Jan 5, 2026

The research peptide industry operates in regulatory gray areas where vendors self-regulate quality standards creating wide performance variation.

Premium vendors invest in comprehensive testing (HPLC purity, mass spectrometry identity confirmation, sterility testing, heavy metal screening), maintain pharmaceutical-grade storage conditions, implement batch tracking systems, and provide responsive customer service.

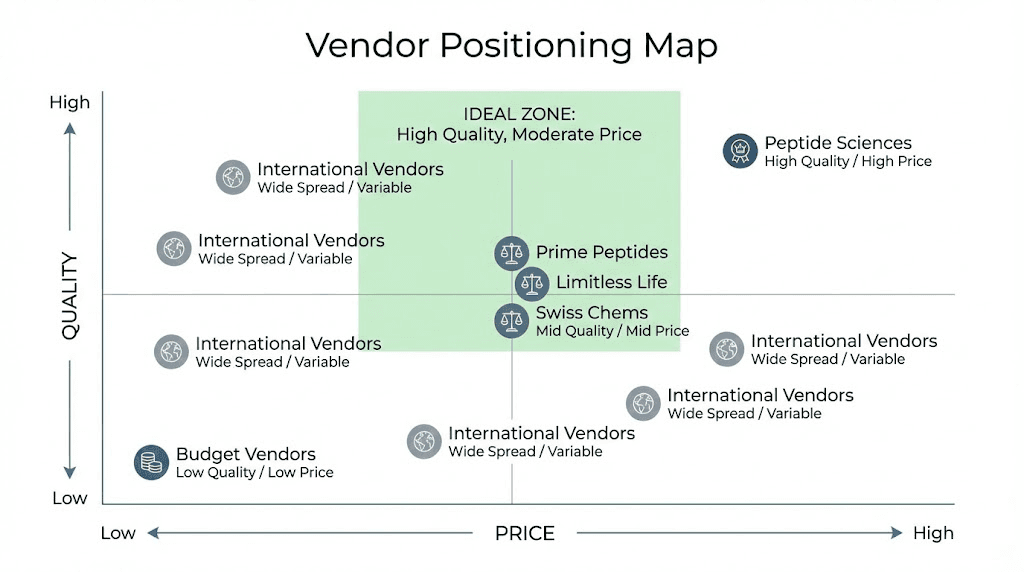

Budget vendors minimize overhead through limited testing, inconsistent storage, minimal customer support, and variable product sourcing potentially including unreliable manufacturers. Mid-tier vendors like Prime Peptides attempt balancing quality and affordability, offering better standards than budget options while remaining more accessible than premium pharmaceutical suppliers. SeekPeptides helps navigate this landscape through vendor verification and comparative analysis.

Community-driven evaluation provides critical insights beyond vendor marketing. Independent testing initiatives where users send products to analytical laboratories (Colmaric Analyticals, Janoshik, university facilities) generate objective purity and identity data.

User experience reports across forums (Reddit r/Peptides, Longecity, Discord servers) document shipping times, customer service interactions, batch consistency, and therapeutic effectiveness.

Long-term vendor tracking reveals whether companies maintain quality over years or degrade after establishing customer base. Prime Peptides' multi-year operational history allows assessment of consistency and reliability versus newer vendors lacking track records. However, even established vendors experience occasional quality issues requiring ongoing vigilance rather than blind trust based on past performance.

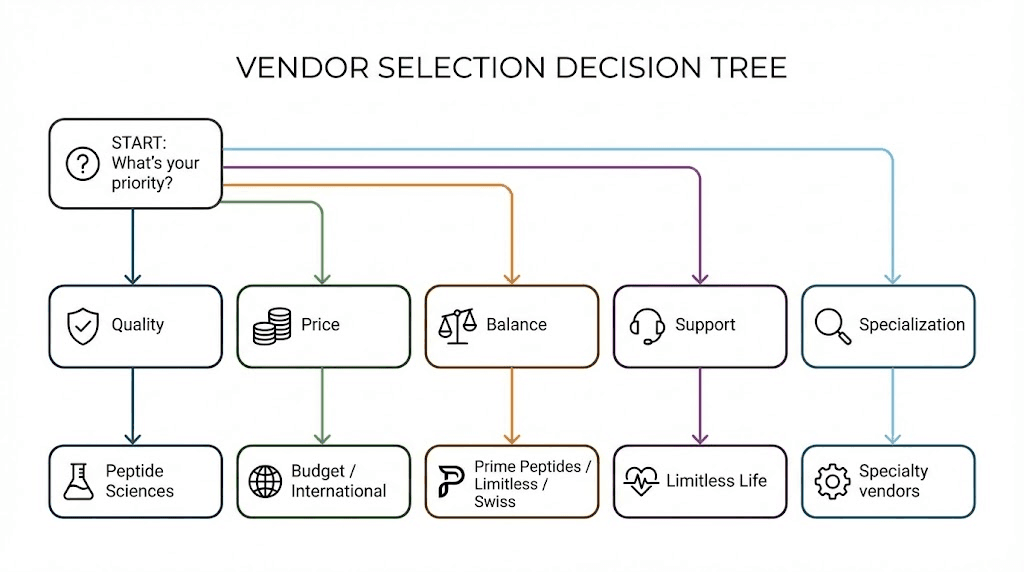

This is the best guide that covers Prime Peptides' company background and market positioning, detailed analysis of Prime Peptides' testing standards and quality control, comparative pricing analysis across major vendors, customer service and shipping performance evaluation, community testing results and user experiences, systematic comparison to top competitors (Peptide Sciences, Limitless Life, Swiss Chems, international sources), product selection and specialization differences, identifying ideal use cases for each vendor category, and practical decision framework for vendor selection based on individual priorities. SeekPeptides provides objective vendor comparisons supporting evidence-based purchasing decisions.

Let's examine Prime Peptides' position within the competitive vendor landscape.

Prime Peptides background and market position

Understanding vendor history and business model provides context for quality expectations.

Company history and evolution

Operational timeline: Prime Peptides operating approximately 4-5 years as of 2025 (exact founding date varies by sources). Moderate longevity in research peptide market where many vendors appear and disappear within 1-2 years. Survived initial establishment phase suggesting viable business model and adequate quality avoiding widespread customer dissatisfaction driving closure.

Market segment: Positions as mid-tier vendor offering balance between budget and premium options. Not cheapest (undercutting competitors by 50%+) nor most expensive (pharmaceutical-grade pricing). Marketing emphasizes quality testing and American operations versus international suppliers though actual manufacturing likely overseas (most peptides synthesized in China or India regardless of seller location).

