Jan 3, 2026

Revive Peptides enters the saturated mid-tier domestic research peptide vendor market where differentiation proves challenging when dozens of competitors offer identical catalogs, comparable pricing, and standard Janoshik testing claiming 98-99% purity. The systematic evaluation of competitors like Transcend, Planet Peptides, RPO, and numerous others reveals remarkable standardization across vendors providing functionally identical quality and service at comparable price points.

Revive faces the common mid-tier challenge of demonstrating value when objective metrics show uniformity.

Name recognition, current stock availability, and minor pricing differences become selection factors rather than meaningful quality or service differentiation.

This review examines Revive through systematic evaluation including company background, product catalog, quality control, pricing, customer service, community reputation, and honest comparison determining whether Revive offers compelling advantages or represents another adequate but unremarkable mid-tier option.

Company background and market positioning

Revive Peptides operates as a domestic US research peptide vendor with approximately 3-5 years of operational history, positioning them in the mid-age category that's established enough to suggest legitimacy while lacking the decade-plus track record of truly seasoned vendors. This timeframe mirrors many mid-tier competitors who emerged during the recent peptide research interest surge, creating a crowded marketplace where newer vendors struggle to differentiate from equally adequate alternatives.

The business model follows standard research vendor patterns with direct online e-commerce sales, individual order fulfillment, and the ubiquitous research-only disclaimers protecting vendors from regulatory scrutiny while serving customers pursuing self-directed peptide protocols. Operational transparency remains limited as typical for this market segment - website functionality proves adequate without exceptional features, company information stays minimal, contact methods center on email communication, and physical location details remain understated or absent entirely.

Learn about what peptides are and how they work before selecting vendors.

Market tier analysis

The research peptide vendor landscape stratifies into distinct tiers with clear pricing, quality, and service patterns. Budget international vendors like Amopure occupy the $150-300 monthly range offering 50-70% cost savings with 3-6 week shipping timelines and variable quality requiring group buy participation and cryptocurrency payments. Premium domestic vendors command $600-900 monthly with extensive multi-lab testing, exceptional customer service, and established decade-plus reputations justifying premium pricing. Pharmaceutical compounding pharmacies represent the $900-1500 tier with medical supervision, prescription requirements, and pharmaceutical-grade quality assurance.

Revive Peptides sits solidly in the mid-tier domestic category at $300-600 monthly alongside dozens of competitors offering standard Janoshik testing, adequate customer service, 3-7 day domestic shipping, and established-but-not-premium reputations. This positioning creates the fundamental challenge - when Transcend, Planet Peptides, NextGen, Profound, Elite Research, and numerous others deliver functionally identical offerings, vendor selection becomes largely arbitrary based on minor factors rather than substantial competitive advantages.

Vendor Tier | Monthly Cost | Shipping Time | Quality Assurance | Service Level |

|---|---|---|---|---|

Budget International | $150-300 | 3-6 weeks | Variable, minimal testing | Minimal support |

Mid-Tier Domestic (Revive) | $300-600 | 3-7 days | Standard Janoshik | Adequate support |

Premium Domestic | $600-900 | 3-7 days | Multi-lab, comprehensive | Excellent support |

Pharmaceutical | $900-1500 | Varies | Pharmaceutical-grade | Medical supervision |

