Feb 4, 2026

Everywhere you look, someone is selling oral tirzepatide. Sublingual drops. Dissolving tablets. Troches you hold under your tongue. The marketing is polished. The promises are bold. And most of it is misleading at best, dangerous at worst.

Here is the reality that matters. No FDA-approved oral tirzepatide exists. Not as a pill. Not as a drop. Not as a tablet. The injectable versions, sold under the brand names Mounjaro and Zepbound, remain the only forms that have passed clinical trials, earned regulatory approval, and demonstrated consistent results in peer-reviewed research. Everything else occupies a murky space between compounding pharmacy creativity and outright fraud.

But the demand for a needle-free version of tirzepatide is enormous, and that demand is not going away. Millions of people want the weight loss benefits, the blood sugar control, and the appetite suppression that tirzepatide delivers. They just do not want to inject themselves every week. That is a perfectly reasonable preference, and it is driving one of the most active areas of pharmaceutical development right now. Eli Lilly is racing toward FDA approval of orforglipron, an oral GLP-1 pill. Novo Nordisk already secured approval for oral Wegovy in late December of last year. The oral GLP-1 landscape is shifting fast, and understanding where oral tirzepatide fits, or does not fit, within that landscape matters for anyone researching these compounds. SeekPeptides has tracked every development in this space, and this guide breaks down everything you need to know without the hype, without the sales pitch, and without the misinformation that dominates this topic online.

What tirzepatide actually is and why the oral question matters

Before diving into oral formulations, understanding what tirzepatide is at a molecular level explains why creating an effective pill version is so difficult. Tirzepatide is a 39-amino acid linear peptide with a molecular weight of approximately 4,813 daltons.

That is a large molecule. For context, aspirin weighs about 180 daltons. Ibuprofen comes in at 206. Tirzepatide is roughly 26 times heavier than ibuprofen, and that size creates massive challenges for oral delivery.

The peptide works as a dual agonist, meaning it activates two different receptors simultaneously. It binds to both the GIP receptor (glucose-dependent insulinotropic polypeptide) and the GLP-1 receptor (glucagon-like peptide-1). This dual action is why researchers call it a "twincretin." Most other weight loss peptides in this class only activate GLP-1. Tirzepatide hits both targets, and the synergistic effect produces superior results for both blood sugar control and weight reduction.

Structurally, tirzepatide is based on the native human GIP hormone sequence. Eli Lilly engineered specific modifications to make it more potent and longer-lasting. Two non-coded amino acid residues, alpha-aminoisobutyric acid (Aib), sit at positions 2 and 13 of the peptide chain. These modifications protect against degradation by dipeptidyl peptidase-4 (DPP-4), an enzyme that would otherwise chew through the molecule in minutes. A C20 fatty diacid chain connects to lysine at position 20 through hydrophilic linkers, giving tirzepatide a strong affinity for albumin in the blood. That albumin binding extends the half-life to approximately five days, which is why a single weekly injection maintains therapeutic levels throughout the week.

The C-terminus of the peptide is amidated, another structural choice that improves stability. Fourteen amino acids in the sequence differ from native GLP-1, each carefully selected to balance GIP receptor potency with meaningful GLP-1 receptor activation. In laboratory testing, tirzepatide binds to the GIP receptor with affinity comparable to native GIP itself, but its GLP-1 receptor affinity is roughly five times lower than native GLP-1. This imbalance is actually intentional. It produces what researchers call "biased signaling" at the GLP-1 receptor, resulting in less receptor desensitization over time. Translation: the drug keeps working effectively even with repeated dosing, because the receptors do not downregulate as quickly as they do with pure GLP-1 agonists.

Now consider what happens when you swallow a peptide this complex. Your stomach produces hydrochloric acid at a pH between 1.5 and 3.5. Pepsin, the primary digestive enzyme in your stomach, specifically targets peptide bonds. That is literally what pepsin evolved to do, break apart proteins and peptides into absorbable amino acids. A 39-amino acid peptide dropped into that environment faces immediate enzymatic destruction. Even if fragments survive the stomach, the small intestine adds more proteolytic enzymes: trypsin, chymotrypsin, elastase, and carboxypeptidases. Each one attacks peptide bonds from different angles. The odds of a full, intact tirzepatide molecule making it through the gastrointestinal tract and into the bloodstream are essentially zero without extraordinary formulation technology.

This is not a theoretical problem. It is the fundamental reason why peptide capsules and oral peptide delivery have challenged pharmaceutical scientists for decades. And it is why the vast majority of injectable peptides remain injectable. The digestive system does exactly what it was designed to do: destroy peptides.

The current oral tirzepatide landscape: separating fact from fiction

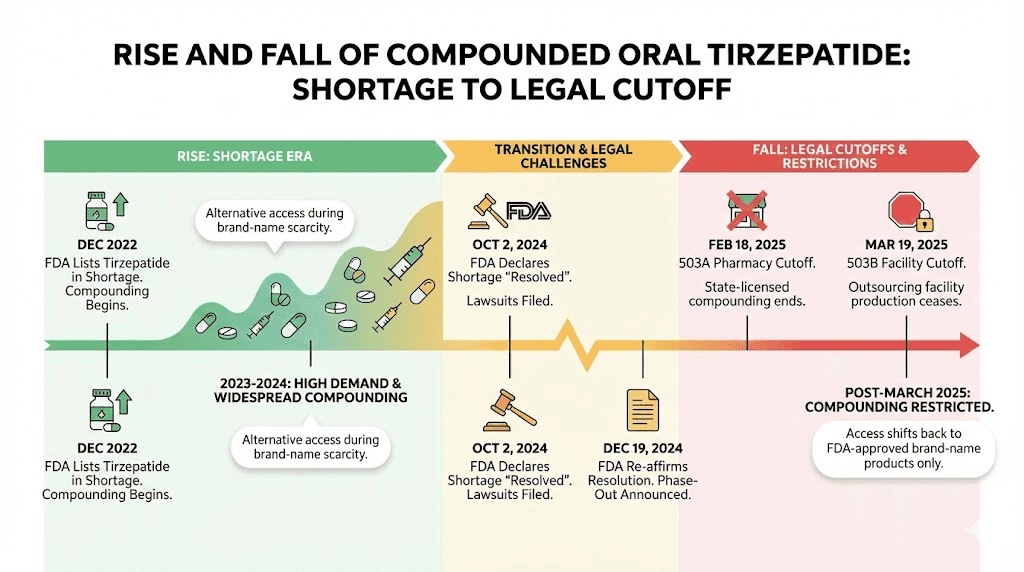

Search for "oral tirzepatide" online and you will find dozens of companies offering sublingual drops, dissolving tablets, and troches. Some of these products existed in a legal gray area during the tirzepatide shortage period from 2022 through early 2025. Others are outright fraudulent. Understanding the regulatory history clarifies what is available today and what is not.

The compounding pharmacy chapter

When drug shortages occur, the FDA allows compounding pharmacies to create versions of medications that are otherwise protected by patents. During the tirzepatide shortage, some compounding pharmacies began producing oral formulations, primarily sublingual tablets and troches. These products were designed to dissolve under the tongue, where the tissue has a rich network of blood vessels that can absorb medication directly into the bloodstream, bypassing the digestive tract entirely.

The sublingual approach made pharmacological sense on paper. The tissue under your tongue is thin, highly vascularized, and capable of absorbing certain molecules directly. Nitroglycerin tablets for heart patients work this way. So do some pain medications and hormone treatments. The compounding pharmacies reasoned that tirzepatide, delivered sublingually, might achieve meaningful absorption without facing the destructive gastrointestinal environment.