Product range: Offers commonly requested research peptides including BPC-157, TB-500, growth hormone peptides (Ipamorelin, CJC-1295), IGF-1 variants, and various others. Does not specialize in narrow niche, instead covering broad demand. Typical inventory 20-40 different peptides.

Business model: Direct-to-consumer online sales. Accepts credit cards, cryptocurrency, and other payment methods. Ships domestically within US reducing customs risk. Minimum order requirements lower than pharmaceutical suppliers though sometimes batch minimum quantities (must order at least 2-3 vials certain products).

Stated quality standards and claims

Testing assertions: Prime Peptides claims third-party testing for purity and identity. Provides Certificates of Analysis (COAs) showing HPLC purity percentages and mass spectrometry results. However, vendor-provided COAs require skeptical assessment, independent verification essential confirming claims match reality.

Purity targets: Markets products as 98-99%+ purity pharmaceutical-grade. However, "pharmaceutical-grade" term lacks regulatory definition in research chemical context, essentially marketing language. Actual purity requires verification through independent testing, not vendor claims.

Manufacturing statements: Claims sourcing from "reputable manufacturers" and "cGMP facilities" though specifics rarely disclosed. Current Good Manufacturing Practice (cGMP) compliance meaningful for FDA-regulated pharmaceuticals but research chemicals fall outside regulatory oversight making cGMP claims unverifiable marketing unless substantial documentation provided.

Storage and handling: States proper storage conditions maintained (refrigeration, light protection) preserving peptide stability. However, third-party verification impossible without facility inspections. Trust requires faith in vendor operations or independent product testing revealing degradation if storage inadequate.

Market positioning relative to competitors

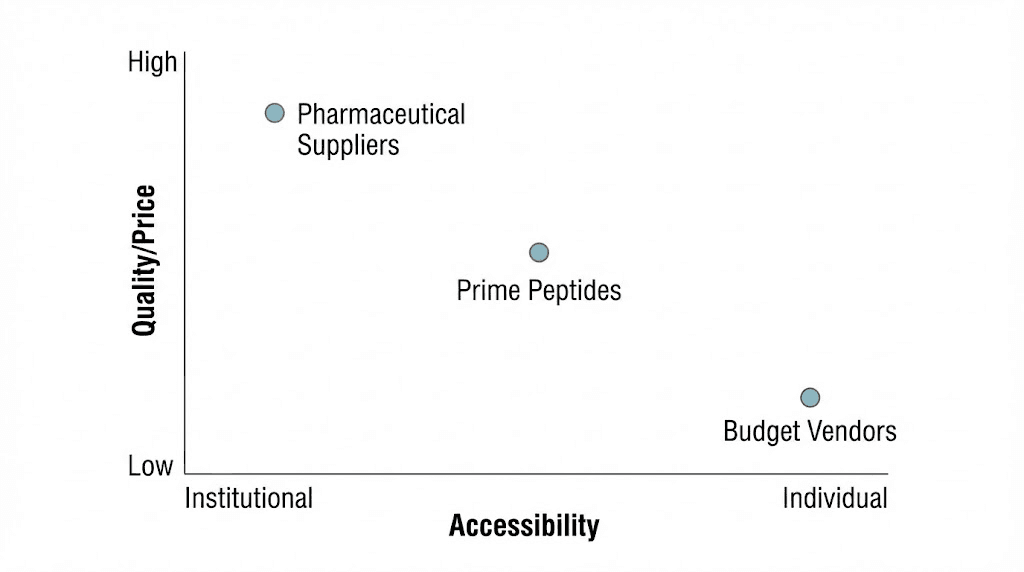

Premium tier (Pharmaceutical suppliers): Sigma-Aldrich, TCI Chemicals, Cayman Chemical sell to institutions with rigorous quality documentation. Pricing $200-$1000+ per peptide depending on quantity and type. Prime Peptides significantly cheaper, more accessible, but lower quality assurance than pharmaceutical suppliers. Different market segments with minimal overlap.

Established research chemical vendors: Peptide Sciences, Limitless Life, Swiss Chems represent direct competitors. Similar price ranges ($50-$300 per vial typical), quality claims, and target customers. Prime Peptides competes directly here on price, quality, service, and reputation. Detailed comparison essential distinguishing between similar vendors.

Budget vendors: Underground sources, international suppliers with minimal documentation, newer vendors without track records. Prime Peptides charges premium over these options positioning as quality upgrade worth higher cost. However, whether quality difference justifies price premium requires verification.

International pharmaceutical manufacturers: Chinese chemical companies, Indian generic manufacturers producing bulk peptides. Extremely inexpensive ($10-$50 per gram versus $100-$500 from US vendors) but require large minimum orders (100g-1kg), business accounts, international shipping complications. Different market entirely though some research chemical vendors source from these manufacturers then repackage and test for consumer market.

Prime Peptides testing and quality control analysis

Evaluating vendor quality requires examining testing practices and verification.

Certificate of Analysis assessment

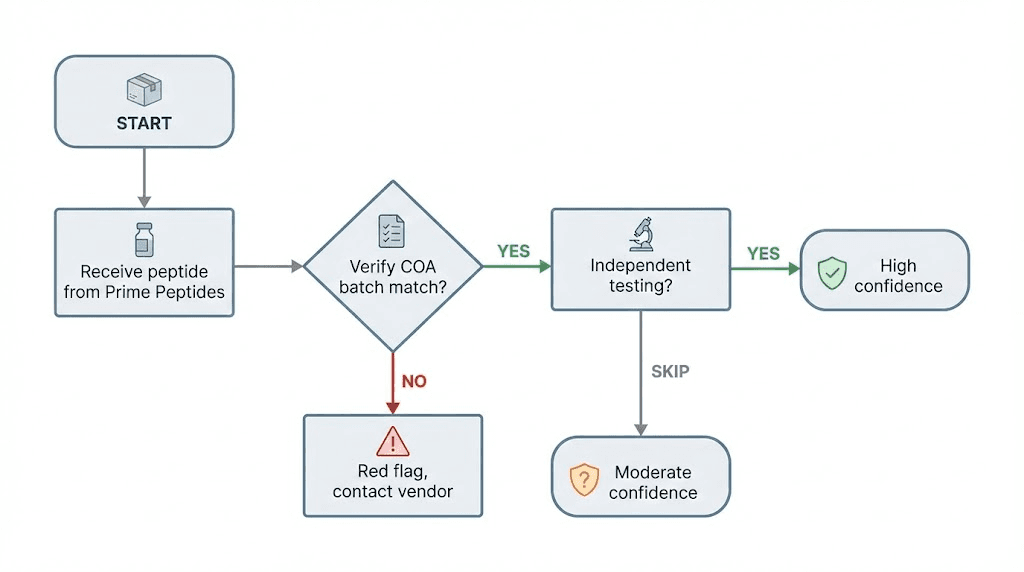

COA format and content: Prime Peptides provides COAs listing HPLC purity percentage, mass spectrometry molecular weight confirmation, testing date, batch number. Professional appearance with laboratory letterhead. However, format professionalism doesn't guarantee authenticity, sophisticated vendors can create convincing fake documents.