Product catalog and availability patterns

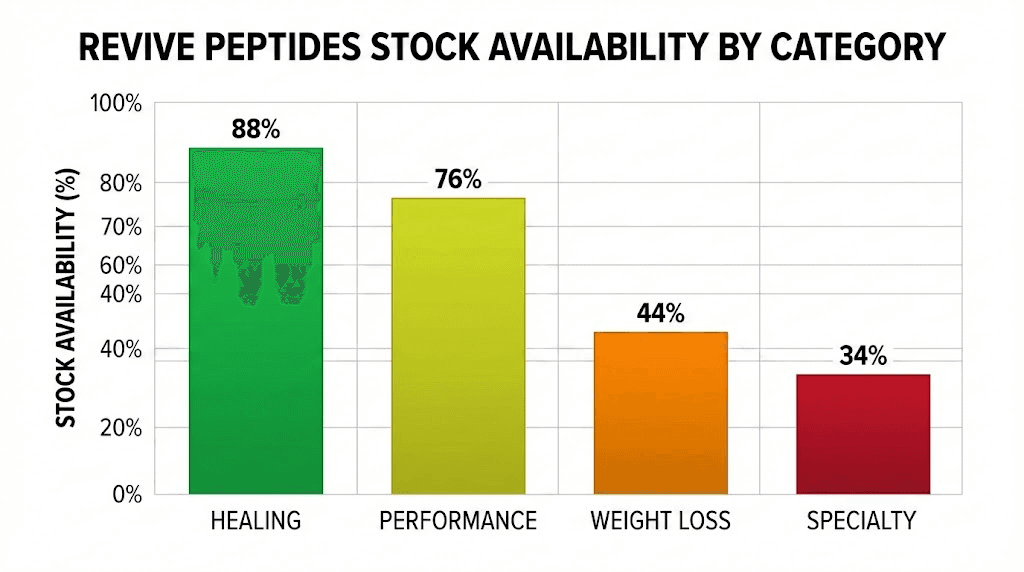

Revive Peptides offers the standard mid-tier catalog that's become remarkably homogeneous across domestic vendors. The healing peptide category forms the core focus with BPC-157 available in 5mg and 10mg formulations alongside TB-500 in standard doses, representing the most consistently stocked and popular category vendors prioritize since demand remains steady and supply relatively stable. These peptides work for injury recovery and tissue repair applications, making them foundational products for any research vendor targeting the healing and recovery market segment.

Performance and bodybuilding peptides occupy the second tier of availability with Ipamorelin and CJC-1295 offered in both DAC and non-DAC formulations, alongside occasional IGF-1 variants when supply permits. These growth hormone secretagogues appeal to bodybuilders, athletes, and anti-aging enthusiasts seeking performance enhancement or recovery optimization, creating moderate but consistent demand vendors attempt to maintain through regular stocking patterns when wholesale sourcing cooperates.

The weight loss peptide category presents the greatest availability challenges across all mid-tier vendors including Revive. Semaglutide and tirzepatide face explosive demand following mainstream media coverage and pharmaceutical marketing creating supply constraints industry-wide. Stock availability hovers around 40-50% for these compounds across mid-tier vendors, with items selling out within hours of restocking and users frequently encountering "out of stock" frustrations requiring multi-vendor relationships or extended waiting periods for availability windows.

Specialty and cognitive peptides like Semax appear occasionally without consistent availability, reflecting Revive's focus on mainstream healing and performance categories rather than niche nootropic applications better served by specialized vendors. The catalog demonstrates zero unique offerings - no proprietary blends, no exclusive compounds, no specialty formulations distinguishing Revive from the twenty-plus competitors offering identical product lists at comparable prices with similar availability challenges.

Peptide Category | Example Products | Typical Availability | Stock Consistency |

|---|---|---|---|

Healing | BPC-157, TB-500 | 80-90% | Good - Core focus |

Performance | Ipamorelin, CJC-1295 | 70-80% | Moderate - Standard demand |

Weight Loss | Semaglutide, Tirzepatide | 40-50% | Poor - High demand, supply issues |

Cognitive/Specialty | Semax, Selank | 30-40% | Poor - Not primary focus |

Stock availability patterns match mid-tier industry averages rather than demonstrating superior sourcing or inventory management. Users report the familiar frustration of checking multiple vendors for desired compounds, particularly weight loss peptides that disappear rapidly when stocked. Restocking timelines remain unclear with vendors rarely providing estimated availability dates, forcing customers into reactive monitoring rather than proactive planning for protocol continuity.

See best peptide vendors for comprehensive vendor comparison across all tiers.