There were problems. Big ones.

First, no clinical trials ever tested these compounded oral formulations. Zero. Not a single randomized controlled trial evaluated whether sublingual tirzepatide achieved therapeutic blood levels, produced meaningful weight loss, or had an acceptable safety profile. The entire premise rested on pharmacological theory, not evidence.

Second, the FDA reported serious quality issues. By April 2025, the agency had collected 480 adverse event reports involving compounded tirzepatide products. Eli Lilly, the manufacturer of the patented injectable versions, independently identified compounded products that were impure, contaminated with bacteria, or did not even contain tirzepatide at all. One tested sample turned out to be nothing more than sugar alcohol. Imagine injecting, or dissolving under your tongue, a product you believe is tirzepatide, only to discover it contains sugar alcohol and potentially harmful contaminants.

Third, the legal window closed. Once Eli Lilly resolved the tirzepatide supply shortage, the FDA removed tirzepatide from its drug shortage list. That action eliminated the legal basis for compounding pharmacies to produce tirzepatide in any form. As of March 19, 2025, compounded oral tirzepatide became unavailable through legitimate channels. Eli Lilly has since filed lawsuits against multiple companies, compounding pharmacies, med spas, and telehealth platforms that continued selling unauthorized tirzepatide products.

What "oral tirzepatide" products actually are today

Any product currently marketed as "oral tirzepatide" falls into one of these categories:

Remaining compounded inventory. Some providers may still have stock from before the legal cutoff. This inventory is aging, potentially degraded, and no longer legally produced. Using it means trusting a product that was never clinically tested, may have been stored improperly, and has no regulatory oversight for quality.

Counterfeit products. The demand for oral tirzepatide created a market for fraud. Products labeled as tirzepatide tablets or drops may contain completely different substances, incorrect doses, or dangerous contaminants. Some products explicitly state "not for human consumption" or "for research use only" on their labels while being marketed for weight loss on the same website.

Mislabeled alternatives. Some products sold as "oral tirzepatide" actually contain different peptides or compounds entirely. Without third-party testing, there is no way to verify what is in the bottle.

The bottom line: if you are purchasing "oral tirzepatide" in early February of this year, you are purchasing an unregulated product with no clinical evidence of efficacy, no quality assurance, and potential legal and health risks. This is not a gray area. It is a clear warning.

Bioavailability: why oral delivery changes everything about effectiveness

Bioavailability measures how much of a drug actually reaches your bloodstream in active form. It is the single most important factor in understanding why oral and injectable versions of the same compound can produce dramatically different results.

Injectable tirzepatide has a bioavailability of approximately 80%. That means roughly 80% of the dose you inject reaches your bloodstream intact and active. This is high for any medication and excellent for a peptide. The subcutaneous injection deposits tirzepatide into the fatty tissue just beneath the skin, where it slowly absorbs into capillaries and enters systemic circulation. The injection process bypasses the entire digestive system, which is precisely the point.

Now consider what happens with oral delivery. The best reference point is oral semaglutide, because it is the only GLP-1 receptor agonist that has been successfully formulated as an oral tablet and approved by the FDA. Injectable semaglutide achieves bioavailability around 89%. Oral semaglutide tablets, which use a specialized absorption enhancer called SNAC (sodium N-[8-(2-hydroxybenzoyl)amino] caprylate), achieve bioavailability between 0.4% and 1%.

Read that again. Less than 1%.

To compensate for this massive absorption gap, the oral semaglutide pill contains far more active ingredient than needed for a single injectable dose. The standard injectable semaglutide dose for weight loss is 2.4 mg per week. The oral Wegovy pill, approved by the FDA in December, requires 25 mg per day. That is a daily dose more than ten times the weekly injectable dose, and even then, the clinical results are roughly equivalent, not superior.

Tirzepatide presents an even greater challenge for oral formulation. Its molecular weight of 4,813 daltons exceeds semaglutide at 4,113 daltons by about 17%. The larger molecule means even more difficulty crossing intestinal membranes. The dual-receptor modifications that make tirzepatide so effective as an injectable, the GIP receptor binding, the C20 fatty acid chain, the Aib substitutions, also make it more structurally complex and harder to protect during oral transit.

Dr. Kathryn Horton, a board-certified internal medicine physician, stated it directly: "Tirzepatide is a synthetic peptide that is rapidly degraded by digestive enzymes within the gastrointestinal tract." The larger molecular size and chemical modifications that enable dual-receptor agonism "currently pose significant challenges for the development of an effective oral formulation."

For sublingual delivery specifically, the absorption story is slightly different but still problematic. Sublingual absorption avoids the stomach entirely, which eliminates the acid and pepsin exposure. But the amount of sublingual absorption depends on the molecule size, lipophilicity, and the surface area of tissue contact. Tirzepatide is hydrophilic (water-loving) because of its peptide backbone, which limits its ability to cross the lipid-rich sublingual membrane efficiently. The C20 fatty acid chain adds some lipophilicity, but the overall molecule is still large and polar enough that sublingual absorption rates remain unpredictable and likely low.

No published study has measured the sublingual bioavailability of tirzepatide in humans. That data simply does not exist. Every claim about sublingual tirzepatide effectiveness is extrapolation, not evidence.

What low bioavailability means for real results

When bioavailability drops below meaningful thresholds, the clinical consequences are significant. The tirzepatide dosing protocol for weight loss starts at 2.5 mg weekly and escalates to 5 mg, 7.5 mg, 10 mg, 12.5 mg, and potentially 15 mg. These doses were calibrated against 80% bioavailability from subcutaneous injection. If an oral formulation achieves only 1% bioavailability (matching oral semaglutide), you would need roughly 80 times the injectable dose to achieve equivalent blood levels. That translates to 200 mg to 1,200 mg of tirzepatide per day, depending on the target dose. Manufacturing costs, stability challenges, and potential side effects at those raw material quantities make it impractical with current technology.

Even sublingual delivery, which likely achieves better absorption than swallowed tablets but far less than injections, would require significantly higher doses. And without clinical trial data, those doses are pure guesswork. Underdosing means the product does not work. Overdosing means amplified side effects, potentially including severe nausea, vomiting, and pancreatitis risk. Both outcomes are bad, and without data, there is no way to find the safe middle ground.

Injectable tirzepatide: what the clinical evidence actually shows

While oral tirzepatide remains unproven, the injectable version has one of the strongest evidence bases of any weight loss compound ever studied. Understanding these results provides a benchmark against which any future oral formulation must be measured.

The SURMOUNT trial program

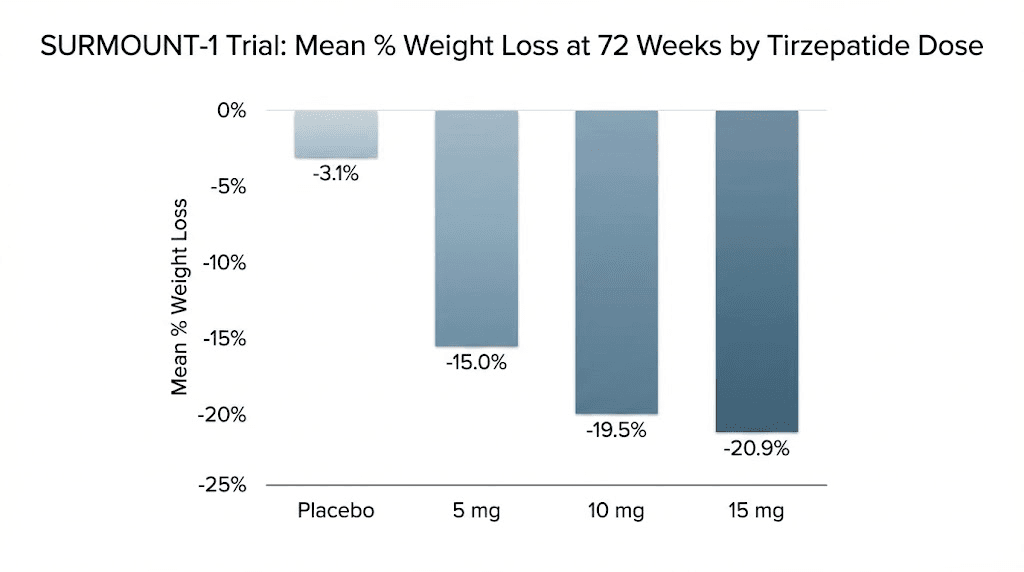

Eli Lilly ran the SURMOUNT series of phase 3 clinical trials, each testing tirzepatide in different populations and against different comparators. The results, published in top-tier journals including the New England Journal of Medicine and Nature Medicine, established tirzepatide as the most effective weight loss peptide available.