Batch-specific documentation: Important factor is whether COA matches specific batch received or generic COA used for all batches. Batch number on vial should match COA batch number. Generic COAs not matching your product indicate questionable testing practices. Prime Peptides generally provides batch-specific COAs though verifying match requires customer diligence.

Laboratory attribution: COAs should specify testing laboratory with contact information allowing verification. Prime Peptides uses various laboratories over time, sometimes well-known analytical services, occasionally less established facilities. Calling laboratory confirming they tested product provides strongest COA verification. Many customers skip this step accepting COA at face value creating opportunity for vendors providing fake documentation to unverified customers.

Red flags: Impossibly perfect results (exactly 99.9% purity with zero impurities detected), inconsistent data within COA, missing critical information (no batch number, vague testing methods), or refusal to provide batch-specific COA upon request all indicate problems. Prime Peptides generally avoids blatant red flags though independent testing still recommended.

Independent testing results

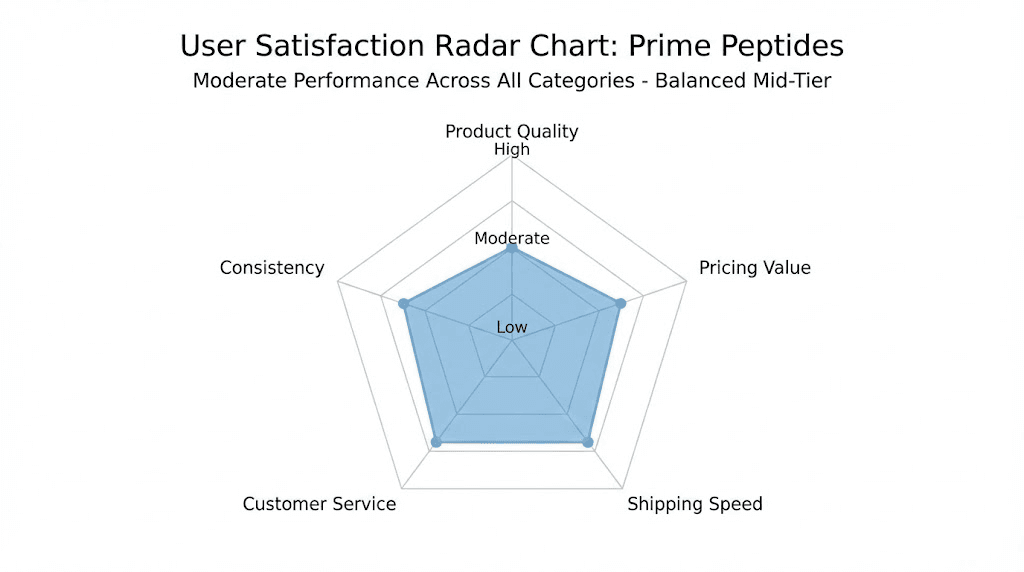

Community testing initiatives: Various Reddit users, forum members, and peptide communities periodically test Prime Peptides products independently sending samples to analytical laboratories. Results provide unbiased quality assessment. Historical testing shows mixed results, some batches testing at claimed 98-99% purity while others showing 90-95% (lower than claimed but still reasonable quality). Variability between batches concerning though not unusual for research chemical market.

Comparative testing projects: Some testing initiatives purchase same peptide from multiple vendors simultaneously comparing results. When Prime Peptides included, typically performs middle-of-pack, better than budget vendors but sometimes lower purity than premium competitors like Peptide Sciences. Suggests mid-tier market position reflected in actual quality not just pricing.

Methodology considerations: Independent testing typically uses HPLC for purity quantification and mass spectrometry for identity confirmation. Same methods as vendor COAs but performed by customer-selected laboratory eliminating conflict of interest. Testing costs $75-$200 per sample, worthwhile for expensive protocols or first-time vendor evaluation. Peptide testing guide explains process.

Longitudinal quality tracking: Tracking Prime Peptides testing results over months to years reveals consistency. Some vendors maintain stable quality while others show degradation over time (potentially cutting corners after establishing reputation). Prime Peptides shows moderate consistency, generally acceptable quality with occasional concerning batches requiring vigilance. Not worst performer but not exemplary either.

Sterility and contamination concerns

Sterility testing: Most research peptide vendors including Prime Peptides do not routinely test for bacterial contamination or endotoxins. Lyophilized peptides stored properly should remain sterile though non-sterile production or handling could introduce contamination. Absence of sterility testing doesn't mean products contaminated but creates uncertainty.

Practical sterility: Using bacteriostatic water for reconstitution, sterile injection technique, proper storage generally prevents contamination issues even if original peptide not certified sterile. Thousands of users inject Prime Peptides products without infection suggesting practical safety though not pharmaceutical sterility standards.

Heavy metal screening: Some COAs include heavy metal testing (lead, mercury, cadmium, arsenic) showing levels below detection limits. Good sign when present though not universal across all Prime Peptides batches or products. Heavy metal contamination from synthesis residues possible, testing provides reassurance about manufacturing quality.

Visual inspection limitations: Customers can inspect for obvious contamination (discoloration, visible particles, unusual odor) though most contamination invisible. Proper appearance doesn't guarantee purity or sterility. Only analytical testing reveals chemical composition, visual inspection merely preliminary screening.

Stability and storage verification

Shelf life claims: Prime Peptides states lyophilized peptides stable 2-3 years refrigerated or frozen. Once reconstituted, recommended use within 30 days refrigerated. Standard claims aligned with peptide chemistry though actual stability depends on storage conditions (temperature control, light protection, moisture exposure).

Degradation indicators: Customers occasionally report suspected degradation (reduced effectiveness, poor reconstitution, discoloration) though difficult distinguishing degradation from underdosing, individual non-response, or placebo effects. Independent testing of aged product versus fresh batch would reveal degradation objectively though rarely performed.