Quality control and testing transparency

Revive Peptides employs Janoshik Analytical laboratory for third-party testing, following the industry-standard approach that's become universal across mid-tier domestic vendors. The testing methodology includes HPLC purity analysis determining the percentage of target peptide present in samples, alongside mass spectrometry for identity confirmation ensuring the compound matches claimed specifications rather than containing wrong peptides or complete substitutions. Batch-specific COAs (Certificates of Analysis) get posted on product pages showing purity percentages typically ranging from 98-99%+, creating the appearance of high-quality verification while actually representing standard mid-tier practice rather than exceptional quality assurance.

The testing transparency level proves moderate - COAs remain accessible on the website with batch numbers listed and recent testing dates shown, matching what Transcend, Planet, and other peers provide without exceeding this baseline standard. Critical testing gaps persist across Revive and all mid-tier competitors, revealing what separates mid-tier from truly premium vendors. Sterility verification testing remains absent despite injectable peptides requiring sterile preparation, endotoxin quantification goes unperformed though bacterial toxins pose health risks, heavy metal screening never appears in testing panels though contamination possibilities exist, and peptide content accuracy verification beyond purity percentages stays unaddressed.

The fundamental testing questions remain unanswered creating uncertainty users must accept when choosing mid-tier vendors. Does Revive test every batch or perform selective testing on representative samples? Do customers receive peptides from specifically tested batches or might untested production batches ship between testing cycles? How frequently does testing occur - monthly, quarterly, or triggered by supplier changes? These operational details stay proprietary, creating a trust-based system where users rely on vendor integrity and spot-check their own results through perceived effectiveness rather than comprehensive independent verification.

User-reported quality experiences generate the 70-75% satisfaction distribution that's become remarkably consistent across mid-tier vendors. Positive feedback centers on functional adequacy - BPC-157 users report injury healing progression, TB-500 protocols produce expected tissue repair effects, reconstitution proceeds smoothly without contamination concerns, and overall effectiveness matches research-based expectations without exceptional results worthy of enthusiastic testimonials. Occasional quality complaints surface mentioning suspected underdosing or batch variation, though objective verification proves impossible without users conducting independent laboratory testing at personal expense exceeding peptide costs themselves.

Testing Component | Revive Peptides | Mid-Tier Standard | Premium Vendors | Pharmaceutical |

|---|---|---|---|---|

HPLC Purity | ✓ (98-99%) | ✓ (98-99%) | ✓ (98-99%) | ✓ (99%+) |

Mass Spec Identity | ✓ | ✓ | ✓ | ✓ |

Sterility Testing | ✗ | ✗ | ✓ | ✓ |

Endotoxin Testing | ✗ | ✗ | Sometimes | ✓ |

Heavy Metals | ✗ | ✗ | Rare | ✓ |

Multi-Lab Verification | ✗ | ✗ | ✓ | ✓ |

Batch Consistency Tracking | Unknown | Unknown | ✓ | ✓ |

The quality assessment ultimately positions Revive as adequate but unremarkable - products work for most users generating functional satisfaction without inspiring confidence that justifies premium pricing or exceptional loyalty preventing users from switching to equally adequate competitors when stock availability or minor pricing differences favor alternatives.

See peptide safety and risks for quality considerations in vendor selection.

Pricing structure and value proposition

Revive Peptides pricing follows mid-tier market rates that cluster tightly around industry averages, making price-based differentiation minimal across competing vendors. A 5mg BPC-157 vial costs approximately $40-60 depending on promotions and bulk purchasing, while TB-500 5mg runs $50-75 per vial reflecting slightly higher wholesale costs for this compound. Performance peptides like Ipamorelin 5mg average $35-55 with CJC-1295 2mg around $30-50, creating monthly protocol costs in the $300-600 range characteristic of mid-tier positioning between budget and premium alternatives.