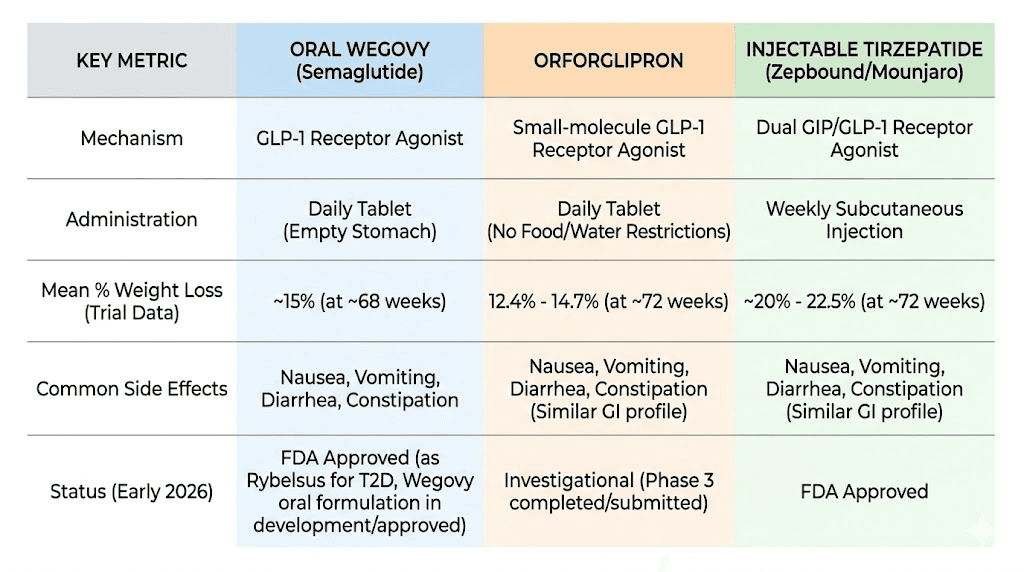

SURMOUNT-1 enrolled 2,539 adults with obesity or overweight with at least one weight-related complication. None had diabetes. After 72 weeks of treatment, participants on the highest dose (15 mg weekly) lost an average of 22.5% of their body weight. Those on 10 mg lost 21.4%. Even the lowest dose of 5 mg produced 16% weight loss. The placebo group lost 2.4%. These numbers set a new standard for pharmacological weight loss interventions.

SURMOUNT-5 was the head-to-head comparison everyone wanted: tirzepatide versus semaglutide, the active ingredient in Ozempic and Wegovy. At 72 weeks, tirzepatide produced a mean weight reduction of 20.2% compared to 13.7% for semaglutide. Tirzepatide also achieved greater waist circumference reduction: 18.4 cm versus 13.0 cm. The statistical superiority was clear across every weight loss threshold measured (10%, 15%, 20%, and 25% body weight reduction).

SURMOUNT-3 tested a different question: can tirzepatide maintain and extend weight loss achieved through an initial intensive lifestyle intervention? The answer was yes. Participants who had already lost weight through diet and exercise continued losing additional weight with tirzepatide, demonstrating that the drug adds meaningful benefit even when combined with non-pharmacological approaches.

The SUMMIT trial expanded into cardiovascular territory. Patients with heart failure with preserved ejection fraction and obesity who received tirzepatide had a lower risk of death from cardiovascular causes or worsening heart failure compared to placebo. This finding positions tirzepatide not just as a weight loss drug but as a potential cardiovascular therapeutic.

And in a phase 2 trial published in Diabetes Care in January, tirzepatide showed efficacy even in adults with type 1 diabetes and obesity, a population that has historically had few pharmacological weight management options.

Real-world results beyond clinical trials

Clinical trials are controlled environments. Real-world usage tells a different story, sometimes better, sometimes worse. On drug review platforms, tirzepatide (marketed as Mounjaro and Zepbound) carries an 8.7 out of 10 rating based on over 1,740 reviews, with 81% of users reporting positive experiences.

Common patterns from user reports include substantial appetite suppression within the first week or two of treatment, meaningful weight loss averaging around 10% of starting body weight by month three, the phenomenon users describe as a "whoosh" of accelerated weight loss after each dose escalation, and significant psychological relief from constant food-related thoughts.

Side effects remain the primary challenge. Nausea is the most frequently reported issue, especially during dose escalations. Constipation, fatigue, and gastrointestinal discomfort round out the common complaints. Most users report these symptoms diminish over time, particularly after the body adjusts to each new dose level. Experienced users consistently recommend starting with the lowest dose, staying hydrated, eating balanced meals, and giving each dose level at least four weeks before escalating.

Oral GLP-1 options that actually exist and work

While oral tirzepatide remains unavailable, two oral GLP-1 options either already exist or are close to approval. Understanding these alternatives matters for anyone who wants the benefits of incretin therapy without needles.

Oral Wegovy (semaglutide 25 mg): the first approved oral GLP-1 for weight loss

On December 22, 2025, the FDA approved oral Wegovy, making it the first and only oral GLP-1 medication approved specifically for weight management in adults. This was a landmark moment in the GLP-1 therapy landscape.

The approval was based on the OASIS 4 clinical trial. With full treatment adherence, participants taking oral semaglutide 25 mg daily achieved 16.6% mean weight loss at 64 weeks, compared to 2.7% with placebo. 34.4% of adherent participants achieved at least 20% weight loss. These results closely match the injectable Wegovy 2.4 mg weekly injection in terms of efficacy, which validated the oral formulation approach.

The pill works through SNAC technology, a specialized absorption enhancer that temporarily raises the pH of the stomach lining and facilitates semaglutide absorption through the gastric wall. You take it on an empty stomach with a small sip of water, then wait at least 30 minutes before eating, drinking, or taking other medications. This strict dosing protocol is necessary because food, liquid, and other medications can interfere with the SNAC-mediated absorption process.

Novo Nordisk priced the starting 1.5 mg dose at $149 per month and launched full US availability in January. The drug does not require refrigeration, which is a significant practical advantage over injectable versions. For people who research peptide storage requirements, a room-temperature oral medication simplifies the entire process.

Important context: oral semaglutide is a GLP-1 receptor agonist only. It does not activate GIP receptors. This matters because the dual GIP/GLP-1 activation is what gives injectable tirzepatide its edge over injectable semaglutide in head-to-head trials. An oral version that only hits one receptor will inherently produce results closer to semaglutide than to tirzepatide.