Storage during shipping: Peptides shipped room temperature typically (not refrigerated during transit). Lyophilized peptides tolerate brief room temperature exposure though extended heat exposure (summer shipping, package sitting in hot vehicle) potentially degrades products. Prime Peptides uses standard shipping methods like competitors, minimizing shipping time reduces degradation risk.

Reconstituted peptide guidance: After mixing with bacteriostatic water, refrigeration essential. Prime Peptides recommends 30-day use though some peptides remain stable 60-90 days. Peptide storage best practices extend usability and maintain potency regardless of vendor.

Pricing analysis and value assessment

Understanding whether Prime Peptides offers competitive value requires detailed price comparison.

Direct price comparisons (specific peptides)

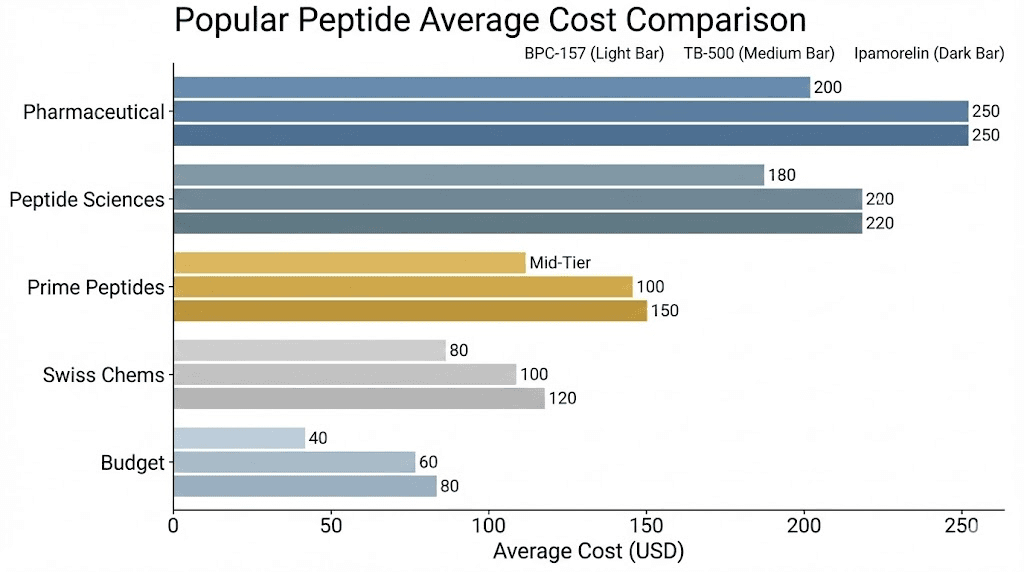

BPC-157 pricing: Prime Peptides typically charges $45-$65 per 5mg vial. Peptide Sciences $55-$75, Limitless Life $50-$70, Swiss Chems $40-$60, budget vendors $25-$45. Prime Peptides middle range, not cheapest nor most expensive. Bulk discounts sometimes available reducing per-vial cost for larger orders.

TB-500 pricing: 5mg vial from Prime Peptides $50-$75. Peptide Sciences $60-$85, Limitless Life $55-$80, Swiss Chems $45-$70, budget sources $30-$55. Again mid-tier pricing. TB-500 synthesis more complex than BPC-157 explaining higher prices across vendors.

Ipamorelin pricing: 5mg vial Prime Peptides $40-$60. Peptide Sciences $50-$70, Limitless Life $45-$65, Swiss Chems $35-$55. Similar pattern, Prime Peptides competitive but not lowest price.

CJC-1295 pricing: With or without DAC (drug affinity complex) affects pricing. CJC-1295 no DAC 2mg vial Prime Peptides $35-$55. With DAC 2mg vial $45-$65. Competitors similar ranges. CJC-1295 popular growth hormone peptide showing consistent pricing across vendors suggesting standardized market rates.

IGF-1 LR3 pricing: 1mg vial Prime Peptides $80-$120. Peptide Sciences $90-$130, Limitless Life $85-$125. Higher prices reflect synthesis difficulty and demand. Price variations between vendors narrower for expensive peptides (competitive pressure) versus inexpensive peptides (less price sensitivity).

Bulk pricing: Ordering 10+ vials sometimes discounted 10-20% from single-vial pricing. Prime Peptides offers occasional promotions (15-25% off sales) though not constant discounting like some vendors. Legitimate sales versus artificial inflation tactics (inflating regular price to make "sale" appear valuable) requires skepticism.

Cost per protocol comparison

Example healing protocol: BPC-157 500mcg daily for 8 weeks requires approximately 30mg total (6 vials of 5mg). Prime Peptides cost $270-$390 for complete protocol. Peptide Sciences $330-$450, Limitless Life $300-$420, Swiss Chems $240-$360, budget vendors $150-$270. Prime Peptides 10-20% cheaper than premium vendors, 20-40% more expensive than budget options.

Growth hormone stack: Ipamorelin 200mcg + CJC-1295 100mcg daily for 12 weeks requires approximately 20mg Ipamorelin (4 vials), 10mg CJC-1295 (5 vials). Prime Peptides total $300-$475. Comparable range to competitors, slight savings versus premium vendors.

Joint health protocol: Combining BPC-157 and TB-500 for tendon/cartilage healing. 8-week protocol using both peptides costs $500-$800 from Prime Peptides depending on dosing. Similar or slightly cheaper than Peptide Sciences ($600-$900), comparable to Limitless Life and Swiss Chems.

Annual cost considerations: Those using peptides long-term (chronic conditions, ongoing performance optimization, preventive health) accumulate substantial costs. 10-15% price difference between vendors translates to hundreds of dollars annually. However, quality variability potentially negates savings if cheaper vendor provides lower purity or effectiveness requiring higher doses. Cost-benefit analysis considers total value not just initial price.

Hidden costs and value factors

Testing expenses: Independent verification costs $75-$200 per sample. If testing every Prime Peptides order, adds 10-30% to peptide costs depending on order size. However, testing one batch then ordering multiple vials from verified batch amortizes testing cost. Premium vendors with better testing track records potentially avoiding some testing expenses through higher baseline confidence.

Shipping costs: Prime Peptides domestic US shipping typically $10-$20 standard, potentially free for larger orders ($100+ thresholds common). International vendors charge $20-$50+ for US shipping with customs risk. Domestic vendor shipping simplicity and reliability provides value beyond product price.