The tier comparison reveals Revive's competitive positioning clearly. Budget international vendors like Amopure undercut Revive by 50-70% on equivalent compounds, making a 3-month BPC-157 healing protocol cost $250-350 through budget sources versus $450-600 through Revive - savings approaching $200-300 that accumulate significantly over extended use periods or multi-peptide stacks. Other mid-tier vendors like Transcend ($420-580) and Planet Peptides ($430-590) cluster within 10-20% of Revive pricing, making vendor selection within tier largely indifferent from pure cost perspective since minor price differences get overwhelmed by other factors like stock availability or personal vendor preference.

Premium vendors exceed Revive by 30-50% at $650-850 for equivalent protocols, positioning clearly above mid-tier while delivering superior testing, service, and quality assurance justifying premium pricing for users prioritizing maximum confidence over cost optimization.

Protocol Example | Revive Cost | Budget (Amopure) | Other Mid-Tier | Premium |

|---|---|---|---|---|

3-Month BPC-157 (250mcg/day) | $450-600 | $250-350 (-50%) | $420-590 (Similar) | $650-850 (+40%) |

6-Month GH Stack (Ipa+CJC) | $800-1100 | $450-650 (-45%) | $750-1050 (Similar) | $1100-1500 (+30%) |

Annual Maintenance | $1800-2400 | $1000-1400 (-45%) | $1700-2300 (Similar) | $2600-3400 (+35%) |

The value proposition centers on convenience and reliability rather than exceptional quality or service. Users pay mid-tier premiums for domestic 3-7 day shipping versus 3-6 week international timelines, credit card payment convenience versus cryptocurrency requirements, established vendor presence reducing scam risk, customer service access for basic order support, and standard quality assurance providing moderate confidence without premium-level comprehensive testing.

The convenience premium proves worthwhile for users prioritizing speed and simplicity while appearing unjustified to cost-optimizers willing to navigate budget vendor requirements for 50%+ savings on functionally equivalent products.

Annual cost calculations reveal where pricing decisions compound significantly. A user running continuous BPC-157 plus quarterly performance peptide cycles faces $1800-2400 yearly through Revive versus $1000-1400 through budget alternatives - savings of $800-1000 annually that fund additional protocols, cover other health interventions, or simply reduce financial burden for cost-conscious users. The mid-tier value proposition ultimately serves convenience-focused customers accepting moderate pricing for speed and simplicity while failing to attract either budget-minimizers seeking maximum savings or quality-maximizers willing to invest in premium assurance.

Use peptide cost calculator for personal protocol cost planning across vendor tiers.

Customer service and operational experience

Revive Peptides customer service follows transactional mid-tier patterns focused on order fulfillment rather than comprehensive consultation or relationship building. The ordering process proceeds through standard e-commerce functionality with straightforward product browsing, shopping cart management, and checkout completion using credit card payments that differentiate domestic vendors from budget alternatives requiring cryptocurrency transactions. Order confirmation emails arrive promptly following purchase with basic details confirming items, quantities, and estimated processing timelines setting appropriate expectations for domestic shipping schedules.

Processing timelines average 1-3 business days from order placement to shipment, falling within mid-tier norms without demonstrating exceptional speed that would create competitive advantage through fulfillment velocity. Tracking numbers arrive via email after processing completion, enabling users to monitor domestic carrier progress through standard USPS, FedEx, or UPS systems depending on vendor shipping arrangements. Total delivery timelines cluster at 3-7 days from order to doorstep delivery, matching all domestic competitors operating in this tier while significantly faster than budget international alternatives requiring 3-6 weeks for customs clearance and international transit.