Orforglipron: Eli Lilly oral GLP-1 racing toward approval

Orforglipron represents a fundamentally different approach to the oral GLP-1 problem. Unlike semaglutide, which is a peptide that requires SNAC technology to survive the gut, orforglipron is a small molecule. It is not a peptide at all. It is a non-peptide oral glucagon-like peptide-1 receptor agonist, meaning it activates the GLP-1 receptor through a completely different chemical structure that naturally survives oral administration without absorption enhancers.

This distinction matters enormously. Because orforglipron is a small molecule, you can take it any time of day without restrictions on food or water intake. No empty stomach requirement. No 30-minute waiting period. No special storage. This convenience advantage over oral semaglutide, and certainly over any injectable, is significant for long-term adherence.

The clinical trial results have been consistently positive across the ATTAIN program for obesity and the ACHIEVE program for type 2 diabetes.

In ATTAIN-1, the highest dose of orforglipron (36 mg daily) produced average weight loss of 12.4% (27.3 pounds) at 72 weeks. All three tested doses (6 mg, 12 mg, and 36 mg) met the primary endpoint of superior weight reduction compared to placebo. These results fall short of injectable tirzepatide (which achieves 20-22% weight loss at top doses) but are clinically meaningful and approach injectable semaglutide territory.

In ATTAIN-2, which focused on patients with both obesity and type 2 diabetes, orforglipron 36 mg produced 10.5% weight loss compared to 2.2% with placebo, along with significant A1C reductions and improvements in cardiometabolic risk factors.

The ATTAIN-MAINTAIN trial asked a particularly interesting question: can orforglipron maintain weight loss initially achieved with injectable tirzepatide or semaglutide? Participants who switched from injectable Wegovy to oral orforglipron maintained their previously achieved weight loss with only a 0.9 kg average difference. Those switching from injectable Zepbound (tirzepatide) maintained their loss with a 5.0 kg difference. This suggests that orforglipron can serve as a "step-down" oral maintenance therapy after achieving target weight loss with more potent injectables.

In the head-to-head ACHIEVE-3 trial, orforglipron outperformed oral semaglutide for both A1C reduction and weight loss outcomes. This is notable because it positions orforglipron as potentially the best oral option available once approved.

Eli Lilly has submitted orforglipron for FDA review and received one of the new "national priority" vouchers, potentially accelerating the decision timeline to weeks rather than the standard six to ten months. If approved, self-pay pricing would start at $149 for the lowest dose, going up to $399 for higher doses.

One critical limitation: orforglipron, like oral semaglutide, only targets the GLP-1 receptor. It does not activate GIP. So while it represents the best oral alternative to injectable tirzepatide, it does not replicate the dual-receptor mechanism that makes tirzepatide uniquely effective.

Oral tirzepatide vs injectable tirzepatide: an honest comparison

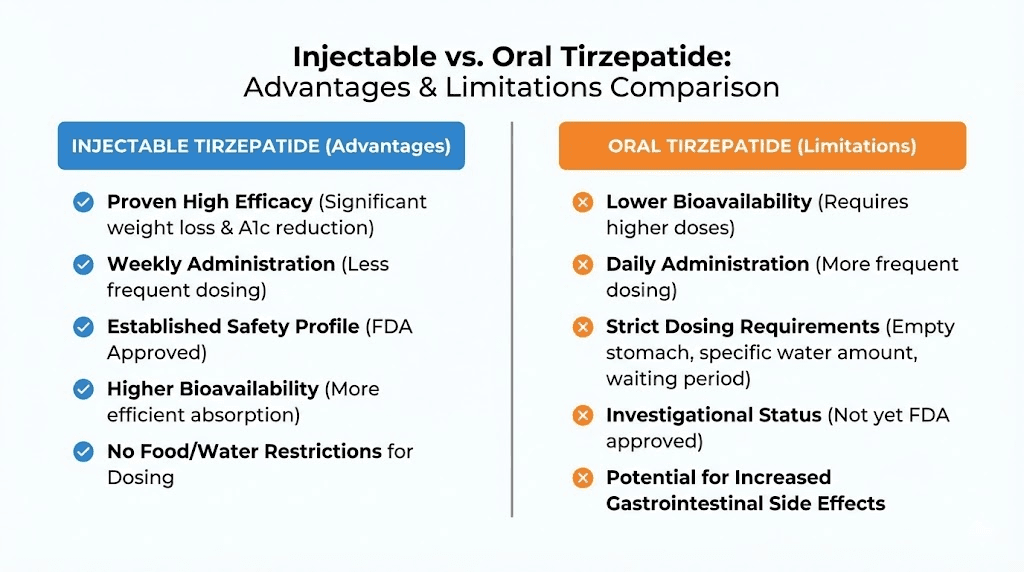

People searching for oral tirzepatide usually have one underlying question: can I get the same results without needles? The honest answer, based on current evidence, is no. But the full picture deserves more nuance than a simple rejection.

Absorption and consistency

Injectable tirzepatide delivers roughly 80% of the administered dose into your bloodstream. Every injection. Every week. The consistency is a core advantage. Your body receives a predictable amount of active compound, and the five-day half-life creates stable blood levels between weekly doses.

Sublingual tirzepatide absorption has never been measured in a clinical study. Based on the pharmacological properties of the molecule, the large peptide size, the hydrophilic backbone, the albumin-binding fatty acid chain, experts estimate absorption rates would be highly variable. Some doses might achieve meaningful blood levels. Others might not. This variability is not just a theoretical concern. It directly impacts whether you experience weight loss benefits, adequate appetite suppression, and appropriate blood sugar control on any given day.

The gastrointestinal tract adds another layer of complexity. Peptides that are swallowed rather than held under the tongue face near-complete destruction. Any oral tirzepatide product designed to be swallowed, rather than absorbed sublingually, would need bioavailability-enhancing technology similar to or better than the SNAC system used in oral semaglutide. No such technology has been developed or tested for tirzepatide.

Dosing accuracy

Injectable tirzepatide comes in pre-filled pens with precise doses: 2.5 mg, 5 mg, 7.5 mg, 10 mg, 12.5 mg, and 15 mg. Each click of the pen delivers a measured amount. The dosing protocols that produced clinical trial results were built on this precision.

Compounded oral products lack this precision. Sublingual troches and drops are mixed in compounding pharmacies without standardized processes. Concentration can vary between batches, between individual troches in the same batch, and even within a single troche if the active ingredient is not uniformly distributed. When your body absorbs an unpredictable percentage of an inconsistently manufactured product, the actual dose reaching your bloodstream becomes a wild guess.

This matters clinically. Too little tirzepatide means no effect. Too much means amplified side effects, including the severe nausea, vomiting, and potential pancreatitis that higher doses can trigger. The dose escalation protocol exists specifically to gradually increase exposure while managing side effects. Unpredictable absorption makes this careful escalation impossible.

Clinical evidence gap

Injectable tirzepatide has been studied in tens of thousands of participants across multiple phase 3 clinical trials. The SURMOUNT program, the SURPASS program for diabetes, the SUMMIT cardiovascular trial, and the phase 2 type 1 diabetes trial collectively represent one of the most extensive evidence bases for any weight loss intervention in history.

Oral tirzepatide has been studied in zero clinical trials. None. No phase 1 pharmacokinetic study. No phase 2 dose-finding trial. No phase 3 efficacy comparison. The entire evidence base for oral tirzepatide consists of theoretical pharmacology and anecdotal user reports. This is not a minor gap. It is a chasm.

Safety profile

The safety profile of injectable tirzepatide is well-characterized. The most common side effects are gastrointestinal: nausea (affecting roughly 20-30% of users at higher doses), diarrhea, vomiting, constipation, and decreased appetite. These effects are dose-dependent and typically diminish over time. Serious but rare risks include pancreatitis, gallbladder events, and potential thyroid concerns (based on animal data).