Replacement policies: If product arrives damaged, contaminated, or testing shows extremely poor quality, vendor replacement policy matters. Prime Peptides generally responsive to legitimate quality complaints though not guaranteed replacements. Premium vendors often better customer service and replacement policies. Budget vendors rarely replace questionable products.

Opportunity costs: Time researching vendors, verifying quality, troubleshooting problems, or dealing with poor customer service creates hidden costs. Paying premium for reliable vendor potentially worthwhile for busy individuals valuing convenience and confidence over minimal savings.

Customer service and operational performance

Beyond product quality, vendor reliability and support matter significantly.

Shipping and delivery

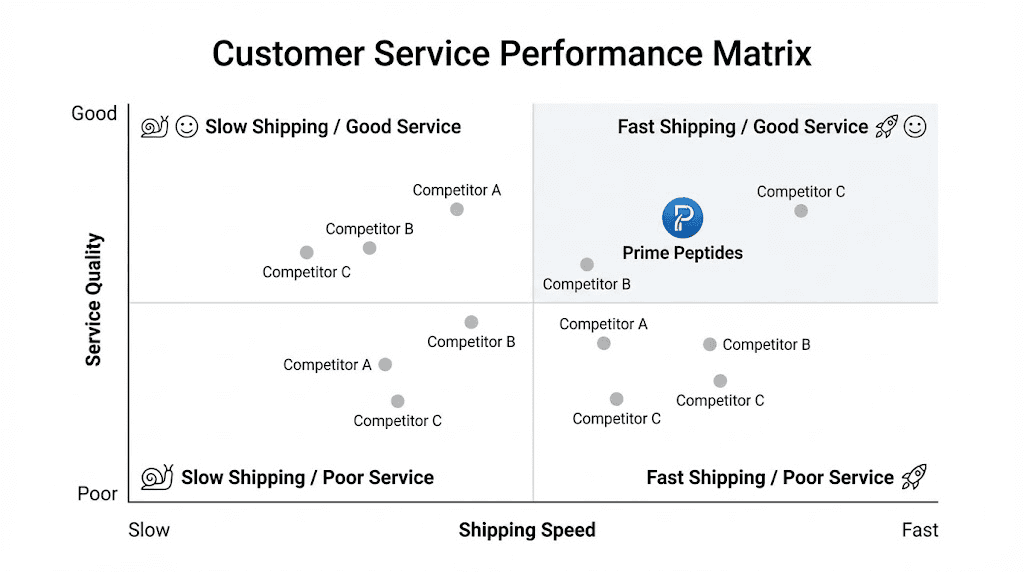

Domestic US shipping: Prime Peptides ships from within United States (exact locations may vary) delivering most orders within 3-7 business days. Standard USPS or private carriers (UPS, FedEx) depending on service selected. Tracking provided for monitoring. Shipping times competitive with other US domestic vendors, faster and more reliable than international sources.

International shipping: Limited or unavailable from Prime Peptides for most international customers. Focuses on US market avoiding international shipping complexities and regulations. International customers requiring Prime Peptides quality must use reshipping services (package forwarding companies) adding cost and complexity.

Packaging: Discreet packaging without obvious peptide or research chemical labeling. Vials packed with padding preventing breakage during transit. Temperature-controlled packaging (ice packs, insulated boxes) not standard though lyophilized peptides tolerate brief room temperature shipping. Appropriate packaging quality preventing most damage issues.

Delivery success rate: Based on customer reports, delivery success rate high (95%+ packages arriving successfully). Occasional shipping damage, lost packages, or delivery delays occur (typical for any shipping operation) though not excessive. Tracking information allows proactive monitoring and issue detection.

Customer service responsiveness

Communication channels: Email primary customer service method. Some vendors also offer phone support, live chat, or social media responsiveness. Prime Peptides mainly email-based with typical response times 24-48 hours. Not instant support but acceptable for non-urgent peptide ordering situations.

Pre-purchase inquiries: Customer reports suggest generally helpful responses to product questions, dosing inquiries (though vendors cannot provide medical advice), and ordering assistance. However, depth of knowledge varies between customer service representatives. Complex scientific questions sometimes receive superficial responses.

Order issues: When problems arise (wrong product shipped, damaged vials, payment processing issues), customer service responsiveness matters. Prime Peptides generally addresses legitimate problems though resolution speed varies. Some customers report excellent service while others describe frustration with slow responses or unhelpful solutions. Mixed reviews suggest inconsistent service quality or individual representative variation.

Returns and refunds: Research chemical vendors generally have strict no-return policies given product nature. Prime Peptides allows returns/refunds only for unopened products with manufacturing defects or shipping damage. Low purity on independent testing rarely qualifies for refund unless dramatically different from COA claims. Understand policies before purchasing.

Website and ordering experience

User interface: Modern website design with product browsing, shopping cart, secure checkout. Generally functional though occasionally slow loading or minor glitches reported. Not cutting-edge e-commerce technology but adequate for peptide ordering.

Product information: Each peptide listing includes basic description, suggested storage, and certificate of analysis link. However, detailed protocols, dosing guidance, or comprehensive educational content generally absent. Vendors cannot provide medical advice explaining limited information though some provide more educational resources than Prime Peptides.

Account management: Registered accounts track order history, saved payment methods, shipping addresses. Convenient for repeat customers. However, creates potential security concern if accounts hacked accessing personal information. Strong passwords and account security essential. SeekPeptides recommends secure ordering practices.

Payment processing: Accepts credit cards (higher fees potentially passed to customers through slightly elevated prices), cryptocurrency (Bitcoin, Ethereum, other major coins), and sometimes other methods (Zelle, Venmo, others). Credit card processing requires payment processor willing to handle research chemical transactions (many processors decline this category). Cryptocurrency provides anonymity and lower processing fees though requires technical knowledge.

Reliability and business stability

Track record: 4-5 years operational history suggests stable business model and adequate customer satisfaction preventing closure. Many research chemical vendors disappear within 1-2 years (exit scams, regulatory issues, or business failure). Prime Peptides' longevity provides moderate confidence though not absolute guarantee of future reliability.

Ownership and management: Little public information about company ownership, management team, or physical location beyond general US operations claims. Common for research chemical vendors maintaining low profiles given regulatory gray areas. However, transparency absence makes assessing long-term stability difficult.

Regulatory risk: Research chemical vendors operate in legal gray areas susceptible to regulatory crackdowns, payment processor termination, or shipping restrictions. Prime Peptides faces same risks as all vendors in this space. Established vendors better positioned weathering challenges through reserves and experience though no vendor immune to regulatory actions.