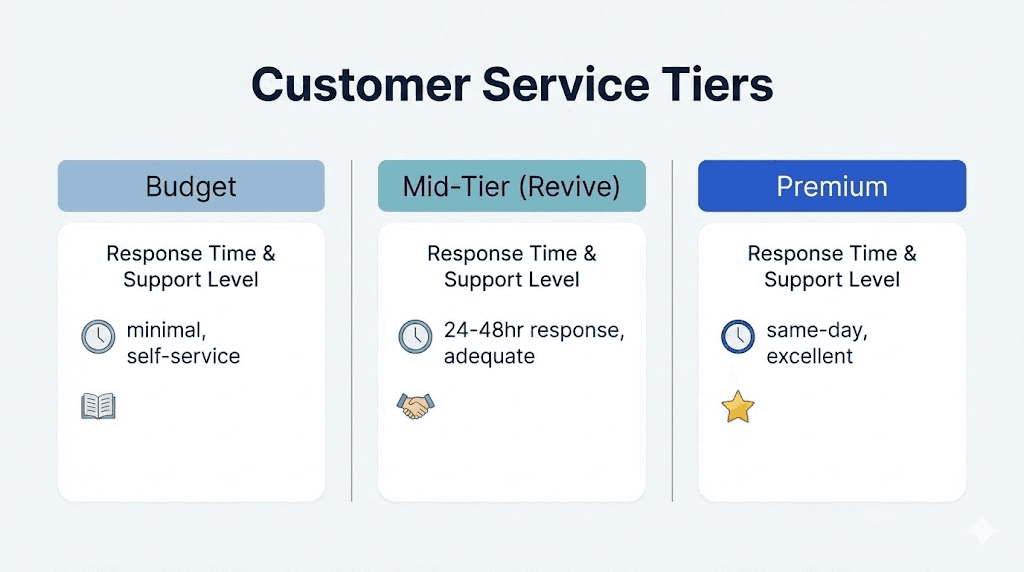

Customer support responsiveness centers on email communication with 24-48 hour response times representing mid-tier adequacy without premium-level same-day attention or proactive outreach. Pre-purchase questions receive adequate responses covering basic product information, dosing guidance remains generic pointing users toward standard protocols without personalized consultation, and stock status inquiries often default to website checking rather than proactive restock notifications creating user responsibility for availability monitoring. Post-purchase support handles order tracking requests competently, addresses shipping errors through case-by-case evaluation typically resulting in reshipment or refund when legitimate mistakes occur, and processes quality concerns through evidence-based review requiring users to document issues thoroughly rather than accepting complaints at face value.

The support quality comparison reveals Revive's mid-tier positioning clearly. Budget vendors provide minimal support beyond order confirmation, forcing users into self-service problem-solving and community resources for protocol guidance.

Other mid-tier peers like Transcend and Planet deliver equivalent adequate-but-not-exceptional service creating interchangeable experiences. Premium vendors exceed mid-tier dramatically through same-day responses, proactive communication, dedicated account management, and generous problem resolution policies treating customers as valued relationships rather than transactional order numbers. Pharmaceutical compounding pharmacies provide medical team access, protocol consultation, and comprehensive safety monitoring surpassing research vendor support entirely.

Support Aspect | Revive Performance | Mid-Tier Standard | Premium Vendors | Pharmaceutical |

|---|---|---|---|---|

Response Time | 24-48 hours | 24-48 hours | Same day | Medical team access |

Order Processing | 1-3 days | 1-3 days | Same day | Varies by prescription |

Problem Resolution | Case-by-case | Case-by-case | Customer-favorable | Comprehensive |

Protocol Guidance | Generic only | Generic only | Detailed assistance | Medical supervision |

Proactive Communication | Minimal | Minimal | Regular updates | Comprehensive monitoring |