The safety profile of oral tirzepatide is completely unknown in the formal sense. The FDA collected 480 adverse event reports for compounded tirzepatide products, but these reports do not distinguish between problems caused by tirzepatide itself versus problems caused by contamination, incorrect dosing, or inactive ingredients in the compounded formulation. Eli Lilly found compounded products contaminated with bacteria, containing incorrect substances, or manufactured with no active ingredient at all. When the product itself is unreliable, adverse event data becomes meaningless for understanding the actual drug safety profile.

Cost comparison

Brand-name injectable tirzepatide (Mounjaro or Zepbound) carries a list price of approximately $1,000 to $1,200 per month without insurance. With insurance coverage or manufacturer savings cards, out-of-pocket costs can drop significantly, sometimes to $25 to $150 per month depending on the plan.

Compounded oral tirzepatide products, when they were available, typically cost between $200 and $600 per month. The lower price was a significant driver of demand. But the lower cost reflected lower manufacturing standards, no clinical testing, and no regulatory oversight, not a genuine value proposition. As the saying goes in pharmacology, the cheapest medicine is the one that actually works.

Practical convenience

This is where oral delivery genuinely wins. A pill or sublingual drop does not require injection technique, needle disposal, refrigeration (in most cases), or the psychological barrier of self-injection. For people with needle phobia, which affects an estimated 20-25% of the adult population, the injection requirement is not a minor inconvenience. It is a genuine obstacle to treatment. The demand for oral tirzepatide is largely driven by this population, and their preference is completely valid.

Weekly injections also require planning: keeping the medication refrigerated, having supplies available, finding a private moment to inject, and managing the injection site rotation. None of these requirements is particularly burdensome, but they add friction to the treatment experience. An effective oral alternative would eliminate all of this friction.

The problem is that "effective" is the operative word. Convenience without efficacy is not a treatment. It is a placebo with better marketing.

Why Eli Lilly is not making an oral tirzepatide pill

Eli Lilly, the company that developed and manufactures tirzepatide, has not announced plans to create an oral tirzepatide formulation. This is a deliberate strategic decision, not an oversight, and understanding why illuminates the science and business of oral peptide delivery.

The company confirmed through its medical information channel: "Is Zepbound (tirzepatide) available as an oral formulation? No." The statement is direct, without any "not yet" or "in development" qualifier. Eli Lilly is not pursuing oral tirzepatide. They are pursuing something potentially better.

Orforglipron, Eli Lilly oral GLP-1 candidate, sidesteps the entire oral peptide delivery problem by not being a peptide. As a small molecule, orforglipron naturally survives digestion, absorbs efficiently through the gut, and achieves predictable blood levels without absorption enhancers or special dosing protocols. It is a fundamentally different approach: instead of trying to force a large peptide through a hostile environment, Lilly designed a small molecule that activates the same receptor through a different structure.

This strategy has trade-offs. Orforglipron only hits the GLP-1 receptor, not GIP. So it cannot replicate the dual-agonist mechanism that makes tirzepatide superior to semaglutide. But Lilly appears to have calculated that a proven, convenient, well-absorbed oral GLP-1 is more valuable than a hypothetical oral dual agonist with uncertain absorption. The clinical data supports this calculation. Orforglipron works. It has clear efficacy data. It is heading for approval. An oral tirzepatide with unpredictable bioavailability would be a scientific gamble with no guaranteed payoff.

There is also a business consideration. Eli Lilly holds patents on both tirzepatide and orforglipron. Developing oral tirzepatide would cannibalize both their injectable tirzepatide franchise and their orforglipron pipeline. Having separate products for separate delivery methods, injectable for maximum efficacy and oral for maximum convenience, creates a larger combined market than a single product trying to do both.

The ATTAIN-MAINTAIN trial data supports this complementary approach. Patients could start with injectable tirzepatide for aggressive weight loss, then transition to oral orforglipron for convenient long-term maintenance. Two products working together, each optimized for its delivery route, rather than one product compromised by the limitations of oral peptide delivery.

The science of oral peptide delivery: where the field stands

The challenge of delivering peptides orally has occupied pharmaceutical researchers for over 40 years. Progress has been slow, but recent breakthroughs suggest the landscape is shifting. Understanding the current science helps contextualize whether oral tirzepatide might eventually become feasible.

The three barriers to oral peptide delivery

Barrier 1: enzymatic degradation. Your gastrointestinal tract contains dozens of proteolytic enzymes whose sole purpose is breaking peptide bonds. Pepsin in the stomach, trypsin and chymotrypsin in the small intestine, and brush border peptidases in the intestinal lining all attack peptides from multiple angles. A 39-amino acid peptide like tirzepatide presents 38 peptide bonds, each one a potential cleavage site. Protecting all of these bonds simultaneously requires sophisticated formulation technology.

Barrier 2: membrane permeability. Even if a peptide survives enzymatic attack, it must cross the intestinal epithelium to reach the bloodstream. This membrane is designed to absorb small, lipophilic molecules (fats, certain vitamins, simple sugars) and reject large, hydrophilic molecules (which includes most peptides). Tirzepatide molecular weight of 4,813 daltons puts it well above the typical threshold for passive intestinal absorption, which favors molecules under 500-700 daltons.

Barrier 3: first-pass metabolism. Molecules absorbed through the intestine travel first to the liver via the portal vein before reaching systemic circulation. The liver is packed with additional enzymes that can metabolize peptides. This "first-pass effect" further reduces the amount of active drug that reaches its target receptors. Sublingual delivery avoids first-pass metabolism, which is one reason it remains the most pharmacologically plausible oral route for peptides.

Current absorption enhancement technologies

SNAC (oral semaglutide approach). Novo Nordisk SNAC technology temporarily raises local pH and promotes transcellular absorption through the gastric wall. This is the only absorption-enhancing technology that has succeeded in bringing an oral peptide to market for systemic delivery. But SNAC achieves less than 1% bioavailability, requires strict fasting conditions, and works best with smaller peptides. Applying it to tirzepatide would face additional challenges due to the larger molecular size.

Permeation enhancers. Compounds like sodium caprate, EDTA, and various surfactants can temporarily open tight junctions between intestinal cells, allowing larger molecules to pass through. The challenge is controlling this process, opening junctions enough for peptide absorption without compromising the intestinal barrier function that protects against bacterial invasion.

Nanoparticle encapsulation. Wrapping peptides in protective nanoparticles (liposomes, PLGA nanoparticles, chitosan complexes) can shield them from enzymatic degradation and enhance mucosal adhesion. This approach shows promise in animal models but has not yet produced an FDA-approved oral peptide product for systemic delivery.

Enteric coating with targeted release. pH-sensitive coatings can protect peptides through the stomach and release them in the more neutral environment of the small intestine. Combined with protease inhibitors to shield against intestinal enzymes, this approach can improve peptide survival but still faces the membrane permeability barrier.

None of these technologies has been tested with tirzepatide. The field is making progress, and future breakthroughs could enable effective oral tirzepatide delivery. But "future" is the key word. Today, the technology does not exist in validated form.

The sublingual route: the most realistic oral approach for tirzepatide

Of all oral delivery methods, sublingual absorption remains the most pharmacologically plausible route for a large peptide like tirzepatide. The sublingual mucosa offers several advantages over gastrointestinal delivery, and understanding both the promise and limitations of this route matters for researchers evaluating their options.