Exit scam indicators: Warning signs include dramatically increased discounts (liquidating inventory before closure), declining customer service, shipping delays, payment processing issues, or social media silence. Prime Peptides shows none of these currently though monitoring important for detecting problems early. SeekPeptides tracks vendor reliability indicators for community.

Community reviews and user experiences

Aggregating user feedback provides real-world performance insights beyond vendor marketing.

Reddit and forum sentiment

r/Peptides discussions: Prime Peptides frequently mentioned with mixed reviews. Positive comments include acceptable quality at reasonable prices, reliable shipping, and adequate customer service. Negative experiences report occasional low-purity batches, slow customer service response during busy periods, and product availability issues. Overall sentiment cautiously positive, not enthusiastic endorsement nor widespread condemnation.

Longecity and peptide forums: Similar mixed feedback. Some long-term users report satisfactory experiences over multiple orders while others describe quality inconsistencies requiring vendor switching. Common theme is Prime Peptides as solid mid-tier option, not premium choice but better than budget vendors.

Discord and Telegram groups: Real-time discussions in peptide communities provide immediate feedback. Prime Peptides generally considered acceptable vendor though not universally preferred. Communities often have members loyal to specific vendors based on positive experiences creating some bias in recommendations.

Review authenticity concerns: Online reviews manipulated through fake positive reviews (vendors paying for favorable comments), competitor sabotage (fake negative reviews), or selection bias (satisfied customers less likely reviewing than dissatisfied). Critical evaluation weighing multiple sources and looking for specific detailed experiences versus generic praise or criticism.

Common positive feedback themes

Acceptable quality-to-price ratio: Many users find Prime Peptides' mid-tier pricing matched by mid-tier quality providing reasonable value. Not cheapest nor highest quality but balanced for budget-conscious users wanting better than lowest-tier vendors.

Domestic shipping reliability: US-based operations providing faster, more reliable delivery than international vendors highly valued. Avoiding customs risks and long shipping times significant advantages.

Product selection: Carrying most popular peptides (BPC-157, TB-500, growth hormone peptides, IGF variants) satisfies common needs without requiring multiple vendor orders. Convenient one-stop shopping for standard protocols.

Responsive to issues: When legitimate problems arise (damaged shipments, obvious quality defects), customer service generally resolves within reasonable timeframes though not universally or instantly.

Common negative feedback themes

Batch inconsistency: Most common complaint involves quality variation between orders. One batch testing at claimed purity while next batch shows lower results. Inconsistency creates uncertainty requiring ongoing vigilance and potentially testing each new batch rather than trusting based on previous good experiences.

Customer service limitations: Some users report difficulty reaching customer service, slow response times during peak periods, or unhelpful responses to complex questions. Not worst customer service but not exemplary compared to premium vendors offering phone support or live chat.

Availability issues: Occasional stock-outs on popular peptides forcing backorder waits or finding alternative vendors. Inventory management apparently imperfect creating inconvenience for customers needing specific peptides immediately.

Testing transparency: While Prime Peptides provides COAs, some users desire more comprehensive testing (additional analytical methods, more frequent batch testing, independent verification) increasing confidence. Current testing adequate for mid-tier vendor but not pharmaceutical standards.

Comparative user satisfaction

Net promoter scores: Informal assessments suggest Prime Peptides has moderate customer loyalty. Some users repeat customers but many try different vendors over time seeking better quality, pricing, or service. Not creating passionate advocates nor widespread detractors, instead occupying middle satisfaction range.

Repeat purchase rates: Moderate repeat business suggests adequate satisfaction though not exceptional vendor loyalty. Many peptide users purchase from 2-3 vendors routinely hedging quality risks and accessing different product selections. Prime Peptides often included in vendor rotation but rarely exclusive choice.

Recommendation frequency: Community members occasionally recommend Prime Peptides when asked for vendor suggestions though usually alongside other options. Rarely singularly enthusiastic endorsement. Typical recommendation context: "Prime Peptides, Peptide Sciences, and Swiss Chems all decent, choose based on current pricing and stock."

Detailed vendor comparisons

Systematic comparison to specific competitors reveals relative positioning.

Prime Peptides vs Peptide Sciences

Quality perception: Peptide Sciences generally considered higher-quality vendor based on community testing showing more consistent purity, comprehensive COAs, better testing transparency. Prime Peptides acceptable quality but Peptide Sciences edges ahead in testing reputation. Quality difference modest but real.

Pricing: Peptide Sciences typically 15-25% more expensive than Prime Peptides for same peptides. Example: BPC-157 5mg costs $45-$65 Prime Peptides, $55-$75 Peptide Sciences. Price premium reflects (or claims to reflect) better quality control and consistency.

Product selection: Both offer comprehensive standard peptide selections. Peptide Sciences sometimes carries more specialized or research peptides not available from Prime Peptides. However, popular products available from both.

Customer service: Peptide Sciences reputation suggests slightly better customer service with faster response times and more knowledgeable representatives. However, both primarily email-based support. Difference modest, not dramatic service quality gap.

Recommendation: Those prioritizing maximum quality and willing to pay premium choose Peptide Sciences. Budget-conscious users accepting modest quality trade-off for savings select Prime Peptides. Both legitimate vendors, decision depends on individual priorities. Peptide Sciences review provides detailed analysis.

Prime Peptides vs Limitless Life

Quality comparison: Similar quality tier as Prime Peptides. Community testing shows comparable purity ranges (90-98% typical). Neither consistently superior, batch-to-batch variation similar. Quality difference negligible between these vendors.

Pricing: Very competitive, often within 5-10% of each other. Sales and promotions affect relative pricing at any moment. Currently similar value propositions.

Specialization: Limitless Life focuses heavily on peptide education and protocol development alongside product sales. More educational content, dosing guides, and community engagement than Prime Peptides' primarily transactional approach. Appeals to users wanting guidance alongside products.

Customer experience: Limitless Life invests more in customer experience (better website, more communication, educational resources) while Prime Peptides maintains straightforward ordering without extras. Preference depends on whether user values educational support or just wants efficient product ordering.

Recommendation: Negligible quality or price differences make choice primarily about preferred vendor style. Educational support seekers choose Limitless Life, straightforward shoppers satisfied with Prime Peptides. Limitless Life analysis explores differences.

Prime Peptides vs Swiss Chems

Quality and pricing: Swiss Chems similar or slightly lower pricing than Prime Peptides with comparable quality. Sometimes wins price comparisons by 10-15% though not dramatically cheaper. Quality testing shows similar results, neither vendor advantage.