Community reputation and user feedback

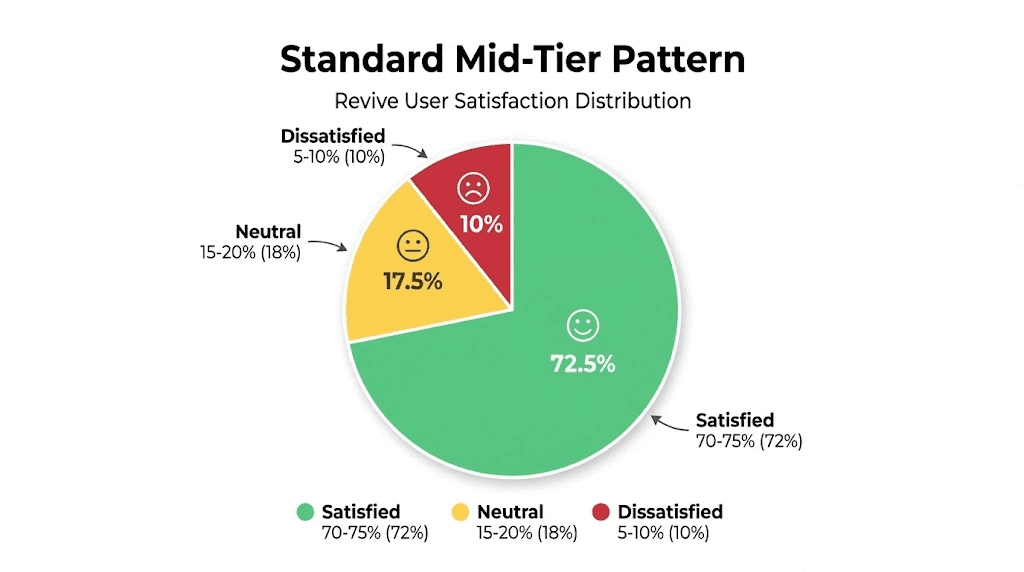

Revive Peptides generates the remarkably consistent 70-75% satisfaction distribution that characterizes mid-tier vendors across the research peptide landscape. User feedback patterns emerge from Reddit peptide communities, bodybuilding forums, Discord groups, and direct vendor reviews showing majority positive experiences tempered by realistic expectations rather than exceptional enthusiasm. The 70-75% satisfied segment reports products working as expected without remarkable results, shipping arriving within promised timeframes without noteworthy speed, and customer service proving adequate for basic needs without exceptional support creating memorable positive experiences worthy of enthusiastic recommendations.

Positive feedback centers on functional adequacy rather than exceptional quality. Users report BPC-157 protocols producing expected injury healing progression matching research-based timelines, TB-500 supporting tissue repair within normal effectiveness ranges, and performance peptides like Ipamorelin generating anticipated growth hormone secretagogue effects including sleep improvement and recovery enhancement. The praise proves generic and unremarkable - "products work fine," "shipping arrived quickly enough," "no major problems encountered" - reflecting satisfaction with baseline competence rather than delight with exceptional performance exceeding alternatives.

The 15-20% neutral segment occupies the honest middle ground expressing neither satisfaction nor dissatisfaction but rather indifference born from unremarkable experiences. These users acknowledge adequate quality comparable to other mid-tier vendors they've tried, note nothing exceptional distinguishing Revive from alternatives, report expectations met without exceeding them, and conclude vendor selection within mid-tier proves largely arbitrary since functional equivalence makes switching costs minimal. This neutral feedback actually proves most informative since it captures modal experiences uncolored by outlier enthusiasm or frustration, revealing Revive's true positioning as one among many interchangeable adequate options.

Negative feedback from the 5-10% dissatisfied segment focuses on standard mid-tier complaints rather than catastrophic failures. Stock availability frustrations dominate complaints as users encounter desired peptides unavailable when ordering, creating delays while waiting for restocks or forcing multi-vendor relationships to maintain protocol continuity. Pricing concerns surface from budget-conscious users comparing Revive to Amopure and calculating 50-70% potential savings through patient international ordering. Occasional quality consistency questions emerge with users suspecting batch variation or subtle underdosing, though objective verification remains absent making these complaints unprovable and potentially reflecting tolerance development, dosing errors, or placebo effects rather than actual product deficiencies.