How sublingual absorption works

The area under your tongue has an extremely thin epithelial layer, just a few cell layers thick, sitting directly over a dense network of capillaries. Molecules that penetrate this thin barrier enter the bloodstream almost immediately, bypassing both the gastrointestinal tract and first-pass liver metabolism. This is why sublingual nitroglycerin works within minutes for angina, and why sublingual peptide delivery has attracted research interest.

For the absorption to work effectively, the molecule needs certain characteristics. Ideal sublingual candidates are small (under 1,000 daltons), lipophilic (able to cross cell membranes easily), and require low doses. Tirzepatide meets none of these criteria perfectly. It is large (4,813 daltons), predominantly hydrophilic (water-soluble peptide backbone), and requires doses in the milligram range.

However, tirzepatide does have some favorable characteristics. The C20 fatty acid chain attached at position 20 provides a degree of lipophilicity. The amidated C-terminus improves membrane interaction. And the modified amino acids at positions 2 and 13 provide some protection against salivary enzymes, though these enzymes are less aggressive than gastric and intestinal proteases.

Practical challenges of sublingual tirzepatide

Contact time. Effective sublingual absorption requires the drug to remain in contact with the sublingual mucosa for an adequate period, typically one to three minutes. Salivary flow constantly dilutes the medication and triggers the swallowing reflex. Any tirzepatide that is swallowed rather than absorbed sublingually faces the full destructive gastrointestinal environment. Compliance with the "hold it under your tongue" instruction varies widely among real-world users.

Dose uniformity. Sublingual troches and drops are compounded products, and achieving uniform distribution of a large peptide throughout a troche matrix is technically challenging. If the tirzepatide is unevenly distributed, each troche could deliver a different effective dose, even within the same batch.

Absorption variability. Sublingual absorption rates vary based on mucosal blood flow, saliva pH, the presence of mouth ulcers or inflammation, recent food intake, and individual anatomy. This variability makes consistent dosing difficult even under ideal conditions.

No supporting data. The most significant challenge is the complete absence of pharmacokinetic data. No study has measured tirzepatide blood levels after sublingual administration. Without this data, every aspect of sublingual tirzepatide dosing, from the amount needed to the expected absorption percentage to the therapeutic window, is speculative.

How to approach tirzepatide therapy today: evidence-based options

For researchers and patients interested in tirzepatide benefits, the evidence-based options are clear, even if they do not include an oral formulation. SeekPeptides members access detailed protocols and guidance for navigating these options effectively.

Option 1: FDA-approved injectable tirzepatide

Brand names Mounjaro (for type 2 diabetes) and Zepbound (for weight management) remain the gold standard. The evidence is extensive, the manufacturing quality is regulated, and the results are documented across multiple phase 3 trials.

The standard dosing protocol begins at 2.5 mg weekly for the first four weeks. This starting dose primarily assesses tolerance and allows the body to adjust. At week five, the dose increases to 5 mg weekly. Subsequent increases of 2.5 mg every four weeks follow, up to a maximum of 15 mg weekly. Each dose escalation should include at least a four-week stabilization period. Rushing this process amplifies side effects without improving long-term outcomes.

The injection itself is straightforward. Tirzepatide comes in pre-filled single-dose pens with a hidden needle mechanism. Users inject into the abdomen, thigh, or upper arm, rotating injection sites to prevent tissue irritation. The needle is small gauge and short, making the injection minimally painful for most users. Many describe it as less uncomfortable than a blood draw or flu shot.

If missed doses occur, the medication should be administered within four days (96 hours). If more than four days have passed, skip the missed dose and resume on the regular schedule. Do not double up.

Option 2: oral semaglutide (Wegovy pill) as an alternative

For people who genuinely cannot or will not use injections, oral Wegovy became available in January. While semaglutide does not match tirzepatide in head-to-head comparisons, 16.6% average weight loss at 64 weeks is still a clinically significant result. The pill form eliminates needles entirely.

The oral Wegovy protocol requires taking one pill daily on an empty stomach with a small sip of water (no more than 4 ounces). Wait at least 30 minutes before eating, drinking, or taking other medications. The starting dose is 1.5 mg daily, escalating through 3 mg, 7 mg, and 14 mg before reaching the target dose of 25 mg. This escalation schedule takes approximately 16 weeks.

The strict dosing conditions are non-negotiable for effectiveness. Taking oral semaglutide with food, too much water, or other medications dramatically reduces absorption. This is not a minor suggestion; it is a fundamental requirement for the drug to work.

Option 3: wait for orforglipron

If oral convenience is the primary concern and the timeline works, orforglipron may become available through FDA approval sometime this year. The key advantages over oral semaglutide include no fasting requirement, no water restriction, and potentially better tolerability based on the clinical trial safety profile. The trade-off is that orforglipron data shows lower weight loss than injectable tirzepatide, approximately 12.4% versus 20-22% at maximum doses.

Option 4: combination approach

The ATTAIN-MAINTAIN trial data suggests a compelling combination strategy: use injectable tirzepatide to achieve aggressive initial weight loss, then transition to oral orforglipron (once available) for convenient long-term maintenance. This approach maximizes initial results while minimizing long-term injection burden. SeekPeptides protocols can help researchers plan this kind of phased approach based on individual goals and timelines.

Drug interactions and safety considerations for any tirzepatide formulation

Whether injectable or oral, tirzepatide mechanism of action creates specific drug interaction considerations that every user must understand. The delayed gastric emptying effect, one of the mechanisms by which tirzepatide reduces appetite, also slows the absorption of other oral medications.

Oral contraceptives

This is the highest-priority interaction. Tirzepatide delays gastric emptying, which can reduce the absorption rate of oral hormonal contraceptives. Reduced absorption means reduced effectiveness, which means increased pregnancy risk. The FDA labeling recommends using non-oral contraceptive methods or adding a barrier method (condoms, diaphragm) for four weeks after starting tirzepatide and for four weeks after each dose escalation. This applies regardless of whether tirzepatide is taken as an injection or theoretical oral formulation.

Medications with narrow therapeutic indices

Drugs where small changes in blood levels can cause significant problems, warfarin, digoxin, lithium, certain anti-epileptic medications, deserve careful monitoring when combined with tirzepatide. The delayed gastric emptying can alter absorption timing and peak blood levels. Healthcare providers may need to adjust doses or monitor levels more frequently.

Insulin and sulfonylureas

Combining tirzepatide with insulin or sulfonylureas increases the risk of hypoglycemia (dangerously low blood sugar). This is especially relevant for people with type 2 diabetes using tirzepatide in addition to existing diabetes medications. Insulin doses often need to be reduced when starting tirzepatide.

Absolute contraindications

Tirzepatide should not be used by anyone with a personal or family history of medullary thyroid carcinoma (MTC) or multiple endocrine neoplasia syndrome type 2 (MEN 2). In animal studies, GLP-1 receptor agonists caused thyroid C-cell tumors. While this has not been confirmed in humans, the precautionary contraindication remains. Anyone with a history of pancreatitis should use tirzepatide with extreme caution and close medical monitoring.

Side effect management during dose escalation

The most common side effects, nausea, vomiting, diarrhea, constipation, and decreased appetite, are manageable for most users. Strategies that experienced researchers report include eating smaller, more frequent meals, avoiding high-fat and fried foods during the first weeks of each new dose, staying well hydrated, eating slowly and stopping when full rather than finishing meals out of habit, and using ginger or peppermint tea for nausea relief.

If side effects persist beyond two to three weeks at a given dose, or if they are severe enough to prevent eating or cause dehydration, medical attention is warranted. Dose reduction or temporary pause may be necessary. The goal is consistent, tolerable therapy, not suffering through side effects in pursuit of faster results.

Understanding the future: when might real oral tirzepatide arrive?