Product range: Swiss Chems carries peptides plus other research chemicals (SARMs, nootropics, other compounds). Broader selection for users wanting multiple research chemical categories. Prime Peptides more peptide-focused though some overlapping products.

Brand positioning: Swiss Chems markets more aggressively with frequent promotions, influencer sponsorships, active social media presence. Prime Peptides maintains lower profile. Marketing intensity doesn't necessarily correlate with quality but affects brand awareness and perception.

Geographic focus: Both US domestic shipping. Swiss Chems sometimes better international shipping options. Prime Peptides primarily US-focused. International customers may prefer Swiss Chems.

Recommendation: Very close competition. Price shop between them for specific orders. Swiss Chems better for those wanting SARMs or nootropics alongside peptides. Prime Peptides fine for peptide-only needs. Swiss Chems evaluation compares thoroughly.

Prime Peptides vs International Suppliers

Quality uncertainty: International vendors (Chinese manufacturers, Indian generics) highly variable quality. Some produce excellent pharmaceutical-grade peptides while others sell heavily contaminated products. Prime Peptides more consistent baseline quality. However, best international sources potentially match or exceed Prime Peptides quality at lower prices.

Pricing advantage: International sources substantially cheaper for those accepting larger minimum orders and navigating complications. Bulk prices $50-$150 per gram versus $200-$400 from US vendors for same quantities. Price advantages eroded by minimum order requirements (100g+), international shipping ($50-$100), customs risks, and testing necessity.

Shipping reliability: International shipping 2-6 weeks typical with 10-30% seizure rates depending on destination country and vendor stealth. Prime Peptides 3-7 days with high delivery success. Time and reliability strongly favor domestic vendors for most individual users.

Practical considerations: International sources appropriate for very high-volume users, research laboratories, or those willing accepting complications for maximum cost savings. Individual users ordering 5-20 vials for personal protocols generally better served by Prime Peptides convenience despite higher per-unit costs. International peptide sourcing explains considerations.

Vendor comparison summary table

Factor | Prime Peptides | Peptide Sciences | Limitless Life | Swiss Chems | International |

|---|---|---|---|---|---|

Quality Tier | Mid | High-Mid | Mid | Mid | Variable |

Typical Purity | 92-98% | 95-99% | 92-98% | 90-97% | 70-99% |

Price Range | $$ | $$$ | $$ | −- −$ | $ |

Shipping Speed (US) | 3-7 days | 3-7 days | 3-7 days | 3-7 days | 14-45 days |

Customer Service | Moderate | Good | Good | Moderate | Poor-Variable |

Product Selection | Broad | Comprehensive | Broad | Very Broad | Extremely Broad |

Testing Transparency | Moderate | Good | Moderate | Moderate | Poor-Variable |

Best For | Budget-conscious quality seekers | Quality prioritizers | Education seekers | Multi-category shoppers | Bulk/research buyers |

Product selection and specialization differences

Vendors sometimes differentiate through specialized product offerings or formulations.

Core peptide availability

Universal offerings: All major vendors carry popular peptides like BPC-157, TB-500, Ipamorelin, CJC-1295, IGF-1 LR3. Prime Peptides inventory mirrors competitors for these high-demand products. Little differentiation, all vendors source similar peptides from overlapping manufacturer pools.

Growth hormone secretagogues: GHRP-2, GHRP-6, Hexarelin, MK-677 availability varies. Prime Peptides carries most common variants. Premium vendors may offer more complete growth hormone peptide selections.

Specialized peptides: Research peptides for specific applications (cosmetic peptides, cognitive enhancers, metabolic modulators) show greater vendor differentiation. Prime Peptides focuses on proven popular products rather than extensive specialized inventory. Those wanting exotic research peptides may need specialized vendors.

Formulation differences

Standard lyophilized powder: All vendors primarily sell lyophilized (freeze-dried) powder in vials requiring reconstitution before use. Standard pharmaceutical format for peptide storage and shipping. Prime Peptides follows industry norm.

Pre-mixed solutions: Some vendors offer pre-reconstituted peptides in bacteriostatic water or other solutions. Convenience for users uncomfortable with reconstitution. However, stability concerns (reconstituted peptides degrade faster than lyophilized powder) and higher shipping costs (liquid weight). Prime Peptides does not offer pre-mixed, customers reconstitute themselves following reconstitution guides.

Blends and combinations: Some vendors create proprietary blends combining multiple peptides in single vial (example: BPC-157 + TB-500 combination). Marketing convenience though dosing flexibility reduced (cannot independently adjust each peptide dose). Prime Peptides offers individual peptides allowing custom combinations and precise dosing control.

Concentration variations: Vial sizes (2mg, 5mg, 10mg, 20mg) affect concentration after reconstitution and dosing convenience. Prime Peptides generally offers 5mg vials as standard with some products available in 2mg or 10mg options. Similar to competitors, minimal differentiation.

Quality tiers and pricing strategies

Single-tier pricing: Prime Peptides uses one quality/price level for each product. No "budget" versus "premium" versions of same peptide with different quality/prices. Simplified but limits choice for those wanting either maximum savings or highest quality.

Bulk discounts: Quantity discounts (buying 10+ vials) reduce per-unit costs. Prime Peptides offers standard bulk pricing similar to competitors. Discounts typically 10-20% for larger orders.

Membership and loyalty programs: Some vendors offer subscription services, loyalty points, or membership tiers providing discounts or perks. Prime Peptides does not currently have formal loyalty program beyond occasional returning customer coupons. Peptide Sciences and others sometimes offer structured loyalty benefits.

Promotional patterns: Prime Peptides runs occasional sales (10-25% off) during holidays or promotional periods. However, not constant clearance-style discounting suggesting reasonable baseline pricing without artificial inflation. Some competitors run perpetual sales creating confusion about "real" prices.

Ideal use cases and recommendations

Different scenarios favor different vendors based on priorities.

Best scenarios for Prime Peptides

Budget-conscious quality seekers: Those wanting better than budget vendors but unable affording premium prices. Prime Peptides balances acceptable quality with moderate pricing. Appropriate for mid-tier budget users.

Standard peptide needs: Users requiring commonly available peptides (BPC-157, TB-500, growth hormone peptides) without exotic or specialized product requirements. Prime Peptides inventory covers standard needs.

US domestic preference: Customers prioritizing fast, reliable domestic shipping avoiding international complications. Prime Peptides US operations provide this advantage.

