

Dependence on a single payment processor creates existential risk. If that processor terminates your account, you lose the ability to accept payments immediately.

Maintaining relationships with multiple processors provides redundancy. If one relationship ends, others can handle transaction volume while you find a replacement. The additional account maintenance costs are insurance against business interruption.

Alternative payment methods expand options further. Cryptocurrency payments avoid traditional banking system restrictions. ACH and eCheck processing often faces less scrutiny than card transactions. Wire transfers work for larger orders. Each option reduces dependency on any single channel.

Regulatory monitoring

The peptide regulatory landscape evolves continuously. FDA enforcement priorities shift. State laws change. Payment network policies update. Staying current requires active monitoring.

Industry associations and legal newsletters provide regulatory updates relevant to peptide businesses. Investing time in staying informed helps you adapt before changes become problems.

Peptide regulation news affects every operator in this space. Following developments helps you anticipate changes and adjust operations proactively. SeekPeptides tracks regulatory developments and provides members with updates affecting the peptide community.

Legal counsel relationship

An attorney familiar with FDA regulations, supplement law, and ecommerce compliance provides invaluable guidance. Establishing this relationship before problems arise means you have someone to call when questions emerge.

Legal review of marketing materials, website content, and business practices can identify issues before regulators do. The cost of proactive legal review is far less than defending an enforcement action.

Insurance considerations

Business insurance protects against various risks that peptide businesses face. Product liability coverage addresses customer harm claims. General liability covers operational risks. Cyber insurance addresses data breach exposure.

Finding insurance for peptide businesses can be challenging. Specialized insurers serving high-risk industries may offer coverage that standard carriers decline. Insurance brokers familiar with the supplement and research chemical space can help identify options.

Future outlook for peptide ecommerce

The peptide market continues evolving. Regulatory frameworks shift. Platform policies change. New technologies create opportunities and challenges. Understanding trends helps businesses position for long-term success.

Regulatory trajectory

FDA attention to the peptide market has intensified. Warning letters to peptide sellers increased significantly in recent years. The agency's position on research-only disclaimers has hardened. Expect continued enforcement pressure.

State-level regulation is expanding. New York's minor sales prohibition set a precedent that other states may follow. Age verification requirements could become standard for certain peptide categories.

The FDA's 2024 settlement regarding compounding peptides created some pathway clarity. Certain peptides are being evaluated for potential inclusion on approved compounding lists. Others are definitively excluded. This process will continue shaping which peptides can be legally provided through medical channels.

Platform and payment trends

Mainstream platforms are unlikely to relax restrictions on peptides. If anything, compliance pressures from payment networks and regulators push toward stricter enforcement.

Alternative platforms serving high-risk industries may consolidate or expand. Successful peptide businesses demonstrate market demand for these services. Entrepreneurs may develop improved solutions for this underserved market.

Cryptocurrency payment integration continues advancing.

As acceptance becomes more mainstream, crypto may offer peptide businesses a reliable payment channel outside traditional banking restrictions.

However, regulatory attention to crypto could eventually limit this opportunity.

Market evolution

Consumer interest in peptides continues growing. Research demonstrating benefits for muscle development, weight management, injury recovery, and longevity drives this interest. The gap between consumer demand and regulated availability creates ongoing market tension.

Telehealth peptide services have expanded, offering prescription access to certain compounds through licensed providers. This model may capture some demand currently served by research suppliers, though availability and cost differences limit substitution.

Quality differentiation becomes increasingly important as the market matures. Consumers become more sophisticated about purity, testing, and supplier reliability. Businesses that invest in quality and transparency build sustainable competitive advantages.

Frequently asked questions

Can I use Shopify if I label peptides as "research chemicals only"?

No. Shopify prohibits peptide sales regardless of labeling. The research-only designation doesn't exempt products from the platform's Acceptable Use Policy.

Accounts selling peptides with any labeling are subject to termination.

What happens to my money if Shopify terminates my account?

Pending funds are frozen and held by Shopify to cover potential chargebacks, refunds, and liabilities. Hold periods can extend for months, and in cases of policy violation, funds may not be released. Read the risk considerations carefully before choosing any platform.

Is WooCommerce definitely safe for selling peptides?

WooCommerce eliminates platform termination risk since you host your own site. However, you still need compliant payment processing, which requires high-risk merchant accounts and typically LegitScript certification. The platform is safe; the payment processing challenge remains.

How much does high-risk payment processing cost?

Expect processing fees of 2.95-5% per transaction, plus monthly account fees, gateway fees, and potential setup costs. Rolling reserves of 5-10% of monthly volume are common. Total costs significantly exceed standard ecommerce processing rates.

Do I need LegitScript certification to sell peptides?

Not legally required, but most reputable high-risk payment processors require it for peptide merchants. Certification also enables advertising on platforms like Google and Facebook that would otherwise be unavailable. Consider it a practical necessity for serious operations.

Can I sell peptides internationally?

Technically possible, but regulations vary significantly by country. Many peptide businesses restrict sales to domestic markets to avoid customs seizures, import violations, and complex compliance requirements. Research destination country regulations thoroughly before offering international shipping.

What's the difference between research peptides and cosmetic peptides for ecommerce purposes?

Cosmetic peptides are ingredients in formulated skincare products and may be sellable on mainstream platforms. Research peptides are raw compounds sold for laboratory use and require alternative platforms and high-risk processing. The business models, regulatory frameworks, and platform options differ substantially.

How long does it take to get a high-risk merchant account approved?

Typically 1-4 weeks from application submission, assuming all documentation is complete and LegitScript certification is in place. Complex applications or those requiring additional verification may take longer. Start the process well before your intended launch date.

External resources

In case I don't see you, good afternoon, good evening, and good night. Join SeekPeptides.