Predicting pharmaceutical development timelines is notoriously unreliable. But the current trajectory of the field allows for some informed speculation about when an effective oral tirzepatide, or functional equivalent, might become available.

Near-term: oral GLP-1 options expand

Oral Wegovy is available now. Orforglipron is likely within the year. These two products will serve the large population of patients who want needle-free incretin therapy. Neither replicates the dual GIP/GLP-1 mechanism of tirzepatide, but both provide meaningful weight loss and metabolic benefits through oral delivery.

Medium-term: oral dual agonists

The success of orforglipron as a small-molecule GLP-1 agonist opens a pathway for small-molecule dual GIP/GLP-1 agonists. If a non-peptide molecule can activate the GLP-1 receptor, there is no fundamental reason why a non-peptide molecule cannot activate both GIP and GLP-1 receptors. The challenge is designing a single small molecule with the right binding affinity for both receptors while maintaining favorable pharmacokinetic properties for oral delivery.

Several pharmaceutical companies are exploring this approach, though none have reached clinical trials with an oral dual agonist yet. Based on typical drug development timelines (3-5 years from first-in-human trials to approval), an oral dual agonist is unlikely before the late 2020s at the earliest.

Long-term: advanced oral peptide delivery

Nanotechnology, permeation enhancer technology, and enzyme inhibitor formulations continue advancing. If these technologies mature to the point where a 39-amino acid peptide can be reliably delivered orally with clinically meaningful bioavailability, an actual oral tirzepatide pill becomes possible. This scenario is speculative and likely represents a longer time horizon.

The more probable path to "oral tirzepatide" is through a small-molecule dual agonist rather than an oral formulation of the tirzepatide peptide itself. The chemistry is more tractable, the regulatory pathway is more familiar (small molecules are the majority of oral drugs), and the manufacturing scale-up is more straightforward.

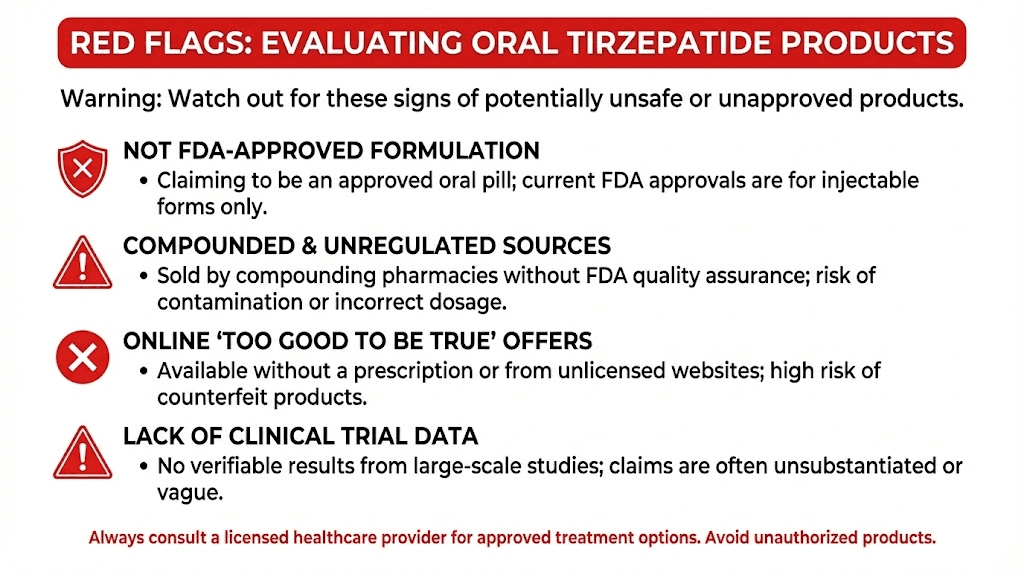

How to evaluate claims about oral tirzepatide products

The internet is full of products claiming to be oral tirzepatide, and new ones appear regularly. SeekPeptides provides tools and guides to help researchers evaluate these claims critically. Here is a framework for assessing any oral tirzepatide product you encounter.

Red flags that indicate a fraudulent or unreliable product

Claims of FDA approval. No oral tirzepatide is FDA-approved. Any product claiming FDA approval for an oral tirzepatide formulation is lying. Full stop.

"Equivalent to injection" claims. No clinical evidence supports this claim. Any product stating it delivers results equivalent to injectable tirzepatide has no data to back that up.

"Research use only" labeling with weight loss marketing. Products labeled "not for human consumption" or "for research use only" that are simultaneously marketed for weight loss on the same website or platform are operating in bad faith.

No third-party testing documentation. Legitimate compounded medications come with certificates of analysis from independent testing laboratories. If a product does not provide this documentation, you have no way to verify what is actually in the bottle.

Prices dramatically below injectable versions. If a product costs 80% less than the FDA-approved injectable while claiming equivalent results, the economics do not support genuine tirzepatide content at therapeutic concentrations. Raw tirzepatide peptide is expensive to synthesize. Very cheap products likely contain very little or none of the actual compound.

No prescriber involvement. Any tirzepatide product, oral or injectable, should involve a licensed healthcare provider who reviews your medical history, assesses contraindications, and monitors your response. Products available for direct purchase without medical oversight violate basic pharmaceutical safety principles.

Questions to ask any provider offering oral tirzepatide

If a healthcare provider offers oral tirzepatide, ask these questions:

What is the source of the tirzepatide used in this product? Can you provide the certificate of analysis? What is the expected bioavailability of this formulation? What clinical data supports the dose you are prescribing? How do you monitor therapeutic levels? What legal basis allows the production of this compound given that tirzepatide is no longer on the FDA shortage list?

Legitimate providers will answer these questions directly. Evasion, vague responses, or hostility toward the questions should be treated as red flags.

The tirzepatide dosing protocol that works: injectable reference guide

Since injectable tirzepatide remains the only evidence-based option, having a clear reference for the dosing protocol is essential. The complete tirzepatide dosing guide covers this in full detail, but here is the essential framework.

Standard escalation protocol

Weeks 1 through 4: 2.5 mg once weekly. This is not a therapeutic dose for most people. It is an initiation dose designed to let your gastrointestinal system adapt to the drug mechanism. Expect minimal weight loss during this phase. Focus on tolerance.

Weeks 5 through 8: 5 mg once weekly. The first therapeutic dose level. Many users begin experiencing meaningful appetite suppression here. Weight loss typically becomes noticeable. Side effects may increase temporarily as the body adjusts to the higher dose.

Weeks 9 through 12: 7.5 mg once weekly. Continued escalation for those tolerating the medication well. Weight loss accelerates for most users. This is where the "whoosh" effect that community members describe often occurs.

Weeks 13 through 16: 10 mg once weekly. A common maintenance dose for many users. Clinical trial data shows robust weight loss at this level. Some users remain at 10 mg long-term without needing further escalation.

Weeks 17 through 20: 12.5 mg once weekly. An optional escalation for those who want additional weight loss beyond what 10 mg provides.

Weeks 21 and beyond: 15 mg once weekly. The maximum approved dose. Clinical trials showed 22.5% average weight loss at this level over 72 weeks. Not everyone needs or tolerates this dose. The decision to escalate to 15 mg should balance additional expected benefit against increased side effect risk.

Critical rules for dose management

Never increase by more than 2.5 mg at once. Never escalate before completing at least four full weeks at the current dose. If side effects are significant, stay at the current dose for an additional four weeks before reconsidering. It is acceptable to step back down to a lower dose if side effects become intolerable. The dosage calculators at SeekPeptides help researchers plan their protocols with precision.