The reputation comparison to direct competitors reveals complete standardization across mid-tier vendors. Transcend, Planet Peptides, RPO, NextGen, Profound, Elite Research, Nexaph, and Revive all generate identical 70-75% satisfaction rates, identical praise patterns focusing on functional adequacy, identical complaint patterns centered on availability and pricing, and identical neutral assessments concluding interchangeable vendor positioning. No clear winner emerges from mid-tier comparison, making vendor selection within this segment largely arbitrary based on minor factors like current stock status, slight promotional pricing differences, or personal brand preference rather than substantial performance differentiation.

Feedback Category | Percentage | Common Themes | Comparison to Peers |

|---|---|---|---|

Satisfied (4-5 stars) | 70-75% | "Works fine," "No issues," Generic praise | Identical to all mid-tier |

Neutral (3 stars) | 15-20% | "Nothing special," "Interchangeable with others" | Identical to all mid-tier |

Dissatisfied (1-2 stars) | 5-10% | Stock issues, Pricing concerns, Suspected variation | Identical to all mid-tier |

When Revive Peptides makes sense

Revive Peptides serves specific customer segments prioritizing convenience over cost optimization while accepting moderate quality assurance rather than demanding premium verification.

The ideal Revive customer lives US-based valuing domestic 3-7 day shipping over 3-6 week international timelines, maintains mid-budget flexibility in the $300-600 monthly range without requiring aggressive cost minimization or affording premium-tier investment, focuses primarily on healing peptide protocols using BPC-157 and TB-500 rather than specialty compounds with inconsistent availability, finds standard quality assurance through Janoshik testing sufficient without demanding multi-lab verification or comprehensive safety panels, and prefers credit card payment convenience over cryptocurrency transaction complexity characterizing budget alternatives.

Alternative recommendations depend entirely on user priorities creating clear decision frameworks. Budget-conscious users prioritizing cost optimization over speed should choose Amopure accepting 3-6 week shipping, group buy participation, and cryptocurrency payments for 50-70% cost savings delivering functionally equivalent quality at dramatically reduced expense. Quality-focused users prioritizing maximum assurance should invest in premium vendors offering multi-lab verification, comprehensive safety testing, exceptional customer service, and established decade-plus reputations justifying 30-50% premium pricing through superior confidence and support. Users with prescription access should pursue pharmaceutical compounding pharmacies delivering pharmaceutical-grade quality, medical supervision, potential insurance coverage, and zero-risk tolerance assurance through legitimate medical channels.

Within mid-tier segment selection proves largely arbitrary since Revive, Transcend, Planet Peptides, and peers deliver functionally identical experiences. Users should check current stock availability across vendors for desired compounds since availability varies independently, compare promotional pricing finding vendors offering 10-20% discounts during sales events, and trust personal brand preferences or previous positive experiences rather than seeking objective superiority that doesn't exist within standardized mid-tier positioning.

How you can use SeekPeptides

SeekPeptides provides comprehensive peptide vendor comparisons, peptide guides covering all major compounds, and planning tools helping users optimize vendor selection and protocol design. Review all mid-tier vendors including Transcend, Planet, RPO, NextGen, Profound, Nexaph, or explore budget alternative Amopure for cost savings.

Access comprehensive peptide guides covering BPC-157, TB-500 benefits, best peptides for injury recovery, best peptides for weight loss, best peptides for muscle growth. Use planning calculators including peptide calculator, BPC-157 dosage calculator, cost calculator, reconstitution calculator.

Learn fundamentals through what are peptides, how peptides work, how to reconstitute peptides, peptide injections guide, peptide storage guide, peptide safety and risks, getting started with peptides.

Final thoughts

Revive Peptides operates as standard mid-tier domestic vendor delivering adequate quality, fair pricing, and functional service matching competitors Transcend, Planet Peptides, and numerous others within the $300-600 monthly price range. User satisfaction rates of 70-75% match mid-tier industry averages with feedback centering on functional adequacy rather than exceptional performance.

The vendor selection within mid-tier segment proves largely arbitrary since standardization creates interchangeable options where stock availability and minor promotional pricing drive decisions rather than meaningful quality or service differentiation.