Moderate-risk tolerance: Those willing accepting some batch variability and testing uncertainty in exchange for cost savings versus premium vendors. Testing one batch then ordering multiple vials from verified batch balances risk and cost.

Straightforward transaction preference: Users wanting efficient ordering without extensive vendor interaction, education, or community engagement. Prime Peptides transactional approach suits straightforward shoppers.

When alternatives preferable

Maximum quality priority: Those prioritizing highest confidence in product purity and consistency regardless of cost choose Peptide Sciences or pharmaceutical suppliers. Extra expense worthwhile for peace of mind and potentially better therapeutic results.

Specialized peptide requirements: Users needing rare, exotic, or cutting-edge peptides not carried by standard vendors. Specialized peptide vendors or custom synthesis services necessary.

Extensive support needs: Those wanting educational resources, protocol guidance, or active customer engagement benefit from vendors emphasizing support and community. Limitless Life or vendors with stronger educational presence better choices.

International location: Customers outside US with international shipping restrictions or seeking local vendors. Prime Peptides' US focus limits international utility. Region-specific vendors often better options.

Maximum budget constraints: Truly price-sensitive users willing accepting higher quality risks for lowest possible prices. Budget vendors or properly vetted international sources provide cost savings though require more diligence and testing.

Research institutions: Academic labs, pharmaceutical companies, or other institutions requiring pharmaceutical-grade with full documentation. Institutional suppliers (Sigma-Aldrich, Cayman Chemical) mandatory despite dramatically higher costs.

Making informed vendor decisions

Practical framework for choosing vendors based on individual circumstances.

Pre-purchase research checklist

Community verification: Search vendor name on Reddit, Longecity, Discord. Look for independent testing results, user experiences (both positive and negative), and long-term track records. Avoid relying solely on vendor website testimonials (easily faked).

COA examination: Request Certificate of Analysis before purchasing. Verify batch-specific, professional laboratory attribution, realistic results (not impossibly perfect), batch number system. Contact laboratory confirming they tested product (strengthens confidence significantly).

Pricing comparison: Check 3-5 vendors for same peptide comparing total costs (product + shipping + testing if needed). Identify outliers (suspiciously cheap suggesting poor quality or too expensive without justifying quality difference).

Return and refund policies: Understand policies before problems arise. What qualifies for returns? Timeframe restrictions? Refund versus store credit? Helps managing expectations and recourse if issues develop.

Payment security: Assess payment methods (credit cards provide buyer protection, cryptocurrency provides anonymity), website security (HTTPS, secure payment processing), vendor reputation for payment issues or card data breaches.

First order strategies

Start small: Initial vendor order should be single product or small quantity testing vendor reliability and quality. Avoid large financial commitment to unverified vendor regardless of attractive pricing or marketing.

Independent testing: For first order from new vendor, budget for independent testing ($75-$150). Verifies vendor claims establishing whether quality acceptable for future orders. Testing cost amortized across subsequent orders from verified vendor.

Documentation: Photograph packaging, vials, COA upon receipt. Save order confirmation, tracking information, and communication. Documentation supports potential disputes and provides records for tracking batch numbers and quality across orders.

Gradual scaling: After successful small order, increase order size incrementally. Successful 1-vial order doesn't guarantee 10-vial order receives same quality but builds confidence. Escalation testing vendor consistency across orders and batches.

Ongoing monitoring and adjustment

Periodic retesting: Even reliable vendors experience occasional quality issues. Retest every 6-12 months or significant batch number changes. Maintains quality assurance preventing complacency leading to accepting degraded products.

Community engagement: Stay connected to peptide communities monitoring vendor reputation changes. Vendors can improve or decline over time. Early warnings from community provide lead time switching vendors before experiencing problems personally.

Vendor diversification: Consider maintaining relationships with 2-3 vendors rather than single source dependence. Allows switching if quality issues arise, accessing different product availability, and price comparing for each order. However, testing costs multiply with vendor proliferation requiring balance.

Protocol journaling: Track which vendors, batches, and peptides produce good therapeutic results. Over time, patterns emerge identifying most effective sources for individual response. Objective tracking prevents relying solely on price or marketing influencing decisions.

Red flags requiring vendor abandonment

Consistent quality problems: If multiple batches test poorly or multiple customers report problems simultaneously, quality control systematically failing. Time to find alternative vendor regardless of price advantages or past good experiences.

Deteriorating customer service: Increasingly slow responses, unhelpful support, or ignoring complaints indicates business problems (financial stress, ownership changes, preparing exit). Service degradation often precedes quality degradation or business closure.

Payment or shipping irregularities: Credit card charges not matching orders, package tracking not updating, requiring unusual payment methods (like gift cards, untraceable cryptocurrency to unknown wallets). Potential fraud or business instability.

Community warnings: If respected community members or multiple independent users report serious issues (fake products, selective scamming, exit scam preparation), heed warnings even if personal experience thus far acceptable. Community collective wisdom often identifies problems before affecting all customers.

Legal or regulatory issues: Vendors facing legal actions, payment processor terminations, or regulatory scrutiny may face imminent closure or product seizures. Diversify away from legally vulnerable vendors even if currently operating normally.

How SeekPeptides supports vendor evaluation

SeekPeptides provides comprehensive resources for informed vendor selection and quality assurance.

Comprehensive vendor database with testing results, user reviews, pricing history, and reliability tracking. Updated regularly as vendors and market conditions change.

Comparison tools allowing side-by-side vendor evaluation across multiple factors (quality, price, service, selection). Customizable weighting based on individual priorities.

Testing guides explaining analytical methods, interpreting results, selecting laboratories, and organizing community testing initiatives. Empowers quality verification.

Community forums connecting peptide users for vendor discussions, testing collaboration, and experience sharing. Collective knowledge exceeds individual vendor marketing or limited personal experience.

Vendor verification protocols providing systematic frameworks for evaluating new vendors, documenting quality across batches, and deciding when switching vendors appropriate.

Alert system notifying community about vendor issues (quality problems, scams, regulatory actions), new vendor emergence, or significant market changes affecting sourcing.

Educational resources covering proper storage, reconstitution, administration, and monitoring ensuring quality products used correctly maximizing effectiveness.

SeekPeptides remains committed to transparent, evidence-based vendor information supporting safe and effective peptide research.

Helpful resources

In case I don't see you, good afternoon, good evening, and good night. May your vendors stay reliable, your peptides stay pure, and your sourcing decisions stay informed.

Cheers.