Weight loss is not linear. Plateaus are normal. Weeks of rapid loss will alternate with weeks of stability. Consistency matters more than any individual weekly result. The 72-week trial duration in SURMOUNT studies was not arbitrary. It reflects the reality that pharmacological weight loss is a gradual process that plays out over months, not weeks.

Tirzepatide and the broader GLP-1 revolution

Understanding oral tirzepatide in isolation misses the bigger picture. The entire incretin therapy field is experiencing an unprecedented acceleration, and tirzepatide is just one compound in a rapidly expanding landscape.

The competitive landscape

Semaglutide from Novo Nordisk was the first blockbuster GLP-1 for weight loss. Now available in injectable (Wegovy) and oral (Wegovy pill) formulations, it remains the most widely prescribed incretin for weight management. Head-to-head, tirzepatide produces more weight loss, but semaglutide has more extensive cardiovascular outcome data (the SELECT trial proved cardiovascular risk reduction) and broader formulation availability.

Orforglipron from Eli Lilly represents the next generation of oral GLP-1 therapy. As a non-peptide small molecule, it solves the oral delivery challenge through molecular design rather than formulation technology. No fasting requirement. No absorption enhancer needed. Potentially the most convenient GLP-1 option once approved.

Survodutide from Boehringer Ingelheim is a dual GLP-1/glucagon receptor agonist, a different dual-agonist approach than tirzepatide. Early data suggests competitive weight loss results. The glucagon receptor activation adds metabolic benefits including increased energy expenditure, but also introduces different safety considerations.

Cagrilintide from Novo Nordisk is an amylin analog being studied in combination with semaglutide (the combination is called CagriSema). The CagriSema combination aims to match or exceed tirzepatide weight loss through a different dual-receptor strategy.

Retatrutide from Eli Lilly is a triple agonist, hitting GIP, GLP-1, and glucagon receptors simultaneously. Phase 2 data showed up to 24% weight loss at 48 weeks, potentially exceeding even tirzepatide. Phase 3 trials are ongoing.

Where oral delivery fits in this landscape

The long-term trajectory of the GLP-1 field points toward increasing oral availability. Injectable therapy will likely remain the most potent option for maximum weight loss. But oral options will continue improving and expanding. Within the next few years, patients may have multiple oral GLP-1 options with different receptor profiles, dosing schedules, and convenience features.

For tirzepatide specifically, the path to oral delivery probably runs through small-molecule dual agonist development rather than oral peptide formulation. The Eli Lilly pipeline suggests this direction. An oral small molecule that activates both GIP and GLP-1 receptors would effectively be "oral tirzepatide" in terms of mechanism, even if the actual molecule is chemically distinct from the tirzepatide peptide.

Storing and handling tirzepatide properly

Until an oral version becomes available through legitimate channels, proper handling of injectable tirzepatide maximizes its effectiveness and safety. This is particularly relevant for anyone using the peptide storage resources at SeekPeptides.

Unopened tirzepatide pens should be stored in the refrigerator at 2 to 8 degrees Celsius (36 to 46 degrees Fahrenheit). Do not freeze. Freezing can damage the peptide structure and render the medication ineffective. Keep pens in their original packaging to protect from light.

Once an injection pen is in use, it can be stored at room temperature (up to 30 degrees Celsius or 86 degrees Fahrenheit) for up to 21 days. After 21 days at room temperature, unused medication should be discarded even if the pen still contains solution. This 21-day window is based on stability data showing that the peptide maintains potency and sterility for this duration outside refrigeration.

Never expose tirzepatide to extreme heat, direct sunlight, or temperature fluctuations. Do not store in a car during hot weather. Do not leave near a window. Temperature excursions can denature the peptide, breaking the carefully engineered structure that enables dual-receptor binding. Denatured tirzepatide is inactive tirzepatide.

For researchers working with peptide storage protocols, the tirzepatide stability profile is consistent with other large peptides. The albumin-binding fatty acid chain provides some structural stability, but the 39-amino acid backbone remains susceptible to heat-induced denaturation, oxidation, and aggregation. Proper storage is not optional. It is a fundamental requirement for the drug to work as intended.

Frequently asked questions

Is oral tirzepatide FDA-approved?

No. As of early February of this year, no oral formulation of tirzepatide has received FDA approval. The only FDA-approved tirzepatide products are the injectable forms sold as Mounjaro (for type 2 diabetes) and Zepbound (for weight management). Any product marketed as "FDA-approved oral tirzepatide" is making a false claim.

Are sublingual tirzepatide drops effective?

There is no clinical evidence demonstrating the effectiveness of sublingual tirzepatide drops. No randomized controlled trial has tested sublingual tirzepatide for weight loss, blood sugar control, or any other outcome. The bioavailability of tirzepatide via sublingual delivery has never been measured in a published study. While the sublingual route is pharmacologically plausible for some peptide absorption, the lack of data means effectiveness claims are unsubstantiated.

Can I switch from injectable tirzepatide to an oral version?

There is no validated oral tirzepatide to switch to. However, the ATTAIN-MAINTAIN trial showed that patients can switch from injectable tirzepatide to oral orforglipron (once approved) while largely maintaining their weight loss. Oral semaglutide (Wegovy pill) is another alternative, though it only activates the GLP-1 receptor, not both GIP and GLP-1.

When will Eli Lilly release an oral tirzepatide pill?

Eli Lilly has not announced any plans to develop an oral tirzepatide formulation. The company is instead pursuing orforglipron, a non-peptide oral GLP-1 agonist that sidesteps the oral peptide delivery challenges. Orforglipron has been submitted for FDA review and may receive approval in the near term.

Is compounded oral tirzepatide legal?

No. Since tirzepatide was removed from the FDA drug shortage list in March of last year, compounding pharmacies no longer have the legal basis to produce tirzepatide in any form. Eli Lilly has filed lawsuits against companies that continue selling unauthorized compounded tirzepatide products.

How does oral semaglutide compare to injectable tirzepatide?

Injectable tirzepatide produces approximately 20.2% weight loss at 72 weeks (at maximum dose in the SURMOUNT-5 trial). Oral Wegovy (semaglutide 25 mg daily) produced 16.6% weight loss at 64 weeks in the OASIS 4 trial. Tirzepatide is more effective due to its dual GIP/GLP-1 receptor mechanism, but oral semaglutide eliminates the need for injections entirely. The detailed comparison between these compounds helps researchers choose the right approach.

What is the difference between orforglipron and tirzepatide?

Orforglipron is a small-molecule (non-peptide) oral GLP-1 receptor agonist. Tirzepatide is a 39-amino acid peptide dual GIP/GLP-1 receptor agonist. Orforglipron only activates GLP-1 receptors. Tirzepatide activates both GIP and GLP-1 receptors. Orforglipron can be taken orally with no food restrictions. Tirzepatide requires weekly subcutaneous injection. In clinical trials, tirzepatide produces more weight loss (20-22% at max dose) compared to orforglipron (12.4% at max dose).

Are there any safe oral alternatives to tirzepatide?

The FDA-approved oral Wegovy (semaglutide 25 mg) is currently the only safe, proven oral GLP-1 for weight management. Orforglipron is expected to receive FDA approval and would provide another oral option. Both target only the GLP-1 receptor, so neither replicates the dual-agonist mechanism of tirzepatide. For maximum weight loss efficacy, injectable tirzepatide remains the top choice.

External resources

For researchers serious about optimizing their protocols, SeekPeptides offers the most comprehensive resource available, with evidence-based guides, proven protocols, and a community of thousands who have navigated these exact questions.

In case I do not see you, good afternoon, good evening, and good night. May your peptides stay potent, your protocols stay evidence-based, and your results stay consistent.

Join SeekPeptides.